Best ETFs Against Inflation TIPS Currency FixedIncome Stocks ETFs

Post on: 24 Апрель, 2015 No Comment

Best ETFs against inflation

April 20, 2013, according to Reuters agency release, Federal Reserve Chairman Ben Bernanke announced to global policymakers he saw no risk of inflation in the United States. Summing up presentations to an International Monetary Fund meeting, Bernanke had given a ‘very optimistic’ portrayal of the U.S. outlook. Federal Reserve Chairman had said U.S. inflation should be 1.3 percent this year. Fed forecasts inflation by the end of this year in a range of 1.3 to 1.7 percent. Some companies were forced to cut prices to keep consumer demand which decreased in previous month because of weak labor market’s growth and slight changes in remuneration. The Federal Reserve realizes record volume program of monetary stimulus due to actual weak inflation.

Current amount of US public debt is comparable with debt in the Second World War period – it was higher than 100 percent of GDP. After war US economy took wing readily versus nowadays when analytics don’t expect the same effect on the economical increase through increment of public debt.

Meanwhile bearish forecasts about US economy make way for more optimistic expectations due to strength of US economy to endure costs dropping and taxes rising in future. Disinflation in the United States is stepping back, and in spite of public optimistic assertions of Mr. Bernanke, inflation is assailing. Investors concern about their savings and will to choose right way to hedge them. Traditional instrument among individuals for this purpose is bank deposit. According to Federal Deposit Insurance Corporation information on interest rates, no bank deposit can beat inflation for a long time during corresponding periods in last several years after financial crisis.

Obviously investors aim to increase their economy, not only to conserve it. So investors are interested in savings’ allocation to more profitable instruments comparing with banking deposit. Clearly there is no single instrument to achieve this goal. Exchange-traded funds can be a good choice comes to mind. ETFs are baskets of different assets, such as stocks, bonds, currencies, derivatives, and follow variation of numerous asset classes, indexes, markets such as fixed-income securities, commodities, real estate, and equities traded in emerging or developed markets. ETFs are submitted on the stock exchanges and could be bought or sold as simple shares. Thus funds can be considered as convenient accumulator of useful qualities of its components.

Inflation hedge through ETFs

Gold ETFs. Gold at all times is the safe heaven for saving investments. Gold prices soared to record highs and could rise even more due to the debt problems in the USA and European Union. A gold-backed ETF is an exchange-traded fund that tracks the price of gold, with gold as the underlying asset. Gold ETFs may be gold-backed, which means that the fund actually owns the gold bullion to back its shares. Other gold ETFs track the performance of gold using options and futures contracts. A third kind of gold ETF consists of stock from companies closely associated with gold, such as mining companies. Purchase of gold ETFs is the most comfortable way to catch investments in this precious metal without additional costs, but with having all benefits of gold.

Other commodity ETFs. Other popular commodity ETFs are silver, energy and agriculture ETFs. Usually any shocks in the economy and on the stock market are paired with growth in demand on commodities. This happens because in instability economic situation investors tend to purchase tangible assets. Naturally commodities prices rise. When prices around are increasing – I mean inflation — people fear further prices’ growth and try to find protection in raw materials. It’s important to know that demand dynamics for commodities and respectively commodity ETFs is volatile and their prices are changeable. So the proportion of commodity ETFs in inflation hedge portfolio should be under regular control.

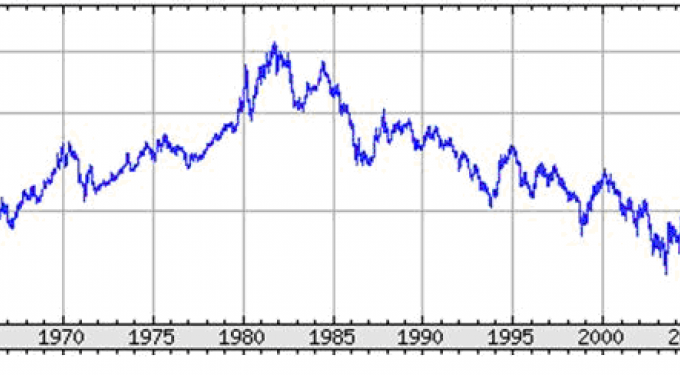

Real estate ETFs. Real estate is a recognized tool to protect against inflation. Real estate assets are considered safe option for resources shield. During last 10 years importance of real estate funds was seriously revised. Till the past financial crisis real estate assets were significant part of most portfolios, but bursting bubble in 2007-2009 shifted situation to other types of assets. Nevertheless real estate investment funds are still popular, because after decline they could beat less standing instruments on long-term horizon. Real estate ETFs buy property or concentrate investments in the real estate industry sector of the U.S. equity market. Here are some examples of real estate ETFs and their performance during last several years: iShares Dow Jones US Real Estate (NYSE: IYR), picture #1 Vanguard REIT Index ETF (NYSE: VNQ), picture #2 Wilshire US REIT ETF (NYSE: WREI), picture #3

TIPS ETFs. Treasury Inflation-Protected Securities, or TIPS, preserve against inflation because the principal increases with inflation (but decreases with deflation), in tandem with the Consumer Price Index. Bright idea is to keep TIPS funds in tax-deferred accounts like an I.R.A. because you’ll be taxed on the amount your fundamental increases, even though you don’t obtain it until the TIPS mallows.

Currency ETFs. Currency ETFs are designed to invest in foreign currencies or a basket of currencies without having difficult transactions. Investors add foreign currency assets in portfolios to hedge against the dollar and the American economy depreciation. Foreign currency assets include external fixed-income instruments, equities and currencies directly. In such vein, currency ETFs perform as a bit of a help at organization broadly diversified portfolio.

Fixed-income and stocks ETFs. Building inflation-defensive strategy requires inclusion in the portfolio reasonable portion of stocks and bonds. Such assets are the most volatile and risky in a short-term period. At the same time exactly they can bring sharp jump of effectiveness of the whole fund. Formation of sterling equities and bonds’ set demands a lot of effort and money. Fixed-income and stocks ETFs consist from shares, bonds or their combinations from single or different sectors to satisfy all investors’ needs. That’s why these funds are so indispensable to achieve key target.

Combination of listed instruments together with rational diversification provides an advantage over separate assets to hedge inflation. Given the variability of all possible instruments that can bring you some profit I recommend include various assets in portfolio. Please remember that risk-free asset will not let you earn money. Risk-free assets just ensure you parallel moving with inflation ratio and do not leave your portfolio to be in the red zone. But investor’s goal is to beat inflation, so you have to take a chance to buy potentially lucrative assets. Any yield is risk-bearing. Distinct assets and even ETFs are risky because they help you get round circumstances. Thus I sneak up you on a question about diversification through various ETFs to hedge your funds against inflation and win.

This article was updated on 4/11/2014 .