Asset Classes for Early Retirement Can I Retire Yet

Post on: 23 Апрель, 2015 No Comment

Asset allocation is the most important variable in your portfolio. The way you allocate your money to different asset classes will dictate the risk you take on. And it will likely prescribe the long-term returns you achieve. Thats conventional wisdom.

Modern Portfolio Theory says that by combining asset classes that have low correlation. you can reduce the overall volatility of your portfolio even if the individual assets are more volatile. (Correlation is the tendency for two assets prices to move together, or not, as they stray from their averages.) And reducing volatility, while achieving the same returns, is a good thing because it evens out your portfolios performance and helps you sleep better at night.

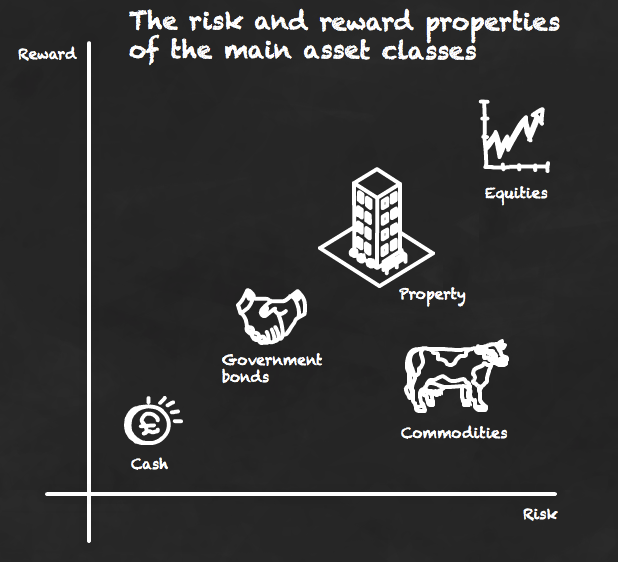

Rather than provide a basic introduction to asset classes here, if youre new to the topic, Ill point you to this excellent post over at Monevator: A quick guide to asset classes. Youll find a simple chart showing the risk/reward positioning of the major asset classes, along with discussions of their relative pros, cons, risk/reward trade-offs, and time horizons.

Note the iron-clad relationship between reward and risk. You cant get more reward without taking on more risk. There is no magic asset class that can deliver more of the former, without also requiring more of the latter.

But many do believe there are optimal asset allocations for certain goals. There are as many model portfolios demonstrating different asset mixes as there are finance writers. At the low end are Scott Burns wonderful Couch Potato Building Block Portfolios. At the high, complex, and expensive end, there are numerous hedge funds and active management strategies, all chasing some optimal asset allocation.

It isnt hard to find financial writers who have back-tested some personal brew of asset classes to demonstrate it would have outperformed the market in the past. I dont dispute that your asset allocation will dictate your returns. But I do question whether any of it can be optimized or predicted in advance.

Some maintain that by rebalancing among different asset classes you can increase returns. Im dubious whether that pays off in the real world. Vanguard legend Jack Bogle reported on a 2007 study showing that a portfolio of 80% stocks and 20% bonds earned a 9.49% annual return over 20 years without rebalancing, and a 9.71% return with annual rebalancing. He concluded that the difference was the equivalent of investing noise.

More recently, author, advisor, and passive investing champion Rick Ferri writes, In the real world, the excess return from rebalancing among two asset classes may not exist at all in the long term. Whatever benefit there is from the exercise likely gets eaten up by fees, commissions, trading costs, cash drag and poor portfolio maintenance.

Candidate Asset Classes

In identifying the key asset classes for retirement or early retirement, what should be your guidelines? Here are my simple criteria:

- the asset class should behave uniquely in response to economic cycles (growth/recession, inflation/deflation)

- the asset class should be easy to buy or sell, without high transaction costs

- the asset class should be inexpensive to hold, without high expenses or maintenance costs

- the asset class should be transparent and not require special expertise to manage or value

The first point above is what makes a certain set of assets an asset class. They are fundamentally different from other kinds of investments, giving them individual risk/return characteristics. What do we mean by fundamentally different? Rick Ferri explains this best: Stocks and bonds are different; one is ownership and the other is loan. U.S. stocks are different from international stocks in base currency and government policy. Real estate and commodities differ from common stocks in collateral structure. In contrast, U.S. mid-cap stocks are not fundamentally different than large cap and there is very little unique risk.

The hallmark of different asset classes is that they are uncorrelated. For example, the correlation between the U.S. stock market and 5-year Treasury notes was only +0.07 from 1926 to 2013. Thats useful to know because it confirms that, over very long time spans, stocks and bonds will perform on their own, mostly unrelated, cycles.

Just be advised that while correlation makes for interesting data, in the short- and mid-term it is not terribly helpful for predicting behavior. Turns out there is no assurance whatsoever that well see those same correlations going forward, and, in general, we wont see the average long term correlations holding at any given point in time. Why? Because asset correlations are dynamic: they fluctuate constantly.

Harvesting Early Retirement Income

Retirement generates new urgency around the choice of asset classes. Now that Im living off my assets full time, the value of holding potentially uncorrelated assets is crystal clear to me. If diversification among asset classes was important to dampen volatility in your accumulation portfolio, its even more important in retirement, especially an early retirement. Why? Because, if you are taking a total return approach to living off your portfolio, consuming both income and some growth for living expenses, then you arent so concerned with predicting what your portfolio will return years hence. Rather, you are focused on optimizing how you consume from it today.

The future is uncertain as always in retirement. But one thing is definite. you need to withdraw some living expenses now. The short term is just as important as the long term. So, if you happen to be holding damaged assets, you cannot wait for losses to be recovered. You need to withdraw living expenses continuously! Your goal is not some far-away target that is insulated from fluctuations en route. Your objective is yearly, monthly, daily, cash flow. So it doesnt help as much if stocks are expected to outperform over the decades. Because, if you cant get the cash to make it through a current downturn without damaging your portfolio, you wont be viable long enough to enjoy those future returns!

Thus, I feel, to bombproof your income stream in early retirement, you need a mix of asset classes that give you the strongest possible probability of holding one or more winners at any given time, in any possible economic scenario. For a simple, visual demonstration of this principle, see the Callan Periodic Table of Investment Returns. It shows the ranked annual returns for a number of asset classes over the past 20 years. Note how the asset classes (colors) at the extreme bottom and top of the table trade places regularly: This years winner can become next years dog, and vice-versa, on and on ad infinitum….

In my opinion and experience, the following are the asset classes that careful investors should consider for a retirement portfolio, along with a rough idea of their historical returns and their possible behavior in different economic scenarios: