Choosing The Right REIT ETF

Post on: 16 Март, 2015 No Comment

Follow Comments Following Comments Unfollow Comments

It may seem like madness to suggest buying REITs at a time when yields are soaring and anything associated with “income investing” is getting slammed. But with many popular REITs down 30% or more, now is precisely the time to start digging around for value.

This bond market selloff roiling all income-focused securities may very well continue for a while, and I don’t recommend trying to catch the proverbial falling knife by calling an exact bottom in REIT shares. But at the very least, you can build a watch list of your favorite names and average into them on any weakness. This has been my approach in my own income-focused portfolios.

But what about REIT ETFs ?

Given the popularity of REITs, a plethora of ETFs have sprung up, each offering a slightly different approach to the asset class. While I prefer to cherry pick a portfolio of my favorite REITs, REIT ETFs may be a great option for smaller accounts or investors who prefer a “one stop shop” approach.

I’ll go through several familiar (and probably not so familiar) names today.

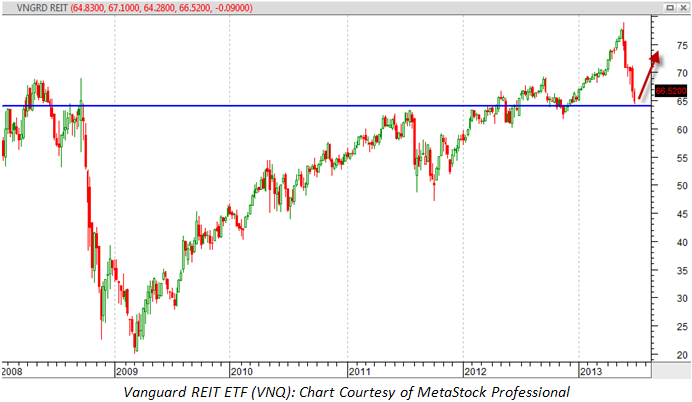

Let’s start with the biggest and most popular ETFs in the segment, which hold the largest-cap equity REITs. In this space, we have the Vanguard REIT ETF, the SPDR Dow Jones REIT, the iShares Cohen & Steers Realty Majors and the iShares Dow Jones US Real Estate ETF.

What is immediately striking about this group is the pitifully low yield on RWR and ICF. For an asset class that is ostensibly income-focused, that is simply not a high enough yield to warrant serious consideration.

Each of these ETFs uses a slightly different index to track the sector, but their top ten holdings are nearly identical. Simon Property Group Simon Property Group is the single largest holding in all four ETFs, and HCP HCP Inc, Public Storage Public Storage. Vornado (VNO), and Equity Residential (EQR) feature prominently as well.

While there is nothing “wrong” with these large-cap REITs, some of them have yields that are a little less than impressive for securities that were designed to be income vehicles. Simon Property Group, the largest holding in all four ETFs, yields only 2.9%.

Some of these REITs—and Vornado has been a high-profile case of this in recent years—have evolved away from pure landlording and have moved to become “deal making” growth vehicles in which property speculation is as important (or more so) than collecting rent checks. Again, there is nothing inherently “wrong” with this, but it may not be what you are looking for if you consider yourself an income investor.

Not surprisingly, since all four large-cap REIT funds hold substantially the same securities, they tend to track each other pretty closely. Given that these are index investments with no active management in place, the smartest course of action is to buy the ETF with the highest yield and lowest management fee. This leaves us with the Vanguard REIT ETF and the iShares Dow Jones US Real Estate.

The iShares Dow Jones US Real Estate has a slightly higher current yield (15 basis points) though its management fee is 37 basis points higher.

Normally, I would call that close enough to be a wash. But the Vanguard ETF is a purer play on actual property-owning equity REITs, whereas the iShares fund has exposure to mortgage REITs and to non-REIT development and holding companies such as Alexander and Baldwin (ALEX), which, among other things, produces sugar and coffee on Hawaiian plantations.

For broad large-cap REIT exposure, go with Vanguard’s VNQ. I would consider this appropriate for a long-term asset allocation, and—in the interests of full disclosure—that is exactly how I utilize it myself.