Commercial Property Foreclosure The Process

Post on: 6 Апрель, 2015 No Comment

Talk to a Local Commercial Real Estate Attorney

%img src=http://www.lawyers.com/

/media/Images/Item /%Businesses can get into financial trouble and fall behind on mortgage payments. When this happens, lenders will typically begin foreclosure proceedings. The commercial process is similar to the residential process, with one big difference. Lenders are more reluctant to foreclose on business property, because it costs a lot to maintain and manage it until they can sell it.

Two Kinds of Foreclosure

Foreclosures are either judicial or non-judicial, and each state’s laws are different. Some states allow only judicial foreclosures, and some allow both. A judicial foreclosure means your lender must file a lawsuit against you to foreclose. With a non-judicial foreclosure, your lender can foreclose simply by giving you notice that it plans to do so.

The Process Starts with a Default Notice

If your state allows only judicial foreclosures, the first notice you’ll receive from your lender will state that you’ve defaulted on the loan. It will threaten foreclosure proceedings if you don’t catch up with the mortgage payments. In non-judicial states you will also receive a default notice, but the notice will probably just demand payment.

The Lender Will File a Lawsuit

If an owner doesn’t catch up on business mortgage payments, the lender will file a lawsuit to foreclose. In states that allow for non-judicial foreclosures, the lender can skip this step. The next notice you receive will tell you that your lender has officially foreclosed. It will inform you of the date when your property will be sold.

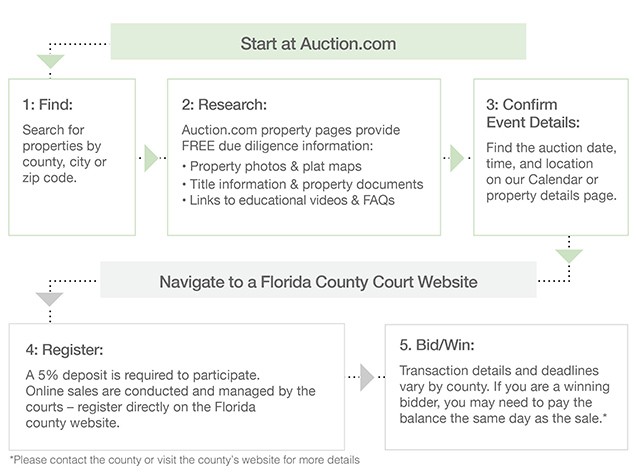

The Property Will Be Sold

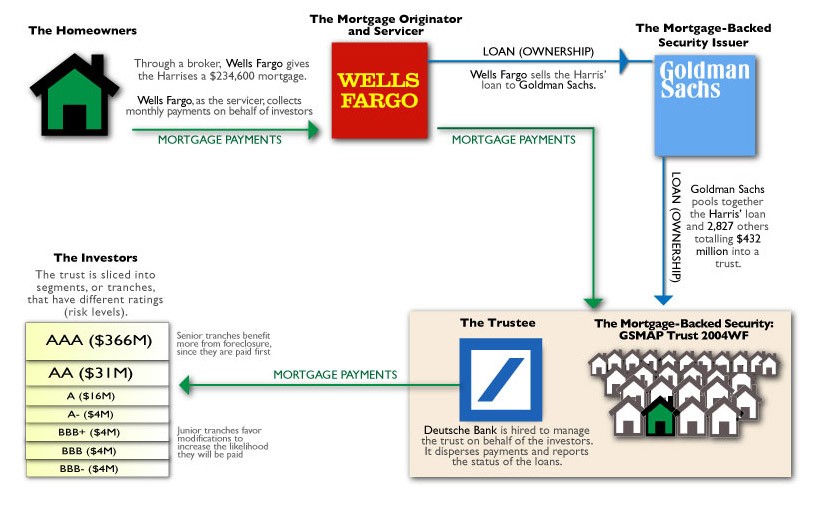

With both judicial and non-judicial foreclosures, your commercial property will be sold at auction. The proceeds pay off your mortgage. Commercial lenders will sometimes bid on and buy the property themselves, up to the amount of your loan. Because they already hold the mortgage, they don’t actually have to pay anything. After they reclaim the property, they will try to sell it at a profit.

Options to Foreclosure

Your lender doesn’t want to sell your property for less than the loan. It doesn’t want to manage and maintain it until another buyer can be found. As a result, you may have some options. You can try to work out a modification of your loan that allows you to catch up with the payments. This is common with commercial properties. You should attempt a modification as soon as possible, before the foreclosure process has gone too far. You can also speak with a lawyer about filing for bankruptcy.

A Commercial Real Estate Lawyer Can Help

The law surrounding foreclosure on commercial property is complicated. Plus, the facts of each case are unique. This article provides a brief, general introduction to the topic. For more detailed, specific information, please contact a commercial real estate lawyer.