Avoiding Capital Gains Tax with the 1031 Exchange Your Real Estate Today

Post on: 13 Апрель, 2015 No Comment

Who we are Articles

Real Estate Tips Free Events

See it Live! Testimonials

Our Students Success

Nov 6, 2013

Real estate investors, being business entrepreneurs and good citizens as well, will always be striving for profits. They realize as good citizens that they should be happy to pay taxes on those capital gains as wellunless they can avoid it! The investor just starting out and wanting to build and grow a portfolio that will eventually provide the riches they deserve in retirement will reach their objective much sooner with the 1031 Like-Kind Exchange.

In real estate, the simple explanation is that if you have an investment property that’s grown in value and you want to sell it and roll up into another “like-kind” investment property, the capital gains taxes on the sale profits can be deferred. In other words, you won’t owe immediate capital gains on the profits from the first sale if you meet all requirements and roll the proceeds into another like-kind property.

Like-kind isn’t as restrictive as many people think. It doesn’t mean that the properties must be of the same type. You can sell a single family rental home and roll the proceeds into an apartment project, or land, or a duplex. Like-kind in this case simply means real estate purchased as an investment. You’ll only pay the capital gains taxes if you cash out later, but not as you’re building your equity value.

Think about it. By way of example, you can sell that $200,000 home that you bought for $150,000, pay no capital gains taxes, and roll that $200,000 into a duplex property. Then you can do it again, moving up to more value, and do it over and over. You can literally become a real estate millionaire without paying capital gains taxes along the way.

If you’re happy in your retirement with cash flow from your large portfolio of rental properties, you can leave them to your heirs and eat your cake too. Since you haven’t sold anything, no capital gains taxes have kicked in. Your heirs will inherit at the “stepped-up” current value basis. If they sell, there will only be capital gains taxes on sale amounts over that basis. Yes, you took it with you!

Of course, laws change and this isn’t investment advice, so talk to a savvy accountant about the 1031 Exchange.

Doug Clark

Star of Spike TV’s FLIP MEN

RealtyTrac Education Partner

Top Real Estate Coach and Trainer Worldwide

Follow @demo_doug

3A%2F%2F0.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D48&r=G /% David

You can also avoid capital gains tax on flips by selling your business instead of doing a double closing, because you are not buying and selling a property within a one year time frame. This can be a huge savings when the typical transactional funding fees range from $2500-6500 depending on the price range and with a 20-25% Capital Gains tax on top of that it can seriously impact your potential profit.

3A%2F%2F1.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D48&r=G /% Randy B.

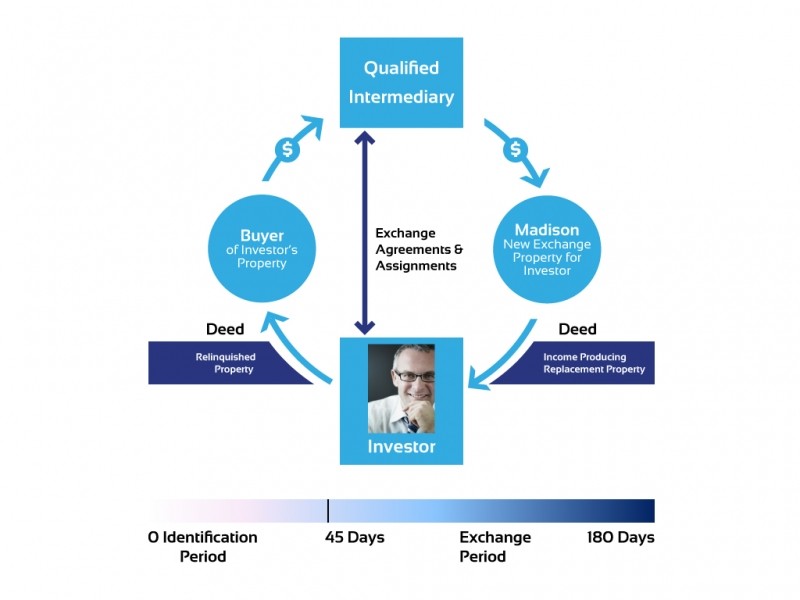

This is a simple strategy and method for selling one property, thats qualified, and then proceeding with an acquisition of another property (also qualified) within a specific time frame. The logistics and process of selling a property and then buying another property are practically identical to any standardized sale and buying situation, a 1031 exchange is unique because the entire transaction is treated as an exchange and not just as a simple sale. It is this difference between exchanging and not simply buying and selling which, in the end, allows the taxpayer(s) to qualify for a deferred gain treatment. So to say it in simple terms, sales are taxable with the IRS and 1031 exchanges are not. US CODE: Title 26, §1031. Exchange of Property Held for Productive Use or Investment.

NNN (Triple Net Lease) properties are suitable replacement properties for your 1031 exchange.Due to the fact that exchanging, a property, represents an IRS-recognized approach to the deferral of capital gain taxes, it is very important for you to understand the components involved and the actual intent underlying such a tax deferred transaction. It is within the Section 1031 of the Internal Revenue Code that we can find the appropriate tax code necessary for a successful exchange. We would like to point out that it is within the Like-Kind Exchange Regulations, issued by the US Department of the Treasury, that we find the specific interpretation of the IRS and the generally accepted standards of practice, rules and compliance for completing a successful qualifying transaction. Within this web site we will be identifying these IRS rules, guidelines and requirements of a 1031. It is very important to note that the Regulations are not just simply the law, but a reflection of the interpretation of the (Section

Any Real Estate property owner or investor of Real Estate, should consider an exchange when he/she expects to acquire a replacement like kind property subsequent to the sale of his existing investment property. Anything otherwise would necessitate the payment of a capital gain tax, which is currently 15%, but may go to 20% in future years. Also include the federal and state tax rates of your given state when doing a 1031 exchange. The main reason for a 1031 is that the IRS depreciates capital real estate investments at a 3% per year rate as long as you hold the investment, until it is fully depreciated. When you sell the capital asset, the IRS wants to tax you on the depreciated portion as an income tax, and that would be at the marginal tax rate. Example, if you hold an investment for 15 years, the IRS depreciates it 45%. It then wants you to pay the taxes on that 45% depreciation. If combined state and federal taxes are 35% at the marginal rate, thats about 15% of the cost of the property (one third of 45%). If your property is fully depreciated, it becomes the whole 35% marginal tax rate. Another way to make it easy to understand is when purchasing a replacement property (without the benefit of a 1031 exchange) your buying power is reduced to the point, that it only represents 70-80% of what it did previously (before the exchange and payment of taxes). Below is a look at the basic concept, which can apply to all 1031 exchanges. From the sale of a relinquished real estate property, we should understand this concept so that we can completely defer the realized capital gain taxes. The two major rules to follow are:

The total purchase price of the replacement like kind property must be equal to, or greater than the total net sales price of the relinquished, real estate, property.

All the equity received from the sale, of the relinquished real estate property, must be used to acquire the replacement, like kind property.

The extent that either of these rules (above) are violated will determine the tax liability accrued to the person executing the Exchange. In any case which the replacement property purchase price is less, there will be a tax responsibility incurred. To the extent that not all equity is moved from the relinquished to the replacement property, there will be tax. This is not to say that the (1031) exchange will not qualify for these reasons. Keep in mind, partial exchanges do in fact, qualify for a partial tax-deferral treatment. This simply means that the amount, of the difference (if any), will be taxed as a boot or non-like-kind real estate property.1031 exchangesite