Can you cancel a real estate deal Know the right of rescission

Post on: 5 Апрель, 2015 No Comment

Dear Real Estate Adviser,

Dear Lolly,

State and city laws vary on this. But there’s a good chance you can’t cancel the contract except in cases of fraud, nondisclosure, misrepresentation or where specific contingency clauses were not met that you (I hope) had placed into the contract.

That’s why it’s imperative that consumers are 100-percent certain they want to purchase a property before signing a sales contract, and that they fully comprehend all the terms of said contract. It is a binding deed.

There is, however, a federal law that provides a three-day right-of-rescission period for residential properties, but it doesn’t apply to loans made for the purchase of real estate. It only covers borrowers who are getting certain home equity and refinancing loans for their primary residence, or who are securing an extension of credit.

A rescinding in this case entitles the would-be borrower to a refund of all fees paid in advance of getting the refinancing loan, including title search fee, inspection fees, escrow fees, etc. It’s essentially a cooling-off law created by the Federal Truth in Lending Act to help protect certain borrowers from such things as high-pressure sales tactics, door-to-door remodeling scams (and to protect overzealous consumers from themselves).

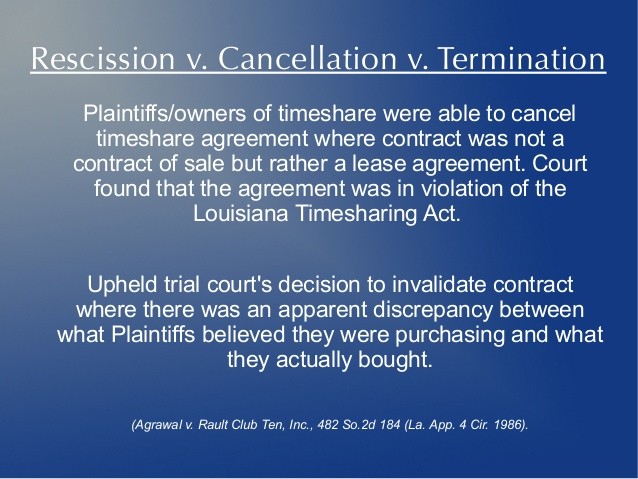

Some states, such as Florida, do have rescission laws that protect condominium buyers or time-share buyers from developers in certain circumstances, but it doesn’t apply to conventional mortgage borrowers.

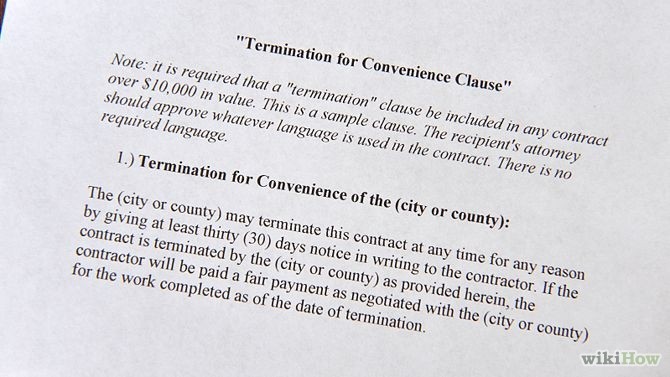

On the off chance you’re referring to a listing contract you’d like to break, it’s generally not a problem to get the agency to terminate the agreement if you are dissatisfied with the level of effort or service by the agent.

If that’s not the case, here’s another tidbit to chew over. In the event you have been deceived by the seller or broker in the deal, you are protected under the Deceptive Trade Practices Act. If something really untoward has happened to you in this transaction, such as nondisclosure of still-prevalent flood damage, then you can pursue rescission through legal or lender channels, or be eligible to recover damages, depending at what stage of the transaction you’re in.

Or sometimes the buyer and seller and agents can agree to simply terminate the contract to avoid a big mess. It might be worth a try.

Failing that, you probably ought to talk with a real estate attorney if you really want out of this thing. Good luck.

To ask a question of the Real Estate Adviser, go to the Ask the Experts page, and select buying, selling a home as the topic.

— Updated: June 12, 2006