Cap Rate Spread Leading Indicator For NonListed REIT Performance

Post on: 16 Апрель, 2015 No Comment

In looking at non-listed REIT performance, analysts typically examine their funds from operation (FFO), or modified funds from operation (MFFO) payout ratio, which provide an assessment of dividend sustainability. The FFO or MFFO payout ratio calculates the dividends as a percent of FFO or MFFO for a given period. If the payout ratio is greater than 100%, then FFO or MFFO is not sufficient to cover the dividend. REITs should have a payout ratio below 100%.

For closed, non-listed REITs and publicly-traded REITs, FFO is the most appropriate real estate operating metric to evaluate the dividend payout. However, for non-listed REITs in their capital raising stage, MFFO will be the most meaningful real estate operating metric. While MFFO has many versions, the most appropriate version adjusts only for acquisition costs, which are now required to be expensed by REITs, from FFO.

In the capital raising stage of a non-listed REIT, many factors, including capital deployment, high upfront costs, and lower leverage, will inflate their MFFO payout ratios against a dividend that the REIT expects to cover once they are stabilized. As a result, MFFO payout ratios in these early stages are not the best indicator of long-term performance. In these early stages, the REITs cap rate spread is the leading indicator of long-term operating performance.

The cap rate spread is the difference between the average cap rate on a REITs invested assets and the average interest rate on their debt financing. Most non-listed REITs utilize a leveraged investment strategy, as long-term debt at attractive rates can provide a significant boost to the REITs equity yield. And, the cap rate spread serves as the best indicator of the long-term leveraged equity yield for a non-listed REIT.

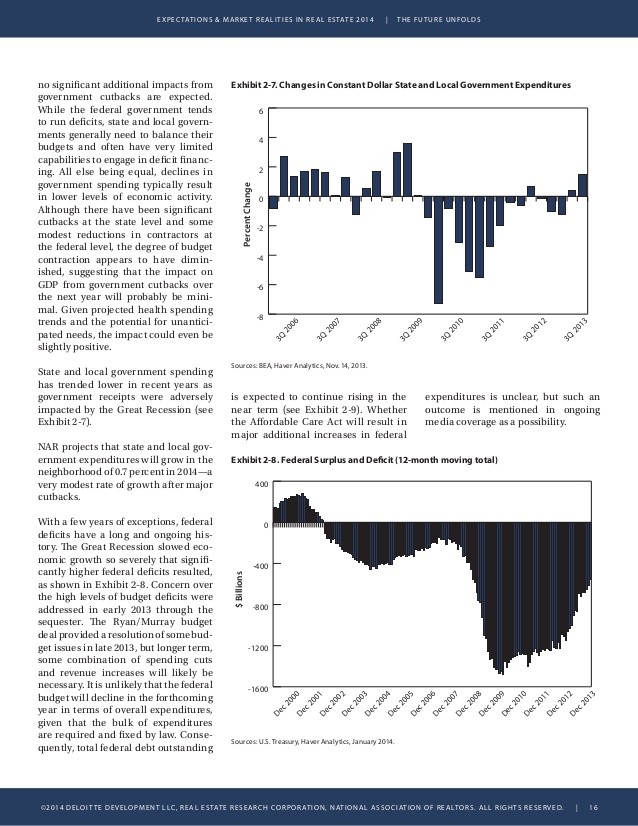

Todays commercial real estate market continues to provide favorable cap rates to investors. While cap rates have compressed slightly since their peak in 2009, current cap rates are still favorable from a historical perspective. Higher cap rates not only provide higher gross yields on real estate investments, but they position these investments for greater opportunity for appreciation due to cap rate compression, which reflects an increase in real estate values.

The credit markets have improved significantly, providing great financing opportunities for REITs with strong performing, institutional-quality assets. The commercial real estate markets were essentially frozen in 2008, and they provided only limited debt financing in 2009. Over the past two years, and in large part due to a low interest rate environment, interest rates on long-term debt has declined significantly, which allow investors to generate higher leveraged equity yields.

The table below lists several effective non-listed REITs that are experiencing strong cap rate spreads. These non-listed REITs are all newer programs taking advantage of a favorable investment and financing environment. As a result of their strong cap rate spreads above 2.5%, these non-listed REITs should have strong operating performance over the next few years, even though their MFFO payout ratios may be high in the near term due to factors discussed earlier.

Effective Non-Listed REITs