Chambers Street Properties A Small REIT With Big Potential Chambers Street Properties (NYSE CSG)

Post on: 27 Июнь, 2015 No Comment

Summary

- CSG offers an attractive distribution yield of 6.1%.

- CSG’s distribution yield is supported by a low payout ratio of just 82.3% of AFFO and only 77.3% of the low end of core FFO guidance.

- CSG has an investment grade credit rating from Moody’s (Baa3) and S&P (BBB-) and a low debt/capital ratio of 46.2%.

- CSG’s owns an attractive portfolio of industrial and office properties serving a wide range of tenants over a diverse geographic footprint.

Chambers Street Properties (NYSE:CSG ) is a relatively small player in the REIT industry, trading at a market cap of just under $2 billion and holding a portfolio of industrial and office properties worth $3.4 billion. In addition, CSG is fairly new in the world of publicly traded REITs, listing in May 2013. However, while only publicly listing in May 2013, CSG has been operating since July 2004 and boasts a management team with extensive industry experience. Still, because of its small size and brief trading history, CSG is largely trading under the radar, presenting an opportunity for investors. With its attractive and comfortably supported distribution, a conservative balance sheet, and diverse portfolio of attractive assets, CSG offers a hard to find combination of attractive current income and capital appreciation potential.

(Source: Bloomberg)

As you can see from the chart above, CSG’s stock price was largely stagnant over the past year, despite offering a yield of over 6% for nearly the entire period during an environment of falling interest rates. Its total return of 11.95% in 2014, while not bad on an absolute basis, lagged that of the average REIT by a significant margin. CSG has performed better so far YTD, hitting a high of $8.82 in early February, but has since pulled back to $8.40 as part of a general sell-off in the REIT sector caused by the recent rise in interest rates. The pullback offers investors the chance to buy this attractive REIT at a +6% distribution yield, an opportunity to take advantage of.

CSG: An Attractive, Well Supported Distribution.

CSG pays a monthly distribution of $0.0425/share, which works out to an annual yield of 6.07% based on its closing price of $8.40. This is an attractive income stream, and there is every reason to believe that it is well covered and the potential for future increases is likely. Consider the following:

- After switching to a monthly payout in late 2013, CSG paid a stable monthly distribution of $0.0420/share before implementing a small increase of 1.2% to $0.0425/share that went into effect in January. While the size of the increase is not substantial, it demonstrates management’s commitment to growing the distribution over time, an important signal to make considering the brief publicly traded history of the company.

- The current distribution represents just 82.3% of CSG’s trailing Adjusted Funds From Operations (AFFO). That suggests that CSG’s payout is not only well supported by their operations, but that there is ample room for future distribution increases.

- CSG’s management prefers to use a measure they call Core Funds From Operations (Core FFO), and it is this measure they use to provide guidance to the market. They currently expect Core FFO of $0.66 — $0.69/share in 2014. The current distribution rate represents a payout ratio of 77.3% at the low end of estimated Core FFO and only 73.9% at the high end. By this measurement, the preferred method used by the company, the distribution is well supported and offers plenty of room for growth.

CSG provides a description of what they use in the calculation of Funds From Operations (FFO), Adjusted Funds From Operations (AFFO) and Core Funds From Operations in their quarterly Supplemental Information, to which I’ve provided a link below. The descriptions of FFO, AFFO and Core FFO begin on page 33:

CSG: Investment Grade Rated With An Attractive Capital Structure:

(Source: Chambers Street Properties November Investor Presentation)

As you can see from the slide above, CSG has been able to attain an investment grade rating from both Moody’s (Baa3) and S&P (BBB-), an impressive accomplishment for a company of its size and limited public history. In addition, the slide also illustrates the impressive capital structure of the company, showing a low debt/capital ratio of just 46.2%. Having an investment grade credit rating and maintaining a conservative capital structure provide CSG with several key advantages, including:

- Having an investment grade credit rating and maintaining low leverage make it easier for CSG to obtain ongoing financing, a necessity in order to refinance existing debt and to fund any new purchases. Most small cap REITs do not have such attractive access to financing.

- Because of its low leverage, CSG has ample liquidity to pursue property deals to help grow funds from operations and future distributions. They are currently only using $170 million of their $850 million revolving line of credit. This gives them the flexibility to opportunistically pursue deals of considerable size, particularly relative to the size of their portfolio. Most small cap REITs do not have such flexibility.

- When interest rates increase, the cost of debt financing for REITs increases as well. While the impact of rising rates cannot be completely mitigated, CSG’s low level of debt makes the impact of rising debt costs less severe for it than for more leveraged peers. Quite simply, it’s better to face rising costs on 46.2% of your financing than having to deal with rising costs on 70% or 80%.

While I am not trying to make an investment case for CSG as a takeover candidate, it is worth noting that the company’s conservative balance sheet does make it a more attractive M&A target. An easy way for a REIT to expand its portfolio is to buy property from another REIT, or to just buy an entire REIT outright. A larger REIT looking to expand by acquisition would be more attracted to a company using less leverage as it would mean they would be absorbing less debt as a result of the acquisition. As a result, a company like CSG employing relatively low leverage would appear more attractive than more highly leveraged peers to a potential buyer.

CSG: Building A Diverse Portfolio of Attractive Industrial & Office Properties.

CSG completed its exit of the retail space earlier this year and is now focused entirely on the industrial and office markets. Their $3.4 billion portfolio is well-diversified; serving a wide range of tenants and boasting a geographic footprint spread across a variety of markets in the US and select properties in Western Europe. The charts below from CSG’s November Investor Presentation highlight the diverse nature of its portfolio:

(Source: Chambers Street Properties November Investor Presentation)

(Source: Chambers Street Properties November Investor Presentation)

The company’s strategy is to acquire office properties located in key population centers while acquiring industrial properties located near major logistics corridors. The slides below show their success in implementing that strategy.

(Source: Chambers Street Properties November Investor Presentation)

(Source: Chambers Street Properties November Investor Presentation)

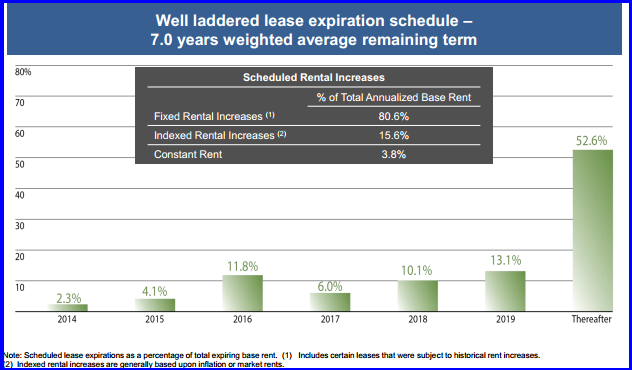

In addition to executing on its strategy of building a portfolio of assets serving a diverse base of tenants across a multitude of attractive markets, CSG has delivered operationally on its portfolio. Currently, 97.3% of its properties are leased and 97% of its rental income is subject to annual rent increases.

CSG: Bringing It All Together:

CSG is an attractive small cap REIT offering investors the potential for attractive monthly income and long term capital appreciation. CSG generates enough AFFO and Core FFO to comfortably support its distribution and offer confidence in their ability to grow it further in the future. Its conservative balance sheet ensures its ability to access funding while giving it flexibility to opportunistically expand its portfolio. In addition, its low reliance on debt financing relative to peers makes it less exposed to pain from rising interest rates while also making it more attractive as a potential takeover candidate. Finally, CSG has outlined a clear strategy and has executed on it, building an attractive portfolio of assets and delivering strong operational results. CSG is flying under the market’s radar, take advantage!

A Quick Note on REIT Distributions.

Please be aware that CSG is a Real Estate Investment Trust (REIT), and its distributions are a combination of income, capital gains and a return of capital. For IRA investors, the tax treatment of the distribution isn’t relevant; however, investors considering making a purchase in a taxable account should be aware of this distinction.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.