Are Markets Too Volatile 7 Ways To Protect Your Portfolio Intelligent Speculator Intelligent

Post on: 23 Апрель, 2015 No Comment

Are Markets Too Volatile? 7 Ways To Protect Your Portfolio

3A%2F%2Fwww.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536&r=G /% By: IS

Date posted: 12.21.2011 (5:00 am) | Write a Comment (0 Comments)

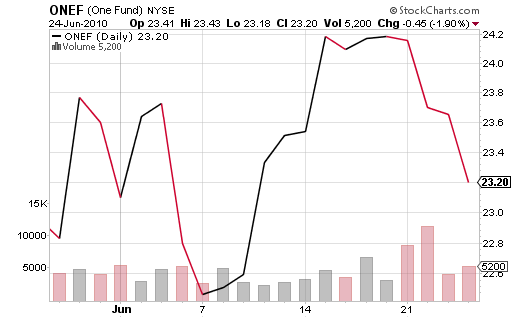

One of the questions that I get the most often is how to protect a portfolio. I think that many investors are scared these days. Why? Markets have been more volatile in recent months and its scary for everyone involved. Especially those that have less years to make up any potential losses. There are many different reasons why markets have reacted so violently. The first one would be the whole credit crisis that makes it unclear what Europe (and indirectly the world) will look like a few years from now. That, the uncertainty around banks, real estate prices and more have greatly diminished investors confidence.

All of those would be enough to make markets volatile but when you add electronic trading, high frequency traders and hedge funds, it seems to add to the violence of moves. The fact that big movements in the markets then setup new trades from all of these investors seems to make movements even more violent. Are markets too volatile? I personally dont think so. If markets go up and down 2-3% every day but the end result is not significant, it should not make a big difference to most of us. In the end, most of us are trading with a long term perspective right?

How To Protect Your Portfolio?

One of the most common questions that I get when markets are so volatile is how to protect such a portfolio from big movements. There are no easy or clear answers but here are the main strategies that can be tried. I think its important to start off by doing these 2 things:

-Do not worry about short term movements (markets crashing for 1 day and rebounding the next one is not a cause for worry)

-Do not panic (trades and moves made when someone is anxious, upset or scared are almost never good ones)

Here are the main things that you can add into your portfolio. Any movements should be done gradually over time to reduce the volatility of your portfolio. It is almost never a good idea to start selling right away when markets decline. Gradual moves though can improve the performance of your portfolio over time.

7 Ways To Protect Your Portfolio

- Only Invest What You Can Afford To. There is no issue in holding some cash in your portfolio. I personally do not invest anything that I cannot afford to suffer significant (15-20%) losses on. if you have trouble sleeping because you worry too much, you probably should hold less stocks and more cash.

- Improve your asset allocation. You should not have all of your eggs in equities or in bonds. Ideally, you have a mix between the two. It seems simple but that is probably the most significant

- Do Not Use Leveraged/Inverse Products. Many products are sold as a way to protect your portfolio. Such products are generally build with very short term goals in mind and its not what you should be using for longer term strategies.

- Improve Your Diversification. I love technology stocks but holding Google, Apple and Microsoft will provide very little protection in market downturns. Its important to try to hold companies in different sectors that will help you perform better over time. This also means having more international stocks.

- Hold Alternative Assets. Buying inflation protected bonds, gold or other commodities can help diversify your portfolio. Its not the first step I would take but as your portfolio becomes bigger, such strategies can certainly make a big difference.

- Pay Attention To Fiscal Impacts. One of the biggest mistakes that investors do when they panic is selling their biggest assets. That may or may not be the best decision. But you should always look at the taxes that will need to be paid. You might have lost $10,000 on a stock and want to sell but if you had made significant profits in previous years, you will be stuck paying capital gains taxes on those.

- Focus On The Right Metrics. I discussed how dividend investors that are using a dividend portfolio to build income should focus on the income that the portfolio generates rather than every days profit and losses and that can be true of any portfolio. Keep in mind that market losses means you are able to buy more of those assets which is a good thing. It might not feel that way but if you take the right perspective, you will not feel as much panic.