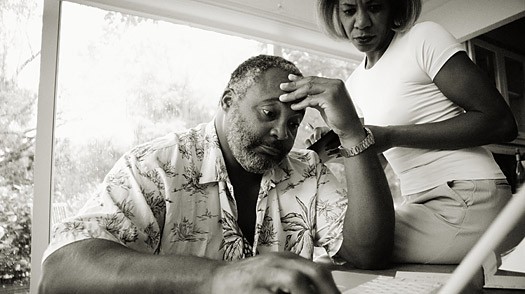

Baby Boomers Retirement Savings Woes

Post on: 17 Сентябрь, 2015 No Comment

Why Arent Baby Boomers Saving For Retirement?

Whats Your Retirement Plan B?

Several different factors have been piling up on todays baby boomers, and these may finally lead to a real train wreck of a retirement outlooks for boomers. You do not have to read some reactionary political blogs to come to this conclusion, but can simply pull government data.

The number of older workers who are living paycheck to paycheck has increased, and this even includes upper-income boomers. Recent retirees are also struggling to live off of their incomes. Consider some recent government data that was summarized in a US News & World Report article about baby boomer retirement problems .

Current Retirement Facts

- Low median retirement incomes. These were $27,707 for men and $15,362 for women in 2011.

- Reliance upon social security: 36% of retirees depend upon social security for 90 percent or more of their income.

- Longer life spans: Men can expect to live an additional 18 years after retirement, while women can expect to live an additional 20 years.

This means that a lot of people are going to depend upon social security payments for a long time. Despite this program, most retirees must live upon very low incomes. People on low incomes will also need help from other support programs like subsidized housing, food stamps, and inexpensive clinics for services that are not covered by Medicare. At least, most US seniors do have Medicare, which is a luxury younger people cannot count on.

Baby Boomer Retirement Savings

The outlook for the majority of baby boomers, who have not yet turned 65, is not any better. According to a CNBC report about baby boomer retirement savings. many more Americans are living from paycheck to paycheck, and this problem is even becoming more common with upper-income earners. The problem is fairly easy to diagnose. Companies have been reducing salaries. Raises have not kept up with the cost of living. But people are having a hard time adjusting their lifestyles to compensate for their loss of real income, and this means they are not adding to their retirement savings.

What Can You Do To Have A Comfortable Retirement?

The news is not all bad. It is actually good news that Americans are living longer than they were a generation ago. This also means that many healthy 65 year old people are not planning to retire on their parents schedule because they still enjoy work and can be very productive. They might retire from their current job, but continue to work as a freelancer, part-time employee, or owner of their own business. One study even demonstrated that delayed retirement may delay age-related mental problem s like Alzheimers and dementia. Who know that brains were muscles that need to be exercised?

So one solution is to delay retirement, but not everybody can count on this. Even though more people will be healthy and active by the traditional retirement age, not everybody will. Besides, many people had dreams of beginning their golden years with a new life after they could finally leave their career behind.

If you cannot earn more money or find a way to increase your retirement nest egg, downsizing seems like the only other solution. This can be a fairly painful process, and it is not always easy to know which decisions are the right ones. For example, you might consider selling your large home, but you will still have to pay to live somewhere. Can you really find an alternative retirement living situation that will be cheaper?

Do You Have A Retirement Plan B?

The problem is that most older workers and current retirees lack an alternative plan. They were supposed to retire form their jobs with benefits, utilize equity in their homes and other assets, and have retirement savings. Family problems, lower real estate values, layoffs, the financial crisis, and several other factors ruined this plans.

It might be harder to go back to work over 50. 60, or 65. If you lack resources, it will be difficult to start your own business. These are some topics that Baby Boomer Concerns plans to explore. Your feedback is welcome in the comments.