China Stock Market 5 Reasons To Be Bullish On FXI GXC HAO TAO

Post on: 22 Апрель, 2015 No Comment

After lagging the global markets the past year, China’s stock market has regained its momentum as the world’s growth leader.

IShares FTSE China 25 Index Fund (ARCA:FXI ), the flagship ETF of the People’s Republic, rallied 9.53% the past three months vs. 3.97% for iShares MSCI Emerging Markets ETF (ARCA:EEM ) and 1.02% for SPDR S&P 500 (ARCA:SPY ).

In the past year, FXI gained 15.31% vs. gains of 17.44% by EEM and 23.86% by SPY.

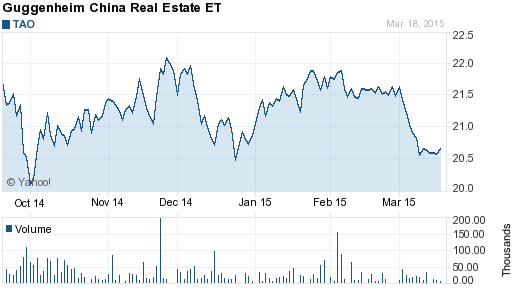

SPDR S&P China (ARCA:GXC ) climbed 9.79% the past three months and 19.45% in the past year. Guggenheim China Small Cap (ARCA:HAO ) gained 15.68% and 17.50% over the same periods. Claymore/AlphaShares China Real Estate (ARCA:TAO ) surged 17.62% and a whopping 58.85%.

Here are five signs that indicate China’s rebound has legs.

• 1. Export growth has topped expectations: China’s exports grew 11.6% year over year in October, following 9.6% growth in September and 2.7% in August, according to Bank of America Merrill Lynch. The firm’s China economists, Ting Lu and Larry Hu, project 7.5% export growth in 2013.

In a client note on Nov. 12, they wrote: October trade data could be positive for markets in three ways: (a) Rising export growth implies a recovery of industrial production and potentially higher GDP growth, (b) Rising volume of ordinary imports could be positive for shipping business, (c) Falling raw material prices are good for margins of Chinese manufacturers and real purchasing power of Chinese consumers.

They estimate China’s GDP will expand by 7.8% in the fourth quarter and 8.3% in the first half of 2013.

• 2. Raw materials imports are rising: Imports of iron ore in October rose 13% from a year earlier. Imports of oil by volume rose 13.8%. Iron imports grew 7.3% in September while oil imports decreased 1.8% that month.

Faster imports of raw materials in volume terms implied higher demand, including restocking, Lu and Hu wrote.

• 3. Industrial production beat forecasts in October: Industrial output grew 9.6% year over year in October after rising 9.2% in September. Output for metals, steel, autos cement and crude all grew at a faster rate in October than September. Lu and Hu believe industrial production will rise above 10% in November and December.

• 4. Infrastructure development sees upward momentum: Fixed-asset investments, a closely watched gauge of construction activity, rose 20.7% year over year in the January-October period vs. 20.5% in the January-September period, according to BofAML. Railway construction surged 81.9% in October vs. 77.2% in September and 37.2% in August.

Property development increased 15.2% year over year in October vs. 14.2% in September. Total investments in new projects vaulted 35.2% in October, faster than the 31.3% growth in September, thanks to a second round of government stimulus.

• 5. Retail sales are rising: Retail sales grew 14.5% year over year in October vs. 14.2% in September. Adjusted for inflation, retail sales climbed 13.5% in October and 13.2% in September. Auto sales climbed 7% year over year in October vs. 1.7% in September. September auto sales were hurt by anti-Japanese sentiment that arose from Japan’s claim of sovereignty over the Senkaku/Diaoyu Islands in mid-September.