Balance Sheet Interpretation Part III PricetoBook Ratio Accounting for Entrepreneurs

Post on: 26 Февраль, 2017 No Comment

Written by Bobby Jan for Gaebler Ventures

As an entrepreneur looking to buy a company, it is important to determine the right price to pay for the business. This article will show you how to use the price-to-book ratio to help you value a business. This is the third article in our Balance Sheet Interpretation series.

Being able to interpret the balance sheet is essential for both running and buying a business.

(article continues below)

In our previous article in this series, we reviewed four liquidity ratios that you could use to help you avoid a liquidity crisis.

Now, using a balance sheet, let’s review how the price-to-book ratio can help you determine the right price to pay for a business.

The Price-to-Book Ratio (or P/B ratio)

The price-to-book ratio is elegantly simple but immensely informative.

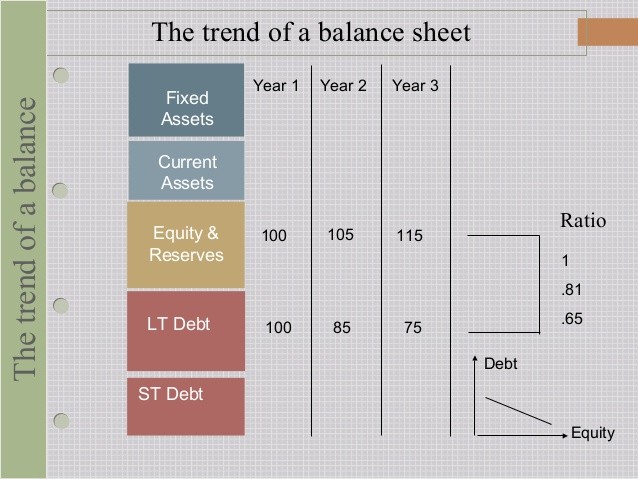

Price-to-book ratio = (Market price of business) / (net book value of business)

Net book value = Owner’s Equity = (Assets – Liabilities)

Some businesses command relatively high price-to-book ratios and some command relatively low ones. For example, Baidu.com, a hot Chinese internet company, has a price-to-book ratio of over 33 as of 8/4/2008 while General Electric’s price-to-book ratio is 2.37. Why is this so?

The price-to-book ratio is determined in large part by the projected return on equity of the business or the business’s profitability growth rate. A business that can consistently make 30 cents on every dollar worth of owner’s equity is a lot more attractive than a business that consistently makes 3 cents on every dollar worth of owner’s equity. Naturally, the attractive business will carry a higher price tag for each dollar worth of owner’s equity. Whether this higher price is justified is something that usually plays out over time. If Baidu.com performs poorly in the months to come, one would expect their price-to-book ratio to drop back to earth.

There are a number of other factors that can impact price-to-book ratios. For example, the economy as a whole might not be doing very well and investors are depressed, which in turn deflates stock prices. In a down economy, businesses tend to sell for lower prices in both the private and public market, and, accordingly, price-to-book ratios decline.

The opposite is true when the economy is doing well. In other words, price-to-book ratios may fluctuate with the market. Although most of the time the ratio shouldn’t fluctuate too much, sometimes markets may get a little (or a lot) out of control.

So how much should you pay for a business? What price-to-book ratio should you use to calculate a valuation? You may find the answer by comparing the P/B ratio of a business to the P/B ratios of similar businesses and to its historical P/B ratio. Remember, it’s always best to bid conservatively when buying a company. As they say, Buy low, sell high.

Liquidation bidding is different thing altogether. The net book value of a business is the theoretical liquidation price of the business. However, this theoretical liquidation price isn’t always what you get in a real liquidation.

When using price-to-book ratios to value a business, you must also consider the conventions of accounting. In some cases, assets may be shown at their historical costs. What this means is that the value of an asset is recorded in the books as the price paid for the asset.

For example, if a business purchased real estate assets 50 years ago and these assets are currently recorded at their historical prices, chances are liquidation value will be significantly higher than the stated book value.

On the converse, if a business carries a lot of outdated machinery at historical prices, such as looms, liquidation value could be significantly lower than book value. The stated book value does not guarantee you anything. Based on your observations, you should adjust the net book value as you see fit to get a more realistic P/B ratio.

When looking at the P/B ratio, ask yourself the following questions:

- Does profitability growth justify the price-to-book ratio?

- How will a change in economic conditions affect the profitability of the business?

- Why is the business selling at such a low/high P/B ratio? Is there something wrong with the business that I do not know or are there hidden assets/liabilities?

- How could I adjust the net book value to derive a more accurate P/B ratio?

Learn More About Interpreting a Balance Sheet

To learn how to read a balance sheet and understand what a balance sheet says about how a company is doing, read the other articles in the Balance Sheet Interpretation Series:

Cheng Ming (Bobby) Jan is an Economics major at the University of Chicago who has a strong interest in entrepreneurship and investing.

Conversation Board