Canada interest rates can’t stay low forever

Post on: 24 Август, 2015 No Comment

Once hailed as a sure fire way to help weather the global financial crisis. Canadas ultra-low interest rate strategy may be proving to be a headache for policymakers.

Its been the lowest stretch for Canadian interest rates since the 1950s, and cant stay this low forever. Consumers are saddled with debt and the economic outlook is not as rosy as previously thought. The Bank of Canada will have a tough time juggling those factors going forward, says Charles St-Arnaud, an economist with Nomura Securities in New York.

It will be hard to manage. Youre in a situation where if the economy slows, bringing interest rates lower doesnt make any difference because the rate-sensitive part of the economy is already exhausted, said St-Arnaud, who is a former Bank of Canada economist.

Its like if youre trying to squeeze the juice of a lemon. When theres no juice, theres no juice. You can squeeze harder, but theres no juice coming out. Youre almost at that point with consumers.

The Bank of Canada is apparently alone among central banks of the Group of Seven to have a tightening stance. St-Arnaud foresees rates staying at 1.0 per cent for a while longer and then likely rising sometime in mid-2014.

Last week, the central bank softened its stance on the need for interest rate hikes and suggested it will probably hold rates steady for a period of time. But it is still signaling its next move would likely be a hike rather than a cut.

The Bank of Canada has maintained that the strategy was needed during the financial crisis, with the key aim of sparking domestic demand to offset weaker exports. The policy appears to have worked as some 60 per cent of Canada’s economic growth since the end of the recession has come from household spending, said St-Arnaud.

But theres not much more that can be done on that front, he added. For starters, household debt levels are sky high with Canadian household debt to disposable income at nearly 165 per cent. Consumers will likely be busy paying off debt rather than driving economic growth through consumption.

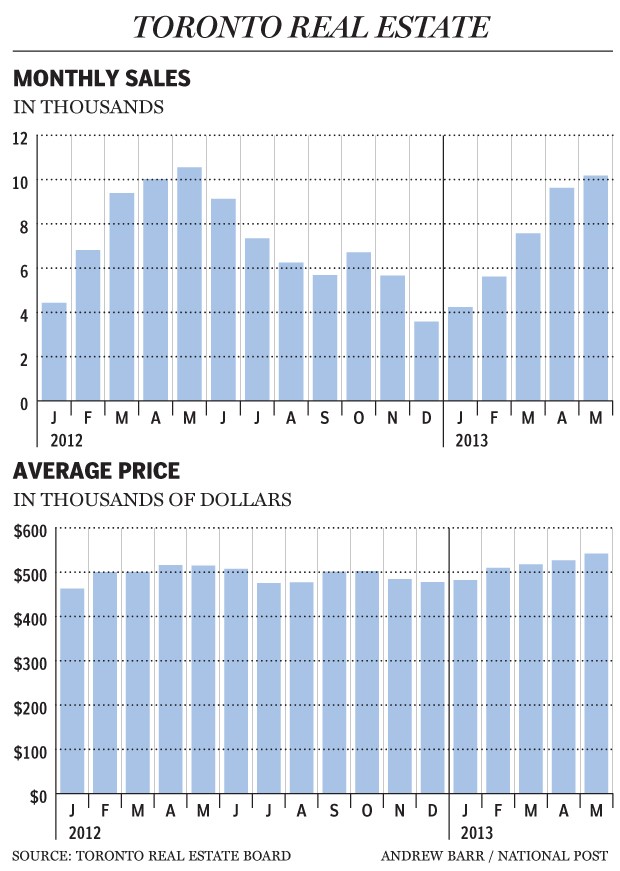

Lowering interest rates further could also wreck the balancing act Finance Minister Jim Flaherty orchestrated last summer when he tightened mortgage lending rules to cool the once-hot real estate market .

The issue now is whether business investment and exports will rebound. Maybe, but probably not at a very robust pace given recent indicators, said St-Arnaud. With monetary policy less able to provide a boost to the economy, the task of stimulating the economy would fall to fiscal policy , he added.

In his new outlook, St-Arnaud sees growth of 1.3 per cent in 2013, the weakest since the 2008-2009 recession. Next year, he sees growth at roughly 2.0 per cent.

Exports a factor in slow economy: Mark Carney Bank of Canada governor Mark Carney says if he had to choose one reason for the slow growth of the Canadian economy, it would be weak exports. Carney says even after dampened forecasts, exports have been lower than expected.