Beware of Leveraged ETFs

Post on: 16 Март, 2015 No Comment

ENLARGE

Morgan Stanley was fined for improperly selling leveraged ETFs. Associated Press

Earlier this month, the Financial Industry Regulatory Authority fined brokers including Citigroup Global Markets, Morgan Stanley. UBS Financial Services and Wells Fargo Advisors for improperly selling leveraged and inverse ETFs.

A Citi spokeswoman said in a statement the company is pleased to have this matter resolved. The other firms said in separate statements that they have bolstered their supervisory procedures since the violations occurred in 2008 and 2009.

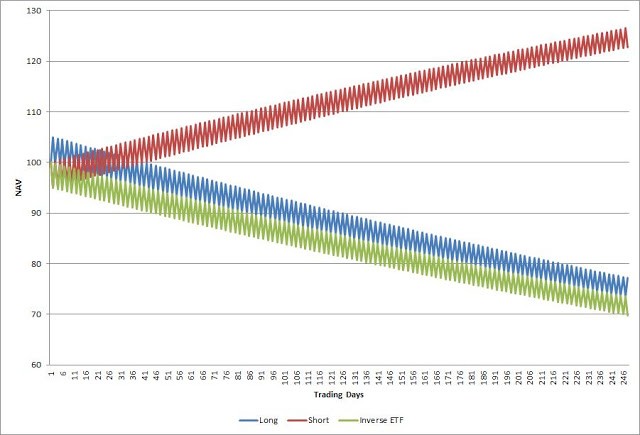

Leveraged ETFs seek to magnify the performance of the indexes they track—for a single day. Inverse ETFs try to achieve the opposite performance.

For example, the ProShares Ultra S&P 500 exchange-traded fund seeks to deliver twice the daily performance of the Standard & Poor’s 500-stock index. If the index rises 1% in a day, the ProShares ETF should rise 2%; if the index falls 1%, the ETF should fall 2%.

But while leveraged ETFs can be useful in some situations, they are expensive and can be harmful to small investors who hold them for longer than a day, say advisers and researchers who have studied the products.

The long-term investor has no need to be in these products at all, says Rick Ferri, founder of Portfolio Solutions, an investment adviser in Troy, Mich.

When the ETFs launched in the mid-2000s, many small investors looking to pump up their returns missed an important wrinkle. Because of daily compounding, long-term investments in leveraged ETFs don’t mirror the indexes the funds tracked.

For example, ProShares Ultra S&P 500 lost 0.83% on Tuesday, about double the loss of the S&P 500. But over the past five years, the ETF has lost about 9% annually, and the index has been flat.

All told, there are 275 leveraged and inverse ETFs with nearly $33 billion in assets, according to tracker IndexUniverse. The biggest, as of this past week, included Direxion Daily Financial Bull 3x. with nearly $1.4 billion, ProShares UltraShort 20+ Year Treasury. with $3.4 billion, and ProShares UltraShort S&P 500, with just over $2 billion.

The ETFs are used mainly to make extremely short-term bets or to temporarily hedge market exposures. Such activities are best left to big institutional investors, Mr. Ferri says.

Leveraged ETF providers make the risks clear on their websites and in prospectuses—in some cases warning that holding the ETFs for longer than one day will result in losses. Before those disclosures, many investors and some advisers held them for months at a time, Mr. Ferri says.

The daily compounding issue is magnified during periods of high volatility. In 2011, an investment in the ProShares ETF would have lost nearly 3%, even though the S&P 500 gained more than 2%.

What’s more, the products are expensive, notes Jeffrey Bogart, a registered investment adviser at Bogart Cunix & Browning in Mayfield Heights, Ohio. Direxion Daily Financial Bull 3x, which tries to triple the daily performance of the Russell 1000 Financial Services index, has an expense ratio of 0.95%. ProShares Ultra S&P 500 costs 0.92%. ETFs that track major indexes without leverage can cost 0.1% or less.

Even after accounting for the compounding issues and costs, during periods of high volatility some leveraged ETFs still fail to perform as expected, says Pauline Shum, director of the Master of Finance program at the Schulich School of Business at York University in Toronto.

It is difficult for retail investors to calculate the net asset value of the contracts that underlie the ETFs, and in the past, leveraged ETFs’ share prices have deviated significantly from the value of the underlying assets, Ms. Shum says.

When things are out of whack, the market becomes temporarily inefficient, she says.

Other research has shown that leveraged ETFs might lose several percentage points of return from the costs incurred to maintain the leverage. Leveraged-ETF providers have to rebalance their portfolios daily to keep the proper amount of leverage, says Marco Avellaneda, a professor at New York University and a partner at Finance Concepts, a risk-consulting firm.

Leveraged ETFs’ mandates are publicly known—that is, a leveraged financial ETF needs to own the assets and derivatives necessary to double the index’s return. Prof. Avellaneda’s research has shown that when ETF providers try to execute the trades needed to support the ETFs, they get poor prices for the contracts and assets they have to buy.

Prof. Avellaneda says that might be because of their publicly known mandate, or because the orders they execute are so large, among other reasons. The result can be a hidden cost of as much as five percentage points of return annually, according to Prof. Avellaneda.

If you know I’m the leveraged-ETF guy, you know which side of the trade I have, and that’s going to move your asking price up, he says.

With all that in mind, there are almost no circumstances in which a small investor should trade leveraged ETFs, says Mr. Bogart: It’s asking for trouble.