Angel Financing How to Find and Invest in Private Equity

Post on: 16 Март, 2015 No Comment

By Gerald A. Benjamin & Joel B. Margulis

Anyone interested in investing in private companies or who wants to understand the process of angel investing should read Angel Financing: How to Find and Invest in Private Equity by Gerald A. Benjamin and Joel B. Margulis.

Many wealthy investors are turning to financing small businesses due to the huge potential return. Benjamin and Margulis tell us that the angel investor who put $100,000 into Ciena Corporation saw the value of his investment grow into $285 million in three years, when the company went public. Further, knowledgeable business people can enhance the value of their angel investments through their experience, knowledge, and contacts. Unless you’re extremely wealthy, this ability to add value to your investments isn’t available when you invest in large publicly-traded companies.

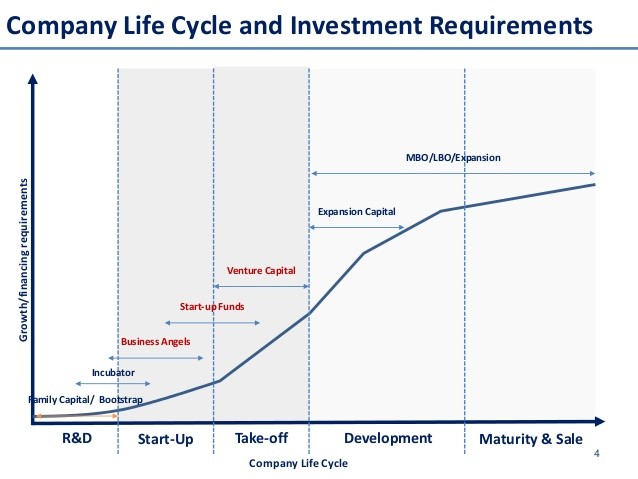

Angel investing isn’t for everyone. Benjamin and Margulis say angel investors expect about one-third of their investments to fail completely. Further, many bad deals out there must be avoided. So, anyone considering angel investing should probably already be wealthy and have business experience. And, there must be good chemistry between the investor and the entrepreneur.

To help new investors ask the right questions and avoid bad investments, Benjamin and Margulis provide a detailed due diligence questionnaire which will help investors understand what questions they should ask before making an angel investment.

Angel Financing is also a good book for entrepreneurs seeking angel financing. It helps entrepreneurs answer the questions: Is my company financeable? Am I financeable? And, Angel Financing helps entrepreneurs understand the private equity market.

We learn that the average angel investor is 48-59 years old, has a postgraduate degree, has management experience, and, typically, invests between $25,000 and $250,000 per deal. Many angel investors are self-made millionaires with a net worth between $1 million and $10 million dollars. Eighty percent of angels have previously started a company and have small business experience.

Benjamin and Margulis tell us that seeking private investments from people with a net worth below $1 million, or an annual income below $200,000, isn’t usually desirable. These people do not possess the discretionary income to make angel investments and are usually not classified as accredited investors. This could create legal problems for the entrepreneur if the investment fails.

Benjamin and Margulis point out that many of the wealthiest families and individuals have their wealth managed by conservative trusts or professional advisors. So, seeking an angel investment from an ultra-rich person may not prove successful, because the trust administrator often kills the deal because of the high risk involved.

Because angel investors don’t need to invest, Benjamin and Margulis tell entrepreneurs to be flexible in structuring the deal to meet the investor’s needs. Many entrepreneurs do not listen adequately to what potential investors are telling them.

Angel Financing contains a good appendix about private placements, discussing such things as exemptions from full securities registration under Rule 504, 505, and 506, although much of this information is also available free from the SEC.

Benjamin and Margulis say that entrepreneurs should expect to budget about 10% to 15% of the amount to be raised as fundraising expenses. We learn that costs of a SCOR offering average about $30,000 nationwide. Typical costs in California are about $10,000 to $15,000. (SCOR, Small Corporate Offering Registration, allows companies to raise up to $1 million and is highly state-specific. Some states encourage SCOR while other states are more hostile to it.)

Overall, Angel Financing is an excellent book for entrepreneurs and angel investors.