Assessing Risk Tolerance

Post on: 16 Март, 2015 No Comment

Re-assess risk tolerance, asset allocation & diversification

- The foundation of your investing strategy is your comfort with risk.

- Most people’s risk tolerance is lowest when they are in retirement.

- Adjust asset allocation to deliver both income and potential growth.

- Spread your money across different investments in each asset class.

In retirement

As your focus shifts from saving to generating income from your savings, you’ll want to re-assess your comfort with risk, adjust the mix of assets in your portfolio and select a range of investments in different asset classes.

Re-assessing your risk tolerance

Once you shift from saving for retirement to drawing on your savings, your comfort with risk may be lower than it was during your working life. However tempting it may be to avoid risk completely, you still need to have some assets in growth-oriented investments so your money has the opportunity to potentially grow faster than inflation and to last throughout retirement.

To determine tolerance for risk, Ameriprise financial advisors ask investors to answer five questions .

What are your goals for your investments?

- To grow aggressively

- To grow significantly

- To grow moderately

- To grow with caution

- To avoid losing money

Assuming normal market conditions, what would you expect from your investments over time?

Suppose the stock market performs unusually poorly over the next decade, what would you expect from your investments?

Which of these statements would best describe your attitude about the next three years’ performance of your investments?

Which of these statements would best describe your attitude about the next three months’ performance of your investments?

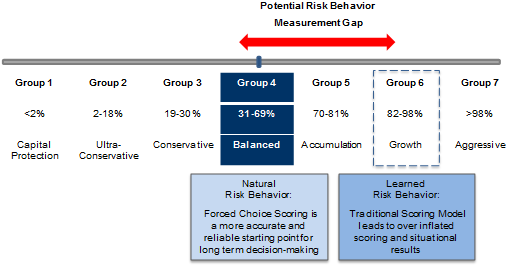

Most investors fall into one of the following categories

Conservative

You are willing to accept the lowest return potential, lowest return variability and the lowest fluctuation in account value in exchange for lower risk.

Moderately conservative