Bank lost your Loan Modification Paperwork Again What s Going On

Post on: 15 Апрель, 2015 No Comment

Loan Modification Paperwork Lost-Again? Whats Going On Behind the Scenes

Posted by admin On November — 10 — 2010

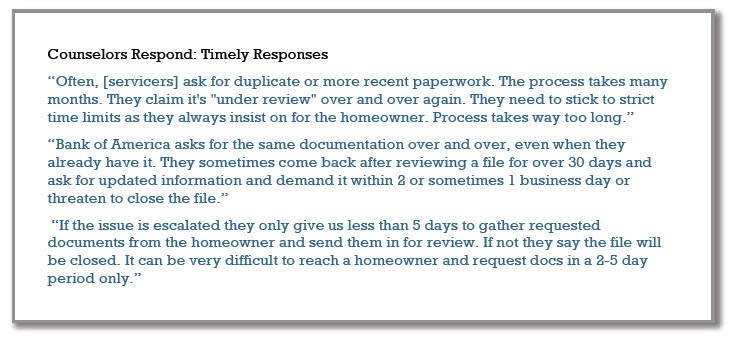

Oh no! Dont tell my my loan modification paperwork has been lost again! Why is it that your lender keeps asking for paperwork, you keep sending it in, and they keep losing it? What the heck is going on and why cant this process be simpler? Really, its enough to make most homeowners give up on the entire thing-wait-maybe thats the whole idea! Why would your bank want to sabotage your loan modification and how can you win this battle?

A quick look at the stats will confirm what most homeowners can confirm-getting approved for a loan modification is a long shot. Only 25% of applicants are approved for a permanent loan workout, so that leaves the vast majority of borrowers facing foreclosure or short sale. Why is this happening and how can the banks be so unorganized that they cannot even keep track of paperwork that is submitted?

Heres a peek of what goes on behind the scenes at some of the nations largest mortgage lenders. Everyday thousands and thousands of pieces of paper are received-either by mail or by fax. Each employee is handling hundreds of files and they are simply overwhelmed with paperwork. When something comes in without a loan number on it, it gets thrown away or shredded. When a file is received with missing documents, it is shredded. If a homeowner does not respond to a request for paperwork, the file is closed and shredded. Only the complete, accurate and acceptable loan modification files are worked on-and this means that the homeowner has to be certain to prepare everything perfectly.

It simply is not enough to slap together your loan modification paperwork, send it in and expect your lender to approve it. That is not how it works. First of all, the bank is under no obligation to help you at all! You have to show them why they should offer you a loan workout and how it will be beneficial for everyone. This is done by preparing your financial statement correctly-so that it proves in black and white that you fit into the standard approval guidelines and so that it clearly demonstrates a loan modification will be the solution for you to stay in your home and make affordable payments.

Know the Guidelines

Once you realize that it is really your responsibility to submit your paperwork correctly, you will be able to work the system and have a good chance at success. Hoping you will get help is not enough-you need to take action, learn and prepare so that you understand exactly what you need to submit. You can be one of the ones who actually get a loan modification if you apply correctly-dont take chances do it right the first time.

Susan Gregory is the author of two resource books for homeowners and real estate professionals, the best selling The Complete Loan Modification Guide Kit and The Stimulus Book-HAMP & HAFA Edition. She also teaches workshop training classes for the federal programs to help real estate professionals assist homeowners with home retention and exit strategies.

www.myloanmodficationcenter.com for more information.

5 Responses

- kelli wright Said,

My mortgage company (CHASE Cynthia Lemus 702-558-5446) is doing the same thing. Its been over 18 months. They keep requesting the same paperwork. We went to a seminar 8/2010 where our mortgage company was there to go over our remod and also had a seperate housing counseling agency (NID Corina Isac 702-228-1975 / 510-268-9792) on hand if we had any questions. Their were maybe 7 customers there. I any case they said that their computer files did not show us making any trial payments. Lucky I had ALL our paperwork. They made copies and took our remod paperwork in COMPLETION. One month after the seminar they stopped exepting our trial payments. Western Union said reciever had refused payment and gave us a letter. Since then we havent made any payments. Sent in numerous requested paperwork (Dodd-Frank eligibility Certificate, copy of taxes, tax form 4506T, paystubs, proof of occupancy, etc.) called several times and were basically told either its in review or we should consider a short sale. None of which they are willing to put in writing. Just keep sending their form letters asking for more paperwork making us chase our own tail. Its all BS. We are ready to walk away. After lighting a match.

Nichols Said,

Kelli be encouraged youre not the only one who is been lied to and strung alone. This is happening to me. I apply for a modification with citimtg. & worked with naca (.neigbhood org.) this has been going on for 16 mons. After faxing paperwork several times I forgot to answered the question Do I have HOA fees on a single family house. Answer was no. I fax this paper 3 times they said they cant read it. I decided to keep the fax copy for myself and send them the original. of They never recd. it. I fax again.Bank lawyers contacted me in February, 2011. I qualify for a deed in lieu walk away from property sign title over but vacant property in order to start the paperwork. Dont trust them, the banks need to keep a record of what you are doing and will try to trick & lie to you. They want you to believe they are trying to help you but they really hoping you give up and quit. Dont make a foolish decisions in their favor. Please write down who you talk to & what time. Keep ALL PAPERS. Contact you a FORECLOSURE ATTORNEY about how long you can stay in your property its different in each state. If you are SERVED WITH MORTGAGE FORECLOSURE SUMMON FROM the COURT. CALL YOUR ATTORNEY. Well I am at this point in my life. Me and my husband has decided: WE WILL NOT FEAR ( Your Enemy) No ARGUINGi NO COMPLAINTING, NO WORRYING ABOUT NOTHING. God will keep our minds in perfect peace whose mind is stayed on him, because we trusteth in him (Isaiah 26:4) KNOW THIS LIFE HAS storms, struggles, uncomfortable encounters & pain. But I BELIEVE in YOU that YOU will SMILE AGAIN and LIFE WILL GET BETTER. (My PART I) .

Vickie Vivarttas Said,

Same old story here. We have been trying to get a loan mod on our home for almost two years now. I have met face too face with BOA agents on two seperate occasions when they held meetings in our town only to find out later on both occasions that they never recieved the paper work even though it was filled out and turned in by their own people. This is also after being told at the meetings that we were approved both times.

We have been in foreclosure since March and have submitted and resubmitted our paper work. My husband actually sent a note to the Florida Attorney General Pam Bondi and she replied telling us that she couldnt do anyting to help while forwarding our letter on too BOA. After recieving the letter from Pam Bondis office Natasha White from the CEOs office called and spoke with my husband stating that we would be dealing with customer relations person Marisa Villalobos and she would help us get this straightened out. Marisa is an incompetent train wreck! She wont return our calls, sits on our paperwork only to finally contact us weeks later to tell us that something was missing, she couldnt read it, couldnt open the file etc

She only returns our calls after we go through everyone over her that we can reach, then she attempts to make us feel bad by acting like shes doing us a favor. She is either a liar and the worlds laziest employee or shes doing all this under the direction of BOA. On the two occasins that our paper work did get to where it was supposed to go we were turned down beccause they were going on last years tax docs. We are making $3000.000 more a month now but cant pay the thousands that they have tacked on because of their attorney fees and late fees since they would no longer accept payments after we went into forclosure.

BTW, I was assured by our original customer service rep Carlos that they wouldnt foreclose while we were going through the loan mod process. We have also went through consumer credit counseling as well. They wouldnt even cooperate with them and finally the counselor gave up and suggested we file bankruptcy. She had tried for monthd to reach Marina Villalobos and never got to speak to her once. If anyone has any suggestions please tell us. At this point Im probably going to make a full time job out of bombing them with the same stack of paperwork they keep loosing. I doubt it will do any good. Their attorneys have already sent our attorney a letter wanting to set a court date for foreclosure. I swear I do not know how these people look at themselves in the mirror every day.

Maria Said,

We have been going through all of the above, we went to mediation, we paid then they (Chase)stopped accepting payments. We did credit counseling twice. We got a lawyer and he scammed us for a year and we caught on and fired him. Now we have another lawyer and trying to redo the modification paperwork for the 13th time! This is ridiculous. We are not leaving until they drag us out. They are scamming people so bad. Whoever becomes President BETTER do something. We worked so hard for 12 years paying for our house and probably already paid for it twice!

Sonny Said,

I felt compelled to write a comment in this blog. We have been going through hell and back with CitiMortgage.

In a nutshell, We are aggressively fighting foreclosure and counter suing Citi Mortgage for committing fraud against us in the Home Modification process. They kept saying we were missing documents (like they have done to 10s of thousands of others across the country) 1 difference with our case, we have a recorded phone transcript that has already been admitted as evidence where they (Citi) admitted they do in fact have all our necessary docs (2-37 page sets as a matter of fact) and had no idea why it wasnt processed and why we are being told that we were missing docsFurther more, we had entered into another agreement with them and sent in 8 adjusted payments (like they required) as part of the loan mod and they accepted and deposited those payments before they told me our loan mod had TIMED OUTCome to find out, the whole time we were working so hard to get them everything the demanded in a reasonable time, they lied and said we were missing docs and had already started foreclosure proceedings..

Im sharing this because it has gone beyond just our house and loan modification. It is affecting literally thousands of good people.Its time the BANKSTERS are held accountable for their actions.My e-mail is sonbon4@cox.net if anyone would like to put in words their story, Ill share it will our attorney.

Thanks for taking the time to read this.