Buyer s Due Diligence Checklist

Post on: 28 Апрель, 2015 No Comment

Buyer’s Due Diligence Checklist

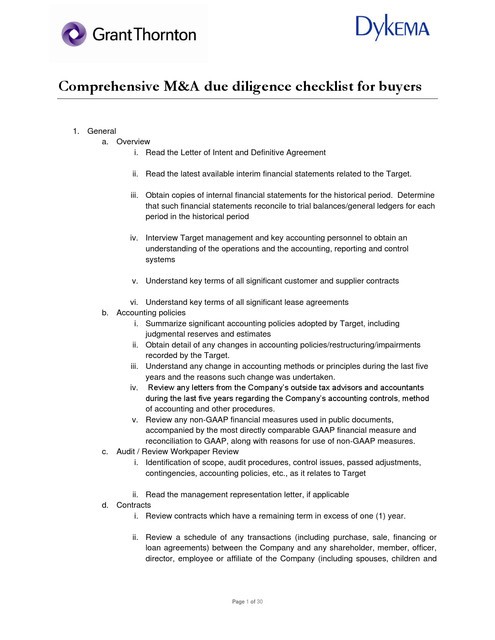

Overview: All buyers looking to acquire a financial advisory firm should have a due diligence checklist prepared in advance. Without one, it is like trying to find your way in the dark without a flashlight. You never want to look back after an acquisition with regrets on the level of due diligence performed.

Due diligence refers to the review process preformed by a buyer to verify the underlying aspects of a seller’s practice. Make sure you have ample opportunity to examine all records and that you conclude the due diligence to your complete satisfaction. You will perform this task only once, so be thorough and persistent in asking for what you need from the seller. Once documents are received, it is your responsibility to make sure any professionals you are working with are moving quickly in their work. Just as you wish for the seller to be involved and moving along at a good pace, you should be doing the same out of respect for the person you may succeed.

A complete due diligence encompasses a wide array of necessary steps for the buyer to get the full picture of the potential acquisition. If the acquisition is a larger or complicated, it is recommended that you hire a knowledgeable coach or specialist firm that has experience in performing due diligence on financial practices. The process will require a look at the history of the firm, its present circumstances, and most importantly, an eye to the future profitability of the potential transaction.

Below are the most relevant categories you should consider performing due diligence in a financial advisory firm. Your list should contain other categories or concerns you may have on the subject firm that are not on the list. For example, if you would like more information on the what the investor demographics look like surrounding the practice location, arrange for a demographic study. Likewise, if you’re buying a business (rather than a book of business) and are therefore assuming the current product and service provider relationships, you may want to request a meeting with the key players that support these areas. Use this list as a guide and then complete it by listing additional items of particular concern to you.

- 3 to 5 years of financial statements

- Detailed breakdown of revenues (both recurring and non-recurring)

- Detailed breakdown of expenses

- Detail of total assets under management

- Last three years federal and state tax returns

- Copies of all debt contracts or obligations (including compensation related such as

- pay plans, pension plans, 401K plans)

- List of all business assets (real estate, equipment, software, patents, etc…)

- Credit history/bank references

- Insurance policies on key personnel

- Policies and procedures manual

- Detailed list of all office processes

- Errors and omission insurance records

- Other insurance records (liability, business interruption, etc.)

- Software and technology used in the firm (both internal and outsourced)

- Marketing plan

- Advertisements and promotional materials

- Newsletters

- Client communications

- Seminar background and material

- Information on special niches or markets

- Marketing contacts

- Past marketing initiatives

- Current marketing initiatives

- Client profile established by the firm

- Client list (breakdown by A, B, C, ECT.)

- Client list by assets under management

- Client list by revenue per client

- Client list by time with firm

- Client list by profitability

- Client surveys

- Customer complaint file (request full disclosure of past and present client issues)

- Client referral file

- Client review process (all steps, materials and programs used)

- Information on client contact management systems(s)

- Investment policy statements

- List of clients with potential future investments

- Employee manuals and procedures

- Employee contracts

- Employee discipline and dispute files

- Employee review file

- Employee payroll records

- Employee agreements

- Copies of all insurance records

- Copies of all benefit plans offered to employees

- Investment philosophy

- Investment style

- Investment performance

- Third party investment relationships (money managers, wholesalers, broker-dealer,

- Custodian)

- Key industry contacts

- Third party vendor relationships

- Association memberships and industry groups

- Major accomplishments

- Company awards

Additional due diligence pointers:

Make sure the necessary registrations and licenses match between your firms and to the seller’s and that the seller is in current compliance. Ask for, review the seller’s compliance and audit history. Ask for and review any correspondence from federal or self-regulatory agencies regarding actions taken against the seller.

Ask for copies of any client complaints, lawsuits (pending or historical), and any judgments and decrees to which the advisor had been subject.

If the seller has a different broker-dealer than yours, take care to know early on whether that is a deal-breaker. If they are not willing to move their firm into NEXT Financial Group and that is required, this should be known up front.

Identify the tangible and intangible aspects of the firm such as brands, market niches, client management programs, and other processes and systems that may bring increased value to the deal.

The Take Away: The outcome of performing due diligence on a potential acquisition firm will be directly determined by the buyer’s preparation and the seller’s willingness to collaborate in the process. Sellers should be forth coming with the information sought by the buyer as long as it is reasonable. Should a buyer have great difficulty in gathering the necessary information, it should serve as a caution flag as to the higher potential risk of the deal.