Collateral Management Guide What is Collateral Management

Post on: 8 Апрель, 2015 No Comment

Collateral Management Guide PART 1: What is Collateral Management

Author: Financial-edu.com

This 13-Part Collateral Management Guide is written as a source of useful free information on all aspects of collateral management. Each Part can be accessed by clicking the link at the bottom of the page.

What is Collateral Management?

At a high level, collateral management is the function responsible for reducing credit risk in unsecured financial transactions. Collateral has been used for hundreds of years to provide security against the possibility of payment default by the opposing party (or parties) in a trade. In our modern banking industry collateral is used most prevalently as bilateral insurance in over the counter (OTC) financial transactions. However, collateral management has evolved rapidly in the last 15-20 years with increasing use of new technologies, competitive pressures in the institutional finance industry, and heightened counterparty risk from the wide use of derivatives, securitization of asset pools, and leverage. As a result, collateral management now encompasses multiple complex and interrelated functions, including repos. tri-party / multilateral collateral. collateral outsourcing. collateral arbitrage. collateral tax treatment. cross-border collateralization. credit risk. counterparty credit limits. and enhanced legal protections using ISDA collateral agreements .

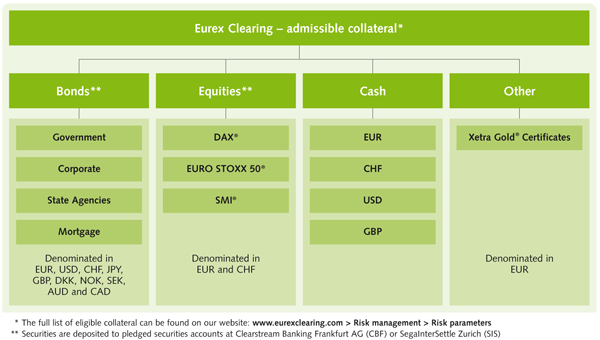

Credit risk exists in any transaction which is not executed on a strictly cash basis. An example of credit-risk free transaction would be the outright purchase of a stock or bond on an exchange with a clearing house. Examples of transactions involving credit risk include over the counter (OTC) derivative deals (swaps, swaptions, credit default swaps, CDOs) and business-to-business loans (repos, total return swaps, money market transactions, term loans, notes, etc.). Collateral of some sort is usually required by the counterparties in these transactions because it mitigates the risk of payment default. Collateral can be in the form of cash, securities (typically high grade government bonds or notes, stocks, and increasingly other forms such as MBS or ABS pools, leases, real estate, art, etc.)

Collateral is typically required to wholly or partially secure derivative transactions between institutional counterparties such as banks, broker-dealers, hedge funds, and lenders. Although collateral is also used in consumer and small business lending (for example home loans, car loans, etc.), the focus of this article is on collaterization of OTC derivative transactions.

Collaterization is the act of securing a transaction with collateral. It has multiple uses which fall under the umbrella of collateral management:

- A credit enhancement technique allowing a net borrower to receive better borrowing rates or haircuts.

- A credit risk mitigation tool for private/OTC transactions — offsets risk that counterparty will default on deal obligations (in whole or part).

- Applied to secure individual deals or entire portfolios on a net basis.

- A trade facilitation tool which enable parties to trade with one another when they would otherwise be prohibited from doing so due to credit risk limits or regulations (for example European pension fund regulations or Islamic banking law).

- A component of firm wide portfolio risk and risk management including market risk (VaR, stress testing), capital adequacy, regulatory compliance and operational risk (Basel II, MiFid, Solvency II, FAS 133, FAS 157, IAS 39, etc.), and asset-liability management (ALM).

- A money market investment (lending for short periods to earn interest on available cash or securities).

- A balance sheet management technique used to optimize bank capital, meet asset-liability coverage rules, or earn extra income from lending excess assets to other institutions in need of additional assets.

- An arbitrage opportunity through the use of tri-party collateral transactions.

- An outsourced tri-party collateral / tri-party repo service for major broker-dealers to offer to their clients.

CONTINUED IN PART 2 >>