Calculating Property Value With Capitalization Rate

Post on: 30 Май, 2015 No Comment

WIN-Initiative/ Riser/ Getty Images

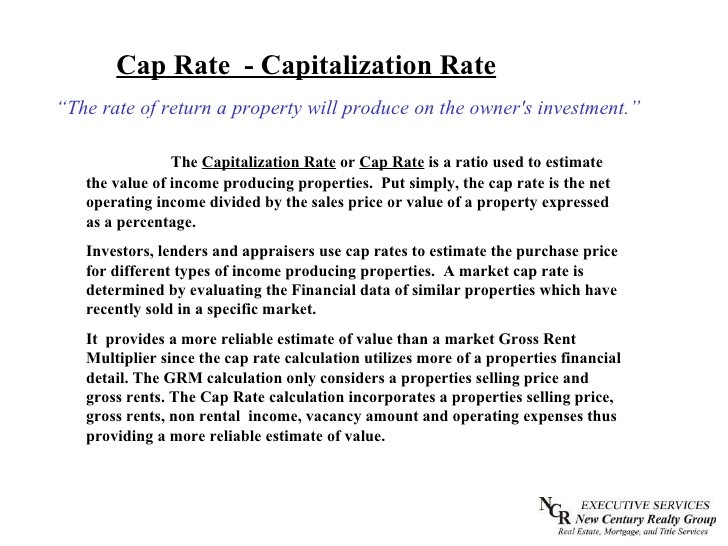

As a real estate agent or broker working with investor clients, you’ll need to understand income property valuation methods. One used frequently uses property income and the capitalization rate to determine the current value of the property for purchase consideration.

Difficulty: Easy

Time Required: 5 minutes

- Determine the net operating income of the subject property the client is considering purchasing. If it’s an apartment complex, determine the net rental income after expenses.

Example: Assume a capitalization rate of 11%.

$30,000 / .11 = $272,727 current value of the property.

More Real Estate Investment Calculations

Real Estate Financial Calculator Problems Explained

Real estate investors use a variety of mathematical tools to analyze the performance of their investment properties. We’ve taken some of the most popular ones.

Understanding Investment Calculations and Formulas — Real Estate .

Learn to apply and utilize the many calculations used to evaluate and select real estate investment properties. Your value to your real estate investor client is.

Net Rental Yield Calculation for Real Estate Investors

The beginning of a successful rental property investment strategy is an accurate estimate of rental yield for the prospective property. Here we see how to.

How To Calculate Capitalization Rate for Real Estate

Those who invest in real estate via income-producing properties need to have a method to determine the value of a property they’re considering buying.

How To Calculate Net Operating Income for an Investment Property

As a real estate professional serving investment clients, you need to be very familiar with all the methods of valuation of income properties. One of these is the.