Asset Backed Commercial Paper

Post on: 13 Апрель, 2015 No Comment

Paper is a term widely used by investors.

Paper is also a term that has special meaning in the mortgage industry and more specifically in the creditworthiness assessment field.

You might hear anyone involved in financing something refer to A-paper. In this case, A-paper refers to a loan with high quality characteristics.

You might also hear someone saying that a certain company holds the paper or sells the paper. With these phrases, we are getting closer to the meaning of paper. Though it can be broadly defined and people could argue a different point, paper is thought of in the investment community a security, such as a bonds. In the mortgage industry, paper can also refer to a mortgage note or promissory note. Holding the paper then, would refer to the lender that is servicing or carrying the mortgage note.

So because of these dual and broad definitions, commercial paper in the mortgage industry could be construed to mean:

Bonds backed by commercial real estate, or

Commercial real estate notes

In essence, bonds and mortgage notes are the same thing. A group of mortgage notes is often packaged together as a bond and sold as a mortgage-backed-security .

The most widely understood and accepted definition of commercial paper however only relates to the mortgage industry when a mortgage company issues a particular type of bond. Commercial paper is a short term security issued by a company in order to finance short term costs or increase short term operating capital. The time frame on these bonds is short to avoid SEC regulation (9 months usually), the return is low, but so is the risk.

Its basically a way for large companies to borrower money from other large companies without actually borrowing it in a conventional sense, but rather by selling a short term security. The denominations are high, so it is only really accessible to investors through the money market.

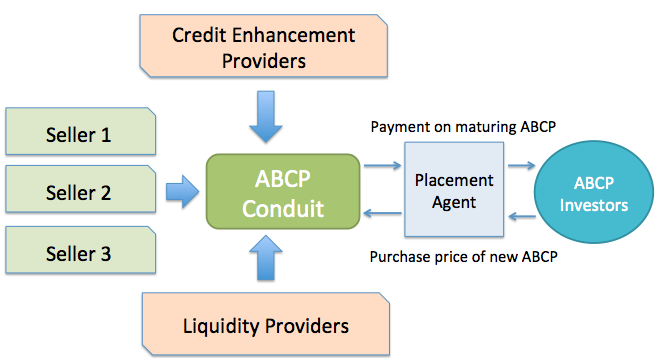

In the mortgage industry, asset-backed commercial paper allows large companies to issue commercial paper in order to free up liquidity to do more business. The problem of late with the mortgage meltdown and ratings agencies downgrading asset-backed commercial paper comprised largely of home loans is that the demand for it is plummeting and if it cant be sold, this is what creates the credit crunch which inhibits these large banks from doing business as usual.

Answered over 7 years ago