Cash Flow Rental Property Real Estate Investment

Post on: 22 Май, 2015 No Comment

Real Estate Investment

Types Of Real Estate Investment

Real estate investment is one of the most popular businesses that investors use because of the dramatic increase of the population. A real estate market also offers a lot of opportunities to any individual who wants to enter in a real estate investment. There are different types when it comes to real estate investment. Let me discuss to you some of the types of investing in a real estate .

Real Estate Investment Types

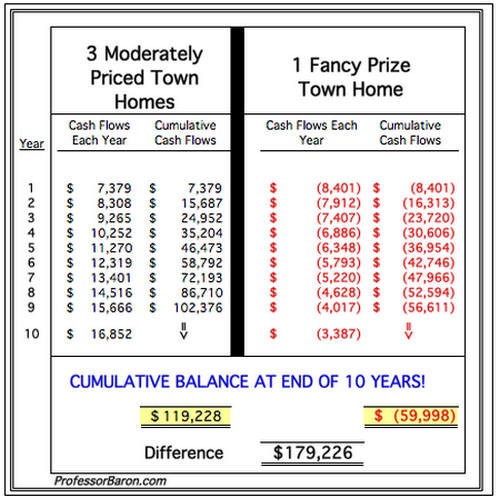

Let’s start with the Basic Rental Properties which are the most common investment that investor handles. In this type of investment an individual will purchase a property and use it as a rental property. This is where a landlord occurs and basically he or she is the one responsible for paying the expenses needed for the property. As for the owner of the property, he or she can assign a landlord or the owner can also act as the landlord. A landlord can charge more of the current rental to produce its monthly profit.

Another type is Real estate investment group. This type of investments is good enough if you don’t want to handle the business alone. A company will help you purchase or build up an apartment or a condo which ever you decide and then they will let the other investors know that this apartment or condo is for sale. However, the investors will buy it through the company that is why they are required to join the group.

As the investor, you may own one or even multiple units. However, the company which is in charge of running the investment group is still responsible for managing all of the units. They are also responsible in the maintenance of the property, the advertising of the units and with the tenant interview. The company will take percentage in exchange of this management procedure.

You can also invest properties through REIT. Real estate investment trust is involved when a corporation uses the money of the investors to buy and run property incomes. REIT’s are purchased and sold to a major exchange like the other kind of stock. The corporation is required to pay 80-90% of the taxable profit depending on the form of dividends in order to keep their status and still be considered as an REIT. REIT’s is now exempted in paying income tax in the corporation. As for the regular company, they are to be taxed in their profits and whether or not decide to distribute the tax profits which can be as dividends.

Real Estate Investment