Asset Allocation – How Much of Your Portfolio Should Be In Bonds

Post on: 23 Июнь, 2015 No Comment

One of the most critical aspects of portfolio management is Asset allocation . It has been often researched and opined that the types of assets one invests in is more important for long-term total return than specific securities selected. Of course since most investors have a wide range of strategies for their money, total return may not the penultimate goal.

While one can utilize various recommended asset balances from a brokerage like 50/40/10 (stocks, bonds, cash) or rely on rules of thumb like “subtract your age from 100 to ascertain a percent of assets that should be in stocks,” investment allocation should be a more introspective undertaking. Indeed, taking the time to understand one’s own risk tolerances and investment needs should not be a simple, flip-of-the-switch proposition.

So, with the obvious wide range of investment persona, it can certainly be argued that some people should have all of their money in bonds, while others should have little to none of their money in bonds. Due to the fixed nature of the payments, some older individuals may be able to consider Social Security payments, employment pensions, and other predictable and/or passive income sources as part of their bond pile, thus reducing or eliminating the need for bonds.

Today’s Bond

For those considering investment options, it is important to understand what bonds bring to a portfolio and what they do not. As a contractual guarantee between a borrower and the lender, bonds are very simple to understand. And while principal value can fluctuate on an interim basis as interest rates wax and wane, capital, at maturity – when one lends to investment grade entities – is rarely in peril. Further, with junk grade defaults at negligible levels today, even higher risk bonds have not posed significant problems – although that does not always have to be the case.

The biggest detraction to investing in bonds today is the relatively low rate of coupon (interest) one receives. Though the Fed is moving towards a more normal interest rate policy with a taper of stimulative bond buying, the nation has been enveloped in what is affectionately known as ZIRP (Zero interest rate policy) for many years now. Thus, if we look at bonds from a historical perspective, interest rates are very low – which is great for those borrowing money – but not so great for those that wish to see higher rates of interest, and return, on their money.

And given this low interest rate environment, bonds may not be a great total return idea – especially if rates embark on a prolonged tightening (increase) spree. Over the past year, bonds have actually been very volatile. The yield on the 10 year Treasury roughly doubled between May of last year and January of 2014 and has now slid back 50 basis points this year – which may not sound like a lot – but on a percentage basis is rather substantial.

You may say, “so what if rates rise – I still get my money back at maturity.” This is true. However, assuming rates do rise over the intermediate to long-term, there can be tremendous opportunity cost in owning bonds with low coupons and lengthy maturity. If you buy a 30-year Treasury at 3.4% and rates start to go up and say hit 6%, or even more, you are sacrificing tremendous yield every year by owning the bond at the lower coupon.

Figuring Your Allocation

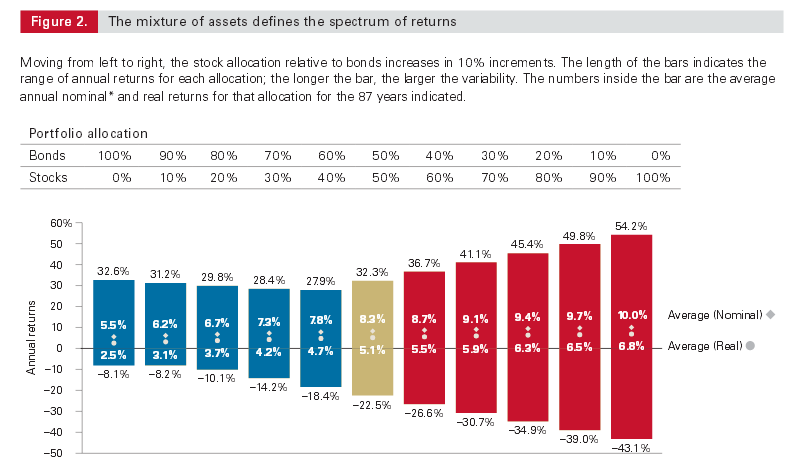

So taking the preceding into account, one can start to assess how much exposure to bonds make sense. While it may be easy to determine that one does not want or need bonds in the midst of a rampant bull stock market run, the next sharp equity correction may determine whether you are correct in that assessment or not.

Bonds may not offer tremendous nominal value, comparatively speaking, in the current market, but they do generally offer peace of mind and stability which, for some, may be more important than they currently realize.

Disclaimer: The above should not be considered or construed as individualized or specific investment advice. Do your own research and consult a professional, if necessary, before making investment decisions.

About the author:

Adam Aloisi has over two decades of experience investing in equities, bonds, and real estate. He has worked as an analyst/journalist with SageOnline Inc. Multex.com, and Reuters and has been a contributor to SeekingAlpha for better than two years. He resides in Pennsylvania with his wife and two children. In his free time you may find him discussing politics, playing golf, browsing antique shops, or traveling.

Learn how to generate more income from your portfolio.