Buying Reits may be better than buying a property Singapore Property News Singapore Property

Post on: 9 Июнь, 2015 No Comment

INVESTING in real estate investment trusts or Reits may be taking the shine off traditional property investment as most Singaporeans know it — buying an apartment or house and holding it for rental income while waiting for its value to appreciate substantially.

The current environment — where nobody is expecting home prices to shoot up anytime soon, with poor yields from renting out apartments, and low interest rates — is helping to nurture this view.

Singapore now has four Reits. The first three — CapitaMall Trust (CMT), Ascendas-Reit (A-Reit) and Fortune Reit — went through initial public offers — while the latest, CapitaCommercial Trust (CCT) which holds seven ex-CapitaLand properties, was listed earlier this year, although it did not go through an IPO. Instead, it was created out of a de-merger from CapitaLand.

Looking at the first three because they have a longer trading history, the returns to an investor — from both the stable distribution or dividend payouts and capital appreciation of the Reits’ unit prices on the stock exchange — have been pretty impressive and far outpaced the returns one would have made from investing in an apartment.

If you had bought units in the oldest Singapore Reit, CMT, at its IPO issue price of 96 cents and are still holding onto them, you would today be sitting on total returns of more than 90 per cent (inclusive of a 76 per cent appreciation in the unit price) in the slightly over two-year period since you bought them.

The Urban Redevelopment Authority’s price index for private homes, on the other hand, has fallen about 2.3 per cent over a similar period: from Q3 2002 to Q3 2004.

And if you had bought your CMT units on the last trading day of 2003, your total return to date would be about 22 per cent, inclusive of an 18 per cent rise in unit price. This compares with a flat performance in URA’s private home price index over a similar period. And current rental yields from apartments, averaging about 3 per cent, are hardly exciting.

Investing in A-Reit, which was listed in November 2002, at the IPO price would have landed an investor a total return of over 100 per cent to date over the past two years (including an 86 per cent appreciation in unit price).

And if you bought units in Fortune Reit during its flotation in August last year, your total returns to date would be 32.5 per cent. Fortune Reit owns suburban malls in Hong Kong.

No doubt most of the gains from investing in Reits so far are from the capital appreciation in the unit price. And most analysts have been cautioning for months now that it’s unrealistic to expect the astronomical rate of appreciation seen in the past to continue.

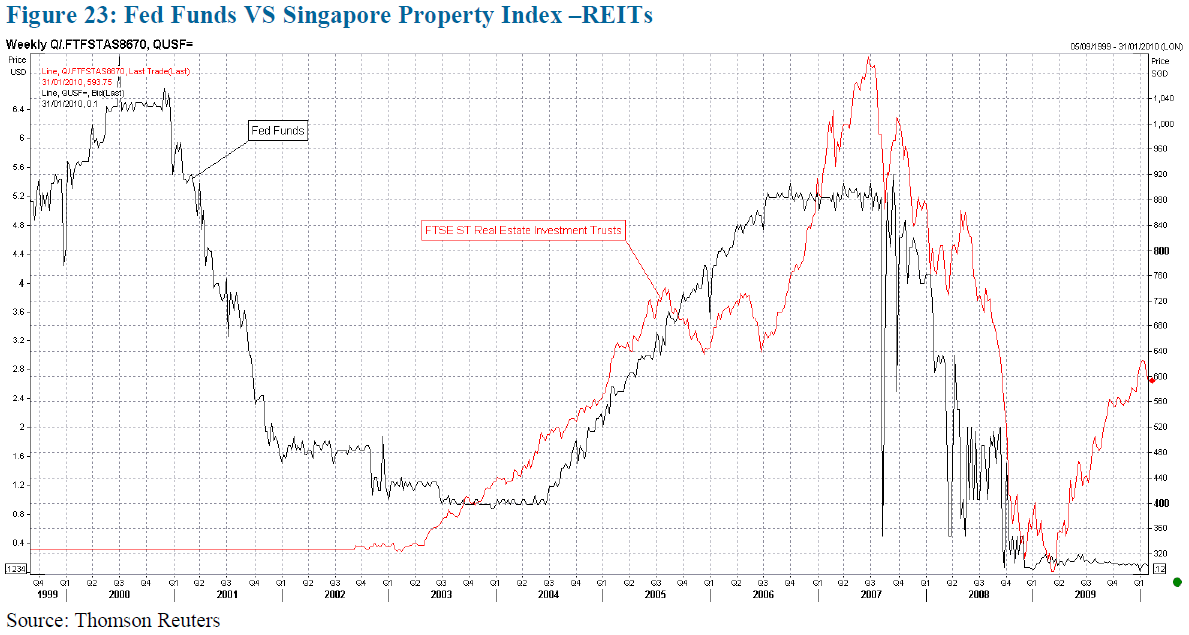

If interest rates were to rise, distribution yields from Reits would also need to increase in tandem. And this means the unit prices of Reits would have to ease, goes the theory. Interestingly, such warnings seem to have fallen on deaf ears so far.

The cash-flush Singapore market and low returns from investing in Sing Dollar fixed deposits have been two key reasons why investors — especially retail investors — have been making a beeline for Reits, chasing up their prices on the stock market.

As well, the inclusion of CMT and A-Reit on the Morgan Stanley Capital International (MSCI) Singapore Index has helped to create institutional demand for the counters. Fortune Reit too is on several indices including the FTSE All World Asia-Pacific Index.

But the stellar rise in Reit unit prices aside, the three trusts have also been giving out stable distributions that work out to a yield of at least 5 per cent. That alone is higher than the measly 3 per cent from renting out an apartment, note analysts.

In addition to the attractive returns, investing in Reits instead of an apartment has other benefits as well.

While you have to pay income tax on the rental income from your apartment, as an individual investor in a Reit, you are exempt from income tax on distributions which you receive from the trust.

Reits pay out nearly all — if not all — of their net income to unit holders as distributions in exchange for not having to pay income tax at the vehicle or Reit level. That is a key reason why distribution yields from Reits are attractive. As well, Reit managers work hard to drive the returns on the properties and manage the property, which is another advantage.

So as a Reit investor, you don’t have to bother with the hassle of administering the property — like finding tenants, servicing them, dealing with the taxman for property taxes, etc. No pesky tenants to bother you with getting the air-con or washing machine fixed or threatening not to pay the rent if you don’t replace the carpets in the living room.

All these matters, the Reit manager handles. You just collect a steady dividend income of at least 5 per cent for most of the Singapore Reits.

Another good thing about investing in Reits versus physical property is that trading in Reit units on the stock exchange is so much easier than buying or selling a property. The market for trading in Reits on the local bourse is very liquid, so entering and exiting your investments is just a phone call or mouse click away.

That sure beats trying to find a buyer for your house, with viewings, appointments, haggling about the price — and try doing that during a property slump.

Of course, there will always be those who still hold dear the idea of investing in residential property with the hope of eventually bequeathing it to their children. To say ‘I inherited an apartment from my parents’ has a different ring to it than saying ‘I got CMT units from my parents’.

Reits certainly look attractive now because of the low returns on fixed deposits and the fact that private home prices are languishing. So the prospect of investing in an apartment for capital appreciation does not look bright.

Of course, it could be a different story when the environment changes again.