Balance Sheet Analysis

Post on: 7 Июль, 2015 No Comment

Meaning and definition of Balance Sheet Analysis

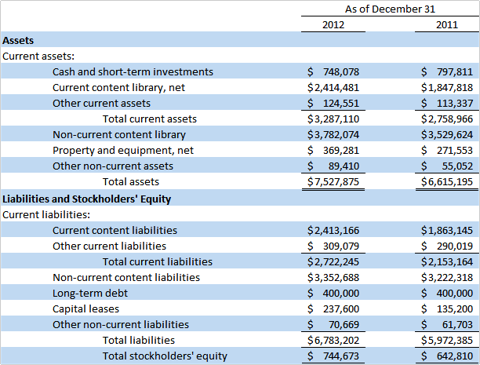

Balance sheet analysis can be defined as an analysis of the assets, liabilities, and equity of a company. This analysis is conducted generally at set intervals of time, like annually or quarterly. The process of balance sheet analysis is used for deriving actual figures about the revenue, assets, and liabilities of the company.

Goal of Balance Sheet Analysis

The balance sheet analysis is helpful for the investors, investment bankers, share brokers, and financial institutions, for verifying the profitability of investment for a specific company.

It is not a difficult task to perform a Balance Sheet Analysis. The main steps include:

- The primary step involves adding up liabilities and the paid up equity share capital. The sum must tally with the sum of total assets. After the process of tallying is done, contrast the total assets with total liabilities. However, this evaluation does not include the issued shares amount in the liabilities. If the total assets are exceeding the total liabilities, the financial standing and performance of the company is considered to be good.

- The next step involves looking at the current assets and liabilities. Sometimes, it is considered as a good sign to have more unsecured liabilities.

- Another important step is calculating the ROA by dividing the net income by assets. Producer companies feature a high ROA unlike the real estate and leasing companies which feature a low ROA.

- The fourth step involves special concern for copyrights and patents. It is important to consider the ratio between invested amount for research and the consequent returns.

- Next step involves calculating the debt asset ratio by dividing total liabilities by total assets. A lower liability dimension reflects a better performance by the company.

- Another step includes estimating the receivables turnover ratio which signifies the relation between investment in sales and money receivable. A better financial status is reflected in high amount of money receivables.

- Another important ratio is the inventory turnover ratio which indicates the company’s capability of producing goods with available assets.

- The final step includes analyzing other features of company including goodwill, credit ratings, and current projects. This analysis is helpful in evaluating the company activities in near future.