Boosting Yield In The ETF Retirement Portfolio

Post on: 16 Апрель, 2015 No Comment

Summary

- The ETF Retirement Portfolio survived the last week of July with minimal loss.

- It is possible to boost the yield of the Retirement Portfolio by properly allocating one’s investments.

- There are two financial instruments that enable the investor to achieve significant yield without unduly risking investment capital.

In my last article concerning the ETF Retirement Portfolio I adjusted the core components of the portfolio to contain — and consist of — the following:

- SPDR SSgA Income Allocation ETF (NYSEARCA:INKM )

- iShares Morningstar Multi-Asset Income ETF (BATS:IYLD )

- First Trust Multi-Asset Diversified Income Index Fund (NASDAQ:MDIV )

- PowerShares CEF Income Composite Portfolio (NYSEARCA:PCEF )

- PowerShares S&P 500 Low Volatility Portfolio (NYSEARCA:SPLV )

Again, the portfolio is intended to:

- generate a reasonable and regular income ;

- provide an opportunity for growth ;

- and be as maintenance-free as possible.

And, as I stated from the outset, I have constructed my own portfolio from these holdings — I have skin in the game and a bit of it got scraped off the last week of July (although the portfolio did not experience the same degree of drop as the S&P and the Dow ), as the following graph shows (the retirement portfolio is ETF/RP).

Corrections in the market cannot be avoided and just about everyone is subject to some loss when the market in general drops; all you can do is wait for things to correct and then get back to the business of growing. However, while share growth is one of the features I want in the portfolio, the most important is dividend yield .

The Need for Yield

Dividends are not expected to be as volatile as share price. That is not to say that dividends cannot be cut, just as it is possible for dividends to increase — it is just not expected that dividends experience the same vacillations as share prices (unless it’s always on the uptick, in which case it will still be a surprise — albeit a pleasant one).

When I retired, it was my goal to derive supplemental income from my investments, but to do so without drawing on my invested capital — except in emergencies. Now, there are many ways to tap into some sizeable dividends: Real Estate Investment Trusts (REITs), Major Limited Partnerships (MLPs), and so forth. The problem is, high dividends come at the price of increased risk (to the invested capital — a bad thing).

The ETF retirement portfolio was intended to secure a good yield without placing the capital invested in the ETFs at too great a risk. I think that has been achieved and the result is a dividend yield that hovers around the 5% mar k. 1 That is not bad, but it could be better.

Assuming the investor is retired, the five selected ETFs should constitute the core of the portfolio. In terms of allocation, I believe it would be appropriate to place 60% — 70% of the capital to be used in the portfolio into the core holdings, although the precise allocation among the core ETFs would depend on the comfort level of the individual investor. I have approximately 60% in the ETFs, and weigh the distribution a bit heavily towards the dividend-earning ETFs (IYLD, PCEF and MDIV) — although about one-third is divided between INKM and SPLV, which provide more reliable sources of growth.

As for the remainder of the portfolio’s assets, they can be used to maximize dividend opportunities or to take advantage of investments having growth potential. For our purposes now, I’ll focus on dividends; more specifically, I want to discuss two instruments for increasing dividend yield while putting invested capital at minimal risk.

Exchange-Traded Debt

Exchange-traded debt (ETD) is a type of bond that can be purchased as one would purchase a share of stock, or an ETF. ETDs are typically issued in $25.00 units (although some may be less or more), and constitute debt (because of the small denomination these are sometimes called baby bonds ). There is no minimum purchase requirement as there would be for other bonds, and they can be traded just as one would any other exchange-based instrument.

There are two attractive features that ETDs have:

- they typically carry a coupon rate, reflecting the annual interest paid on the ETD at its issued price;

- they can be called by the issuing company — usually no sooner than five years after issuance — for the issued/redemption price.

In principle, then, one buys a share of the ETD, receives interest from the issuing company as long as one holds the share, then, when the company calls the debt or when the debt reaches maturity, one redeems one’s share for the redemption price.

Some considerations:

- ETD maturity may be 30 years or longer, and although the company can redeem the ETD at any time after the earliest redemption date (usually five years after issuance), they are under no obligation to redeem the ETD prior to maturity.

- Being sold on the open market, ETDs are subject to the vacillations of the market; shares are issued — and ultimately redeemed — at $25.00/share, but the market may price them higher or lower than that on any given date.

- Regardless of the purchase price, interest payments are made at the coupon rate, and made based on the price of the issuance — an ETD issued at $25.00/share with a coupon rate of 4% will pay $1.00 per year interest, regardless of how much or how little is actually paid for the share.

- Interest payments received are interest. not dividends, and are taxable at the regular income tax rate (they do not qualify for preferential tax rates).

- Interest payments are usually made quarterly. although some may pay monthly.

- ETDs may, or may not, have a Standard & Poor’s (S&P) credit rating.

- ETDs rank higher than common shares and preferred shares, in the event of bankruptcy.

An Example

On January 29, 2013, General Electric Capital Corporation issued a senior note 2 (GEH) in the form of a $25.00-denominated security bearing a coupon rate of 4.875% ; the earliest date at which the security may be redeemed is January 29, 2018 ; redemption value is the issue price plus accrued interest.

The company specifies that interest payments will be made quarterly on the 29th of January, April, July and October of each year, beginning on April 29, 2013. The annual interest is $1.219/share. paid out at a rate of $0.305/share/quarter.

General Electric Capital has an S&P rating of AA+.

On August 1, 2014, GEH was priced at $23.68, essentially a $1.32 discount from the share’s redemption price. This means that the $1.219 annual interest is effectively yielding 5.15% — a 27-basis-point increase relative to the coupon rate. 3

Moreover, one should keep in mind that, if held until redemption, one also sees a $1.32/share increase in value from the original purchase price. This amounts to a 5.57% capital gain on one’s investment. 4

Another Example

The fact that the investor’s purchase price may differ from the redemption price means that one needs to be careful.

Consider the KKR Financial Holdings 8.375% Senior Note (KFH) 5. issued in November, 2011, at $25.00/share, trading on August 1, 2014 at $27.91/share. Quarterly interest payments are $0.52/share, representing a relative yield of 7.5% at the August 1 price. The note is not rated. Even at the increased share price, and the resulting lower relative interest rate, this is a nice yield.

However, this note is subject to being called as early as November 15, 2016. Purchasing the stock at the August 1 price, by the earliest redemption date one could realize $4.70/share in interest payments only to lose $2.91/share when paid the $25.00 redemption value of the note (a loss of 11.64% ) if the note is called as soon as eligible. In this case, one comes out only marginally ahead, with a total return — after two years — of 6.41% — an average of about 3.2% 6 per year, which is a little shy of the 5% target yield.

Needless to say, it would be possible to lose on the investment overall if one pays more than the share’s redemption value but does not make that much back in interest payments before being redeemed.

There are, then, two things to be careful of when considering an ETD:

- Be sure, if one is paying more than the redemption value of the note, that there is sufficient time before the earliest redemption date to earn in interest at least the difference between the purchase price and the redemption price — and realistically, more than that.

- It is always possible that a company default. Companies can go out of business or go bankrupt, and while ETDs have seniority over common shares and preferred shares, that does not guarantee that investors will get their investment back. One should be comfortable with the company’s credit rating; if the note is not rated, one should use due diligence.

Preferred Shares

Preferred Shares (preferreds) are very much like ETDs, but with some significant differences. As with ETDs, preferred shares:

- Are usually issued at $25.00 per share, although they may be priced higher or lower;

- Have a coupon rate;

- May have a date representing the earliest date at which the shares may be redeemed (Earliest Call Date);

- May trade at a price different from the issuance/redemption value;

- Pay dividends quarterly, with some paying monthly.

Unlike ETDs, however, preferred shares:

- Pay dividends. rather than interest and the payments may constitute qualified distributions eligible for lower tax rates;

- May or may not have a maturity date; that is to say, preferred shares are often perpetual;

- Dividends may be Cumulative or Non -Cumulative; that is, if the dividends are cumulative, in the event of a missed payment, the shareholder is still entitled to that payment while, if non -cumulative, the shareholder has no claim to missed payments;

- Have precedence only over common shares.

Other characteristics of preferreds:

- Do not usually carry voting rights;

- May, under certain circumstances, be convertible ; that is, the issuer may choose to exchange the preferred share for a specified number of common shares;

- May, under certain conditions and circumstances, receive extra earnings (referred to as a participating preferred).

The specific nature and conditions of an issue of preferred shares will be stated in the company’s filings with the SEC.

Summary

As stated at the outset, my intention in this article was to describe ways of boosting the yield of the retirement portfolio without undue risk to one’s invested capital. As with any investment, of course, there is always the possibility of losing all or some of one’s investment, but with ETDs and preferreds — at least in principle — one’s investment is more protected than it is when invested in common shares.

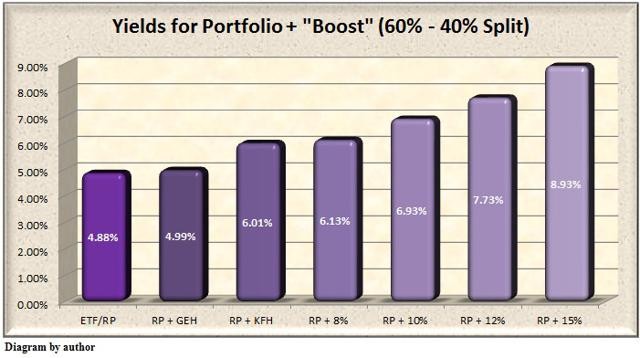

How much can ETDs and preferreds boost the yield of the ETF retirement portfolio? The following graph compares the current yield of the portfolio (4.88%) to portfolios with 60% of the portfolio invested in the core ETFs and 40% invested in instruments with varying yields. For the sake of comparison, the graph includes the approximate yield for the ETDs considered earlier (GEH and KFH, which yielded 5.15% and 7.5%, respectively), and holdings with yields of 8%, 10%, 12% and 15%.

The primary reason I see exchange-traded debt and preferred shares as supplements to a portfolio, rather than as potential core holdings, is that their duration is not a given. A company is more likely than not to opt to redeem its ETDs or preferreds either when they can get a better interest rate or when their cash on hand is adequate to pay for the redemption (as long as the earliest call date has passed). The company is not going to want to continue making substantial interest/dividend payments any longer than necessary.

Since ETDs and preferreds are both exchange-traded instruments, they should be readily accessible through one’s regular broker. Finding the instruments may be a bit more challenging, but I can recommend a couple of sources:

Both sites are free, although you will have to register to use QuantumOnline.com, and both allow you to organize the listings by coupon rate, making it easy to find the higher-yielding shares.

[By the way, in April I purchased MFA Financial, 8.00% Senior Notes due 2042 (MFO) as part of the portfolio. I am keeping some skin in the game, although it’s a bit scratched.]

Disclaimers

This article is intended for informational use only. It is not intended as a recommendation or inducement to purchase or sell any financial instrument issued by or pertaining to any company or fund mentioned or described herein.

All data contained herein is accurate to the best of my ability to ascertain, and is drawn from the relevant SEC filings to the extent possible. All tables, charts and graphs are produced by me using data acquired from pertinent SEC filings; historical price data from Barron’s. Data from any other sources (if used) is cited as such.

All opinions contained herein are mine unless otherwise indicated. The opinions of others that may be included are identified as such and do not necessarily reflect my own views.

Before investing, readers are reminded that they are responsible for performing their own due diligence; they are also reminded that it is possible to lose part or all of their invested money. Please invest carefully.

1 Originally, it was expected to yield around 5.11% or more, but PCEF has paid out less in recent months than had been usual, and the other ETFs do vary to some small degree from month to month. Currently, yield is at approximately 4.88%, based on dividends YTD through June 30 multiplied by 2.

2 The example is taken from the General Electric Capital Corp. debt issuance listing here. I discovered this issue on the site operated by my colleague, Yield Hunter .

3 I refer to the rate as relative because the actual rate is established by the coupon, which applies to the redemption value of the note, and the effective yield of 5.15% is based on the yield the coupon rate amounts to when compared against the market value of the shares.

4 One may, of course, realize a greater increase in capital if one sells the notes at a price higher than redemption value.

5 The filing for this note can be found here. Again, I located this note through Yield Hunter.

6 This is also referred to as the Yield to Call.

Disclosure: The author is long INKM, IYLD, MDIV, PCEF, SPLV. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. I am also long MFO.