Australian Bank Deposit Rates A Tempting Alternative

Post on: 16 Март, 2015 No Comment

After publishing our coverage of Mexican bank deposits. we had a number of you write in regarding various other foreign currency CDs available and whether or not they are viable alternatives to domestic bank deposits (since our rates at home are so horrendous!). And the foreign CD that people seemed to be most intrigued about was in the Australian dollar.

If you are brand new to the concept of investing in bank deposits in foreign countries we would suggest reading over our coverage of the risk and rewards .

In a nut shell the risk is this if the currency in which your foreign bank deposit is being held falls against the US dollar, then you stand to lose not only interest but potentially a portion of your principal as well.

The potential upside then is if the US dollar falls against the foreign currency youre locked into, you stand to earn not only the interest from your bank deposit but the added value of the currency as well.

Why are Australian bank CDs so tempting?

For one, Australia has a very stable economy when compared to the all other developed countries. It ranks 3rd in the regional economic freedom rankings at heritage.org behind just Hong Kong and Singapore (two of the stronger economies in the world).

They have an impressive unemployment figure of 5.1%, a medium income of $41,000 and a GDP growth of 2.6% over the last 5 years. It doesnt take a doctorate in world economics to pit those figures against ours at home and see the relative stability Australias economy possesses.

The other reason Australian bank deposits are looking so tempting is that they are providing much higher returns than any other developed nation has to offer.

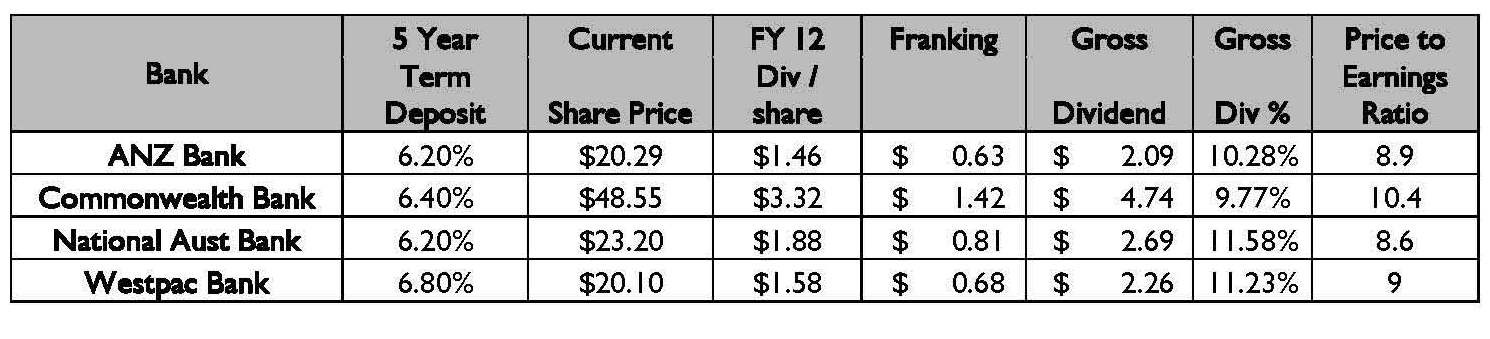

Australian Bank Deposit Rates:

Take a look at the rates above and weigh them against any deposit offered by a European nation, Canada, or any of the most productive Asian economies and youll see Australias come with a far higher APY (annual percentage yield).

Here are Some Comparables:

CD rates in British Pound 0.10% APY on deposits from 3 month to 12 month terms.

CD rates in Canadian Dollar 0.25% APY on deposits from 3 month to 12 month terms.

CD rates in Hong Kong Dollar 0.13% APY on deposits from 3 month to 6 month terms.

CD rates in Swiss Franc 0.00% APY on all deposits.

How to Invest in an Australian Bank CD?

We generally use Everbank for foreign bank deposits since theyre the industry leader in this respect. What makes their foreign deposit offerings so enticing is that they are actually federally insured by the FDIC despite the fact that your money is being held in another currency rather than the US dollar.

Remember though, FDIC insurance will only protect you in the event that the bank in which you are invested in fails, they will not protect you against the rise and/or fall of one currency against another, so conduct your due diligence and use caution before opening any foreign bank deposit.

Do you plan on spending your funds in the Australian Dollar?

Heres one of the biggest caveats to investing in foreign currency CDs and that is how you will spend this money. Will you these funds in US or Australian dollar form?

We had a reader chime in after our coverage of Mexican bank deposits who had duel citizenship in Mexico and the US. He opted for a Mexican bank deposit over a US one simply because the interest rates are much higher and he spends 4 months of the year back home in Mexico. While hes at home each year he obviously spends his money in Pesos rather the US Dollars. This unique situation should also be considered before you invest in a foreign bank deposit as any rise or fall of a certain currency against the US dollar will have far less of an impact (if any) if you plan on using the money in that particular currency.

Compare to the top US CD rates below.