Best Investments for Retirement Income Now

Post on: 14 Июнь, 2015 No Comment

If you’re looking for the best investments for retirement income, you’re not alone. With interest rates so low, lots of folks are asking themselves which are the best retirement investments to make right now.

As I see it, there are still some good alternatives:

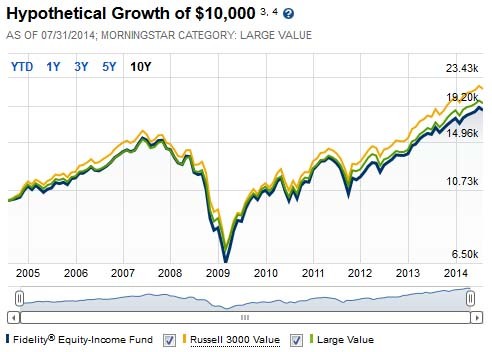

1. A Component Of Equity In Your Portfolio

Remember, just because you are retired doesn’t mean your investment time horizon is short. People ask me all the time, How much money do I need to retire ? They never ask me how much theyll need to stay retired. You have to think about how long you want your money to last, which may not be the same thing as how long you think you are going to last.

Sure the market is dicey at the moment. So what? If you need all your money right now, you should not be in the market anyway. The market is a very long-term proposition. But you knew that already.

And by the wayyour money has to last longer than you think or you may have to work longer than you think .

According to MSN.com, a very healthy 60-year-old female could easily live another 30 years or more. If you are even just of average health, you could celebrate your 80th birthday without too much trouble. That’s a 20-year timeframe…right?

That being the case, the only question that really matters is how to invest to create the most income with the greatest safety over 20 (or more) years. Of course, you will have to balance “greatest income” with “greatest safety,” and that’s a personal choice. But there is no question that over 20 years, your best bet to create retirement income will be a portfolio that includes equity.

2. Real Estate

For the right investor, real estate could be a great way to invest if you want to create retirement income. Prices are low and so are interest rates. That, my friend, spells opportunity. Does real estate offer the best retirement investment?

Of course you have to be mindful about where you buy real estate. Even though prices are low, it doesn’t mean they are low enough and it doesn’t mean they won’t drop further.

For example, you can buy rentals in some parts of the country for under $60,000 and rent them out for over $1,000 a month. But in Southern California, you’d have to invest eight times that amount and only receive three times as much income. Not worth it.

If you’re going to buy real estate, make sure you do it carefully and that the deal makes sense. Also, make sure you are well suited for this kind of investment or that you have partners who are.

What I don’t think makes sense is to buy long-term bonds or immediate annuities right now. Interest rates are low. If you sink your money into either of these options, you’ll be sorry when rates rise.

With the annuity, you’ll be stuck with a low-paying investment and you won’t have any way to get out of it. With bonds, you’ll be able to sell of course, but if rates rise when you sell, you’ll take a beating. Who needs it?

One last thing dont be lulled into complacency by building a diversified portfolio. This approach can help of course but many people think that diversification offers benefits that it really does not. Thats why its important to be mindful of your investment approach. Also, you have to approach investing with an open mind and this is sometimes very difficult to do.

Have I missed anything? What other retirement investments are good options for those interested in retirement? Its tough to think long-term when the short term is rather painful, but its really the best way for you to make retirement income decisions.