China s Local Governments To Issue More Bonds

Post on: 16 Март, 2015 No Comment

Follow Comments Following Comments Unfollow Comments

Update: China has permitted on May 21 10 provinces and municipalities to issue bonds on their own credit later this year. The list covers six provinces, the eastern Zhejiang, Jiangsu and Shandong, southern Guangdong and two central and western provinces Jiangxi and Ningxia. Beijing, Shanghai, Shenzhen and Qingdao will also be permitted to sell bonds.

China’s deeply indebted local local governments plan to issue more bonds in 2014 to pay primarily for shantytown redevelopment, according to Chinese media reports.

Fujian province is seeking to raise 13.2 billion yuan ($2.12 billion), up 36.1% from 2013, via three-year, five-year and seven-year notes that the national finance ministry is expected to sell later this year. The ministry will also issue 11 billion yuan ($1.77 billion) of bonds on behalf of the Xinjiang provincial government, a 1.5 billion yuan ($240 million) increase from last year, reports show.

Fujian’s increase in borrowing amount – 21.8% higher than the national average – registered the sharpest rise among local governments. Many are still finalizing their borrowing plans.

“Every province wants very much to raise funds by issuing bonds,” the Fujian provincial government says. “Our bond issuance is approved after some endeavors.”

A water well in a Chinese shantytown

Beijing has made shantytown redevelopment core to its urbanization plan. The leadership said in March that China would invest more than 1 trillion yuan ($162 billion) to rebuild shantytowns to boost the urban population. The central government is also seeking to build more transportation links, ease household registration rules and allow local governments to issue their own bonds.

Currently, local governments are generally barred from directly issuing bonds and taking out loans from financial institutions. The national finance ministry issues bonds on behalf of some local authorities and allow only a handful of others such as Guangdong, Shanghai and Shenzhen to issue on their own.

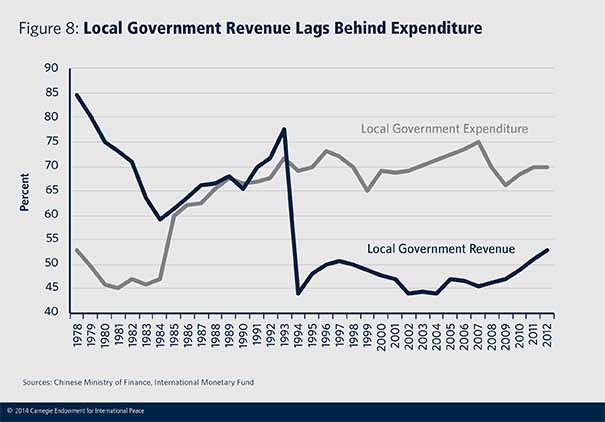

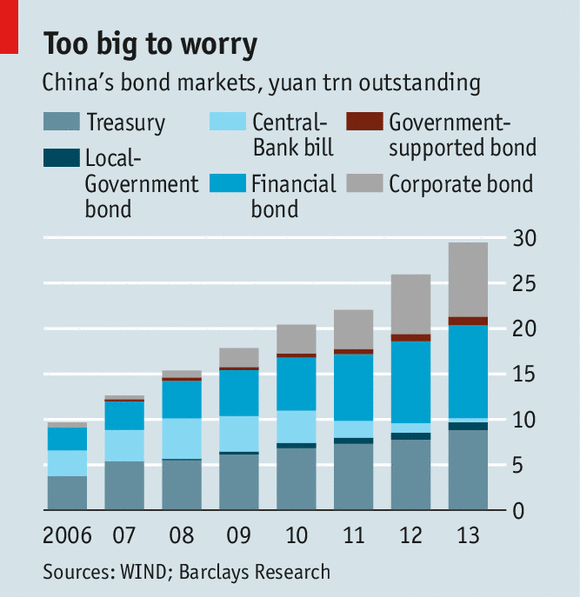

The restriction has prompted many local governments to borrow heavily from higher-risk financing vehicles to fund infrastructure and real estate development. A 2013 report by the National Audit Office says local debt had already swelled to 17.9 trillion yuan ($2.96 trillion) as of June 2013, a 63% increase from 2010.

The recent downturn in China’s real estate sector has strained local finances. Land sales in 20 major cities fell 5% in March from a year earlier, Bloomberg Bloomberg data shows.

China’s local governments have about 99.3 billion yuan ($ 15.94 billion) of bonds maturing this year, according to Beijing-based investigative journal Caixin .