CD Investment Alternatives Why I m No Longer Investing In CDs

Post on: 21 Апрель, 2015 No Comment

Certificates of deposits, aka CDs have long been a stable part of my overall investment portfolio. Whether it was a bull market or a bear market, I would always invest roughly 30% of every dollar saved in the longest CD possible since college. Although I lost around 30% of my net worth during the worst of the crisis in 2009, I knew that even if everything went to hell Id have at least 30% of my net worth intact. The feeling was very comforting, especially when yields were over 4%.

Unfortunately or fortunately, times have changed due to the Feds stance on keeping rates low until 2016 if not much longer. I strongly believe that low interest rates are here to stay for a while. Weve still got a lot of economic slack in our economy to keep significant inflation at bay. Policy initiatives are also much quicker and more effective thanks to technology. As a result, everybody should:

1) Refinance their mortgages, call their credit card companies, and consolidate their student loans.

2) Be more amenable to taking on debt at the margin to build wealth e.g. buy real estate, invest in a business.

3) Look at all other investments besides CDs.

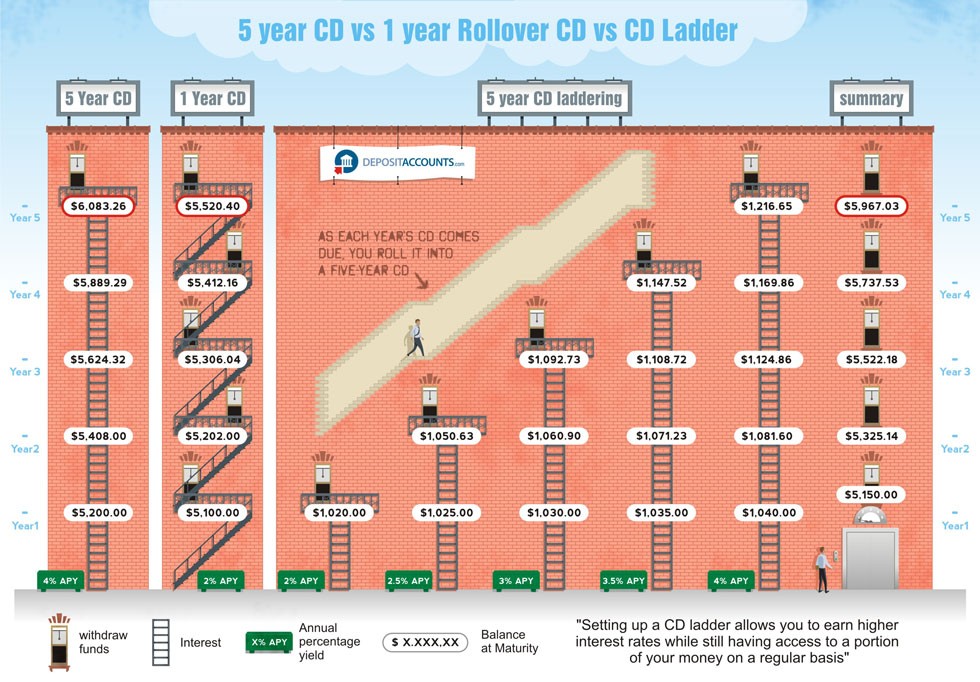

The best CD interest rate I can find is 2.2% for a 10 year CD in 2015. The funny thing is, 2.2% is not bad given the 10-year yield is at around 1.85%. If you deal in LARGE numbers, a 0.3% spread will make you incredibly wealthy! Alas, most of us dont have billions of dollars to invest and must rely on higher returns to surpass inflation and fund our retirement.

ALWAYS REMEMBER EVERYTHING IS RELATIVE IN INVESTING

When you have a 10 year CD or 10-year Treasury bond providing a 2% return, your hurdle rate is very low. There is a good chance a monkey can randomly choose 10 stocks to build a portfolio that will beat these returns if history is any guide. The dividend yield of the S&P500 alone is around 2% for goodness sake.

My conservative investment target return has always been around 2-3X the risk free rate of return. With the 10 year treasury yield likely staying below 2.5% for a very long time, Im shooting for 4-6%. The problem is, no CD provides even close to a 4% return. As a result, we need to move up the risk curve.

As my 5 year and 7 year 3.5%-4.5% CDs start rolling off in 2014, I do not plan to renew at 1.5%-2%. Instead, Im doing research now to invest my money in what will hopefully be much greater returns. Given CDs are part of my risk adverse portion of my overall portfolio, I need to be careful not to invest too far outside my risk tolerance. The rest of my portfolio is split 35% in real estate, and 35% in stocks, excluding all other assets. This mix will start changing as youll read below.

To recap why Im not investing in CDs:

* Highest rate available is a 10-year,

2% yield.

* CDs yields barely keep up with inflation.

* Locking up money for 7-10 years for under 2.5% does not sound appealing, especially with an early withdrawal penalty.