Capital Structure Theory Modigliani and Miller (MM) Approach

Post on: 16 Март, 2015 No Comment

Modigliani and Miller approach to capital theory, devised in 1950s advocates capital structure irrelevancy theory. This suggests that the valuation of a firm is irrelevant to the capital structure of a company. Whether a firm is highly leveraged or has lower debt component, it has no bearing on its market value. Rather, the market value of a firm is dependent on the operating profits of the company.

Modigliani and Miller (MM) Approach

Capital structure of a company is the way a company finances its assets. A company can finance its operations by either debt or equity or different combinations of these two sources. Capital structure of a company can have majority of debt component or majority of equity, only one of the 2 components or an equal mix of both debt and equity. Each approach has its own set of advantages and disadvantages. There are various capital structure theories, trying to establish a relationship between the financial leverage of a company (the proportion of debt in the companys capital structure) with its market value. One such approach is the Modigliani and Miller Approach.

Modigliani and Miller Approach

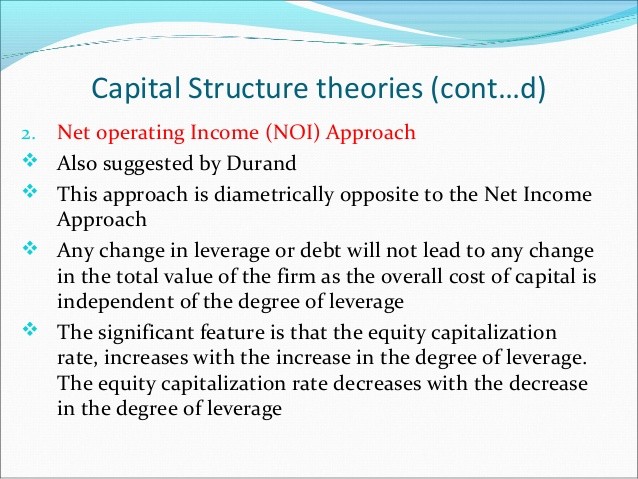

This approach was devised by Modigliani and Miller during 1950s. The fundamentals of Modigliani and Miller Approach resemble to that of Net Operating Income Approach. Modigliani and Miller advocates capital structure irrelevancy theory. This suggests that the valuation of a firm is irrelevant to the capital structure of a company. Whether a firm is highly leveraged or has lower debt component in the financing mix, it has no bearing on the value of a firm.

Modigliani and Miller Approach further states that the market value of a firm is affected by its future growth prospect apart from the risk involved in the investment. The theory stated that value of the firm is not dependent on the choice of capital structure or financing decision of the firm. If a company has high growth prospect, its market value is higher and hence its stock prices would be high. If investors do not see attractive growth prospects in a firm, the market value of that firm would not be that great.

Assumptions of Modigliani and Miller Approach

- There are no taxes.

- Transaction cost for buying and selling securities as well as bankruptcy cost is nil.

- There is symmetry of information. This means that an investor will have access to same information that a corporate would and investors would behave rationally.

- The cost of borrowing is the same for investors as well as companies.

- Debt financing does not affect companies EBIT.

Modigliani and Miller Approach indicates that value of a leveraged firm (firm which has a mix of debt and equity) is the same as the value of an unleveraged firm (firm which is wholly financed by equity) if the operating profits and future prospects are same. That is, if an investor purchases shares of a leveraged firm, it would cost him the same as buying the shares of an unleveraged firm.

Modigliani and Miller Approach: Two Propositions without Taxes

Proposition 1: With the above assumptions of “no taxes”, the capital structure does not influence the valuation of a firm. In other words, leveraging the company does not increase the market value of the company. It also suggests that debt holders in the company and equity share holders have the same priority i.e. earnings are split equally amongst them.

Proposition 2: It says that financial leverage is in direct proportion to the cost of equity. With increase in debt component, the equity shareholders perceive a higher risk to for the company. Hence, in return, the shareholders expect a higher return, thereby increasing the cost of equity. A key distinction here is that proposition 2 assumes that debt share holders have upper-hand as far as claim on earnings is concerned. Thus, the cost of debt reduces.

Modigliani and Miller Approach: Propositions with Taxes (The Trade-Off Theory of Leverage)

The Modigliani and Miller Approach assumes that there are no taxes. But in real world, this is far from truth. Most countries, if not all, tax a company. This theory recognizes the tax benefits accrued by interest payments. The interest paid on borrowed funds is tax deductible. However, the same is not the case with dividends paid on equity. To put it in other words, the actual cost of debt is less than the nominal cost of debt because of tax benefits. The trade-off theory advocates that a company can capitalize its requirements with debts as long as the cost of distress i.e. the cost of bankruptcy exceeds the value of tax benefits. Thus, the increased debts, until a given threshold value will add value to a company.

This approach with corporate taxes does acknowledge tax savings and thus infers that a change in debt equity ratio has an effect on WACC (Weighted Average Cost of Capital). This means higher the debt, lower is the WACC. This Modigilani and Miller approach is one of the modern approaches of Capital Structure Theory.