Asia s Tech StartUps Are The Next Big Thing (BABA)

Post on: 27 Март, 2015 No Comment

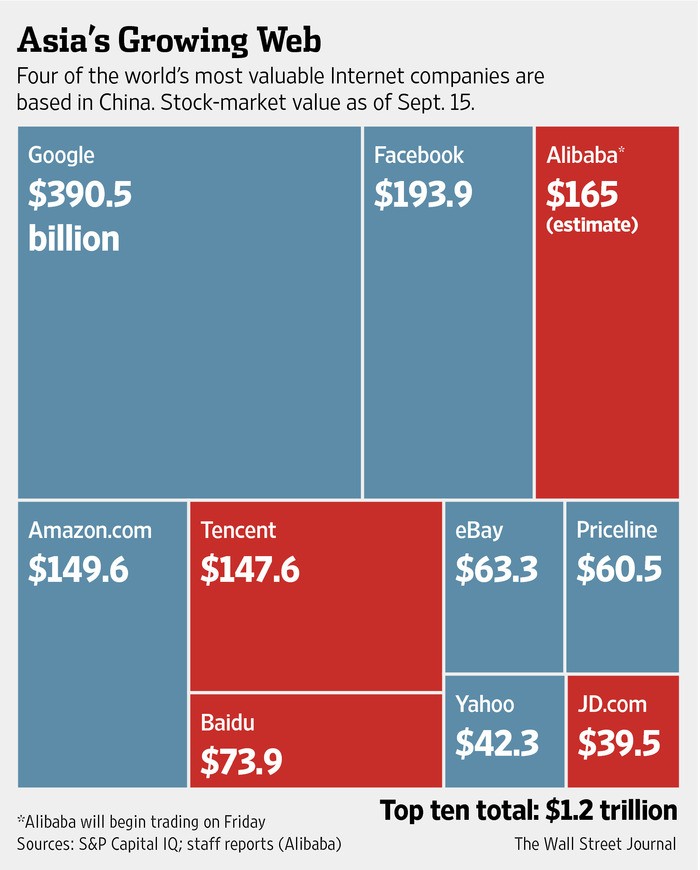

There is often a tremendous focus on the latest and largest investments in tech firms in the United States. Recent reports indicate that this trend is now shifting, in favor of increased focus on investing in tech companies and digital marketing in Asia. For instance, a leading venture capital firm in Japan, Incubate Fund, recently announced that it has raised approximately $91 million. In the past, Incubate Fund has focused on seed investments. but through the new fund an increased emphasis will be put on placing larger amounts of funding in early-stage startups in Asia. The new fund, known as Incubate Fund III, features an impressive roster of backers from some of the largest tech companies in Asia, including Yahoo Japan, Tencent, Tokyo Broadcasting System, and Sega Sammy. (For related reading, see article: Forget Apple: Invest Your Next Tech Dollar In Asia .)

More Funding Funneled into Asian Tech

Increased availability of funding will certainly be welcomed news to Asian startups. Previously, such startups have often found it challenging to find venture capital backing. Recently, however, the prospects for such startups have begun to change, as more Japanese-based firms have turned their attention toward funding regional investments. Among the biggest investments made last year was by SoftBank, a Japanese telecommunications firm. Additional investments have also been made by Rakuten, a leader in e-commerce. which made multiple investments throughout Southeast Asia last year, including the launching of a $100 million fund. (See article: Valuing Startup Ventures .)

While Incubate Fund III plans to focus on a variety of sectors, including gaming, entertainment, media, online commerce, real estate, the financial sector, logistics, housing, and the medical sector, much of the increased focus on funding in Asia has been directed toward tech companies. The tech scene in Asia is practically exploding. WeChat, a popular Chinese messaging app enterprise, launched an online personal investment fund just last year. Over the course of the last twelve months, the fund has attracted 10 million users who have earned an incredible $16.2 billion. averaging $1,610 per user.

Investments Driving Growth of Billionaires in Asia

The significant investments made in Asian tech are certainly paying off. The Times of India reports that technology entrepreneurs in India and China now rank among the top tech billionaires in Asia. Three entrepreneurs from India have a combined net worth of more than $40 billion, while five entrepreneurs from China have a net worth of more than $67 billion.

Why Asian Tech Investments Matter

There are certainly plenty of reasons for investors to focus their attention on Asian tech firms. While Silicon Valley is often considered the cradle of tech, Asia is actually home to more technology firms than the United States. Add in the fact that many of those firms trade at measures that are lower than their American counterparts and it is easy to see why so many investors are interested in Asia. The Asian tech market isn’t just massive; it’s also innovative and evolving rapidly. Driving much of that creativity is a large workforce focused keenly on technology. In terms of R&D workers, China has now outpaced the United States. In fact, China is home to more than one thousand research and development firms. (Considering investing in the tech sector? See: A Primer On Investing In The Tech Industry .)

While many Asian investors have opted to keep their funds at home, that is not always the case. Alibaba (NYSE: BABA ), the rapidly growing Chinese online retailer, has recently expressed an interest in investing in American tech companies. Just a few months ago, Alibaba invested $215 million in Tango, a messaging app. In addition, Alibaba was involved in a $170 million round of funding for online sports memorabilia retailer Fanatics. Alibaba has also funneled $120 million into a video game start-up, Kabam, according to The New York Times .

As if that were not enough, Alibaba has also recently purchased a controlling interest in AdChina, an online marketing company. The move was made in an effort to give Alibaba’s advertising business a boost. Alibaba, which, according to Reuters spent more than $6 billion in acquisitions in 2014, has not disclosed the size of the deal or the precise stake they would have in AdChina.

Tracking the Growth of Tech Startups in Asia

The tech startup scene in Asia is so large and growing at such a rapid pace, that it can sometimes be difficult to track such growth. Techlist recently announced that this is a problem it will be tackling head-on with the introduction of a new service focused on building the Asian startup ecosystem, reports TechCrunch. Techlist itself might sound like a startup, but that is not the case. The service is actually a branch of Tech in Asia, a media firm with offices located throughout Asia. To date, the firm has received almost $3 million in investor funding. In the beginning, Techlist began as a platform for connecting startups and investors in Asia. Eventually, the creators behind the service realized the need to change the model. (To learn more about the process of investing in new ventures, see: The Stages In Venture Capital Investing .)

Renren, a Chinese social networking site, is just one firm that has been steadily investing in tech startups, largely as part of a move to expand its revenue stream while increasing stock prices. CEO Joseph Chen has demonstrated a commitment to acquiring and investing in tech startups showing promise. Forbes reports that the social networking site has plans to invest as much as $500 million in financial tech.

Education-based tech firms are also benefiting from an increased interest among Asian investors to fund startups. XueXiBao, a homework assistance app, is among the latest tech startups to receive funding. SoftBank China Venture Capital recently led a $20 million Series B round of funding for XueXiBao, according to a TechCrunch report. China has always maintained a strong interest in education, but most recently there has been an increased interest in online education in China. More and more students are beginning to look beyond traditional options and are turning to alternatives to help them in preparing for college entrance exams. XueXiBao allows students to upload diagrams and text to the app to receive assistance within just a few seconds. The app also offers a Q&A feature.

There is little doubt that interest in tech and tech startups is on the rise in Asia. Last year, Startup Asia received its largest attendance to date when the event was held in Jakarta, and Startup Asia Singapore. scheduled for early May, is already showing signs of being even bigger, offering start-ups the opportunity to participate in a sort of speed-dating round with investors.

The Bottom Line

Exactly how large and how fast the tech startup scene might grow in Asia remains to be seen, but given the massive amounts of investments currently being directed toward Asian startups, it seems as though Asia could soon be a new hotbed of activity.