Canadian Real Estate Investment Trusts (REITs)

Post on: 16 Март, 2015 No Comment

Canadian Real Estate Investment Trusts

Canadian REITs

by Harry Domash

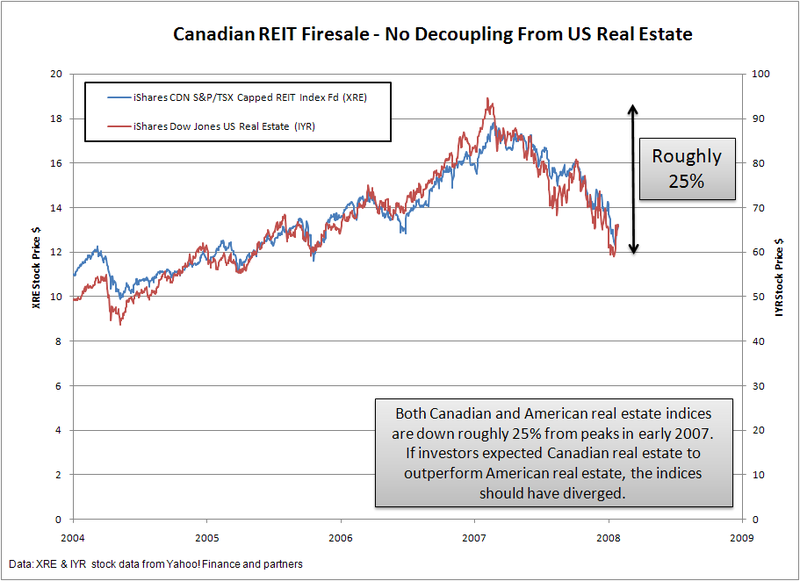

Late to the party compared to the U.S. Canadian Real Estate Investment Trusts (REITs) were first established in 1993. Unlike U.S. REITs, which are corporations, Canadian REITs are unincorporated investment trusts. Otherwise, U.S. and Canadian REITs (pronounced “reets”) are similar.

Differences U.S. vs. Canadian REITs

Both U.S. and Canadian REITS do not pay federal income taxes as long as they distribute a specified percentage of net taxable income to shareholders. However, the minimum percentage is 90% for U.S. REITs, but 100% for Canadian REITS.

Because Canadian REITs are not incorporated, in theory, unitholders are liable for their debts and other liabilities. However, most REITs take steps to shield unitholders from REIT liabilities.

The Canadian government limits foreign ownership of REITs to 49%. If that limit is exceeded, the trustees decide which foreign owners must dispose of their shares.

While U.S. REITs typically pay quarterly dividends, most Canadian REITs pay unitholders monthly.

Tax Issues

The Canadian government requires that REITs withhold 15% of shareholder distributions defined as return on capital. The tax withholding applies to REITs held in tax-sheltered as well as regular accounts. U.S. citizens may claim a foreign tax credit up to $300 for single tax payers and $800 for married couples filing jointly. Those limits apply to the total of all foreign dividends received during a year, not to each REIT. For amounts above those limits, U.S. taxpayers must file IRS Form 1116. The credit received from Form 1116 depends in each filer’s tax situation.

Return of capital distributions are not subject to withholding. However, since REITs typically don’t classify distributions as return of capital until the following year, U.S. holders must apply for a refund from the Canada Revenue Agency.

The withholding issue aside, Canadian REITs offer a significant advantage to U.S. investors in that distributions are subject the maximum 15% capital gains tax rate, not the ordinary income rate that applies to dividends received from U.S. REITs.

Real Estate Operating Companies

A few publicly traded Canadian real estate operators are organized as Real Estate Operating Companies (REOCs) instead of REITs. The advantage to the REOC is that it is not required to pay out all of its taxable income to shareholders. That gives the REOC more flexibility in terms of allocating its resources.

Here are the publicly traded Canadian REITs and REOCs, listed with the largest firms, in terms of market-capitalization, first.