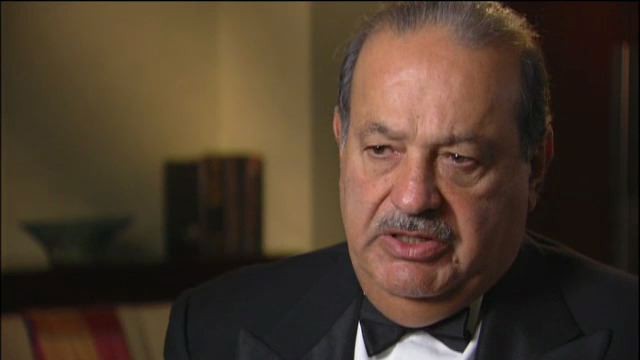

Carlos Slim Biography Academy of Achievement

Post on: 18 Май, 2015 No Comment

Carlos Slim’s father, Julin Slim Haddad, immigrated to Mexico from Lebanon at age 14. With one of his brothers, he opened a dry-goods store in Mexico City. When foreign investors fled the country following the revolution of 1910, Julin Slim resolved to remain in Mexico. By the 1920s, he had acquired a number of businesses and substantial real estate in the capital city. Julin married Doa Linda Hel, a daughter of Lebanese immigrants. The couple raised six children, of whom Carlos Slim Hel was the fifth.

The senior Slim encouraged all of his children to learn and understand finance. He gave each child a ledger to record expenditures. Young Carlos showed a special aptitude for numbers, and by age 12 was buying shares in the Bank of Mexico. When Carlos Slim was 13, his father died, and the next years were difficult for Carlos. He studied civil engineering at the Autonomous National University of Mexico (UNAM), and while still studying, began to teach mathematics and linear programming. After a few years of teaching, Carlos Slim incorporated his first business venture, a stock brokerage, Inversora Burstil. The same year, he married Soumaya Domit; in future ventures, he combined the first letters of their names, as in the name of his holding company, Grupo Carso.

Remembering the lessons of thrift he had learned from his father, he and his growing family lived modestly, while earnings from his businesses were re-invested in expansion and more acquisitions. Over the next two decades, Carlos Slim astutely acquired companies he believed were undervalued and skillfully overhauled their management. He diversified methodically, investing in real estate, then a construction equipment company, then mining interests. The portfolio of Slim companies grew to include a printer, a tobacco company and retail stores.

In 1982, Mexico plunged into an economic crisis. The government defaulted on its foreign debts, and many Mexican investors rushed to expatriate their capital. Carlos Slim’s confidence in his country held firm, and he acquired the Mexican affiliates of Reynolds Aluminum, General Tire and the Sanborn’s chain of stores and cafeterias. As the economy recovered, Slim’s fortune grew, and his acquisitions accelerated. He acquired the Mexican interests of a number of U.S.-based brands: Firestone tires, Hershey’s chocolate, Denny’s coffee shops. He bought and merged a number of insurance companies into the giant firm Seguros Inbursa.

In 2008, Slim surprised the business world with his purchase of a 6.4 percent stake in the troubled New York Times Company. At the time his investment was made public, Slim’s holding in the company was valued at $27 million. The following year, as a global recession and declining advertising revenues took a particularly heavy toll on print-based old media companies, Slim made the Times a loan of $250 million. This infusion of cash, along with other strategic adjustments by Times management, steadied the company’s finances, and the Times repaid the loan, plus 14 percent interest, ahead of schedule. Slim and his family have purchased additional shares, raising their stake in the company to just over seven percent. They hold warrants to increase their holdings to 16 percent of the company’s total stock. Although Grupo Carso spokesmen denied any intention of buying out the Ochs-Sulzberger family, who have controlled the paper for generations, even the suggestion of such a plan caused a sharp rise in the price of New York Times stock, a dramatic demonstration of Carlos Slim’s influence in the word of finance.

Forbes magazine’s 2010 survey of the world’s great fortunes confirmed earlier estimates that Carlos Slim was the world’s richest man. The survey ranked him as the world’s richest man again in 2011 and 2012. In the midst of this staggering success, the Slim family remains an unusually close-knit one. As Carlos Slim devoted more of his time to his philanthropic enterprises, his three sons took the reins of major components of Grupo Carso.

Despite the family’s enormous wealth, political development threatened the centerpiece of their business. In 2012, the Institutional Revolutionary Party (PRI), returned to power in Mexico after 12 years in opposition. Newly elected President Enrique Pea Nieto pledged to increase competition in the national economy by reducing the power of the largest companies, such as America Movil. In the two years following the election, the company, in which Slim and his family members control 57 percent, saw its value decline by nearly $17 billion. Despite these decline in it stock price, America Movil retained its dominant market share. In 2014 the company had 272 million wireless subscribers. In Mexico, 70 percent of mobile phone subscribers and 80 percent of landline users were America Movil customers.

Mexico’s Congress, at the behest of President Pea, prepared to impose antitrust penalties if the company did not reduce its share of the national market to less than 50 percent. Rather than submit to crushing penalties, Slim moved decisively and announced his decision to sell a number of the company’s assets. The operation of its wireless towers would be separated from the rest of the company, and he dropped his option to purchase a competitor, Dish Mexico. Although America Movil would be losing 21 million customers and 4 million landlines, it stood to gain an estimated $8.6 billion in cash. Following Slim’s announcement, the company’s stock price soared to levels not seen since 2009. In the years to come America Movil and the rest of Grupo Carso will operate in a more competitive marketplace, but Carlos Slim still vies with Bill Gates for the title of the world’s richest man.