Analyzing Restaurant Income Statement dLoewi C

Post on: 12 Апрель, 2015 No Comment

Analyzing Restaurant Income Statement

Do you have an idea whether you’re making money on your restaurant business? You, as a restaurant owner(s) or operator, have to know it if you manage the business finance efficiently.

You can recognize problem areas simply by reading the financial statements. Once you can read and analyze that information, you can begin identifying the red flags. If an operator receives this information in a timely fashion, they will be able to quickly identify problem areas and respond accordingly.

The Income Statement and Balance Sheet are the two types of financial statements that allow operators to pinpoint weaknesses and problem areas. The statements should be prepared by your accounting professional and reviewed on regular basis, typical monthly. You need financial statements more than your accountant needs them annually to file taxes.

The following discussion about analyzing restaurant income statement should be paired with the common income statement analysis. You could think that evaluating restaurant income statement as a supplemental step to the common analysis.

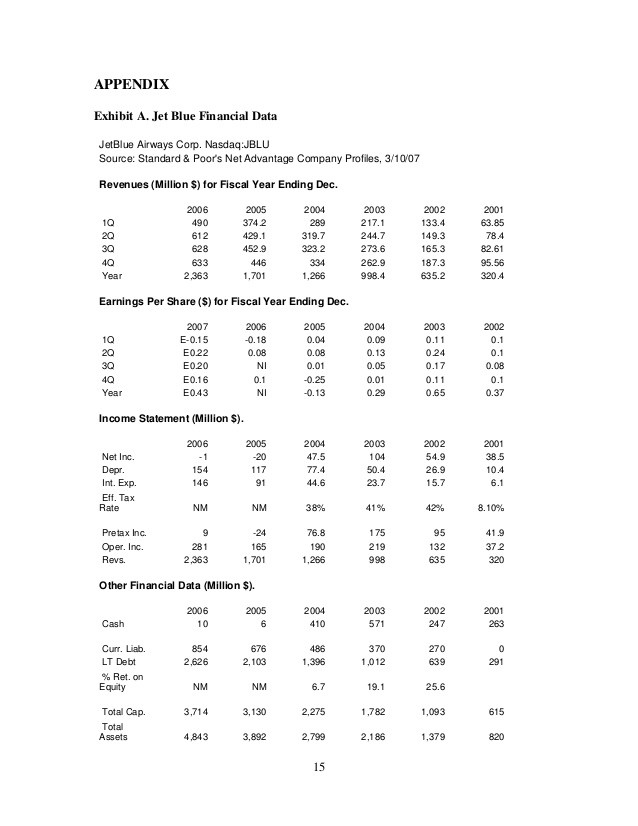

Income Statement

The Income Statement is a favorite financial statement to review because it reveals the nature of the restaurant’s success. The Income Statement shows how the restaurant performs over a period of time (i.e. a week, month or year). It takes all restaurant income and expenses into account, from prepaid expenses to expenses paid in the future. The Income Statement tells the operator if the business is making a profit.

From there, some of key questions that need to be addressed. Should new sales programs be implemented? Is food cost in line with menu prices? Is the restaurant hitting its budgets? Can the owner(s) make distributions to the partners? Answering the questions help the operator making changes in policy and implementing strategies that will help the restaurant achieve its goals.

The basic formula for an Income Statement is:

Sales — Cost of Goods Sold — Expenses = Profit/Loss

Restaurant Income Statement is typically broken down into the following major categories/accounts:

- Sales

- Cost of Goods Cost (COGS)

- Salaries & Employee Benefits Expenses

- Operating/Controllable Expenses

- Occupancy & Utilities Expenses

- General and Administrative Expenses

- Interest Expenses

- Depreciation

Each major category can further be broken down if the operator needs to evaluate the cost in more details. For example:

Sales is detailed into food and beverage sales

COGS can also be broken down into food and beverage costs

Operating/Controllable expense can be drilled down into supplies, repair and improvements, advertising and promotion etc.

Occupancy expense can be split into rent, real estate taxes, utilities and property insurance.

General and Administrative expense is broken down into office supplies, telephone, professional expenses etc.

The two most costly expenses of any restaurant operation are food/beverage and labor. These prime costs must get special attention when analyzing the income statement. Controlling these prime costs require restaurateurs to conduct regular food and beverage inventories as well.

Cost To Sales Ratio

Because raw dollar figures for costs are of no real significance for control purposes, we must express them in relation to a figure with which they vary. This is referred to as the cost-sales ratio. In other words, all costs should be shown as a percentage of sales.

For example:

Food Cost % = (Food Cost / Food Sales) x 100%

Labor Cost % = (Labor Cost / Total Sales) x 100%

Analyzing the cost-ratios, the operator can easily target problem areas. These areas can be investigated and changes can be made to maximize profits.

Industry Average

When reading the Income Statement, operators use the cost ratios and need to compare them with the following percentages of industry range:

- Cost of Goods Sold: 26% to 36%

- Payroll & Benefits: 30% to 40%

- Operating/Controllable expenses: 7% to 12%

- Occupancy expenses: 5% to 10%

- General and administrative expenses: 1% to 5%

- Earnings Before Interest, Taxes Depreciation & Amortization: 0% to 19%

The challenge to every operator is to know the ideal percentages for restaurants of similar type and concept and achieving high net profit percentages. Your restaurant should be in industry range for every category and EBITDA (Earnings Before Interest, Taxes Depreciation & Amortization).

Analysis

To maximize profitability, the operator needs to identify areas where his restaurant can improve. A one percentage point drop in cost of goods sold, payroll, or operating expenses would result in an additional percentage point to the bottom line.

Because sales and expenses are broken down into specific categories, the operator can easily compare and analyze his or her restaurant to industry standard percentages or to its own historical costs.

Analyzing Prime Costs. As you can see on the restaurant industry average, food and beverage costs coupled with labor costs consume the most (56% to 77%) of total sales. The combined total of these two cost categories, referred to as your restaurant’s Prime Cost, are where the battle for restaurant profitability is truly waged. This is not simply because they represent the largest percentage of your total expenses, but also because you have the ability to control them. Because of their importance, they must be the focus of your analysis. When you see a Prime Cost percentage exceed 70%, a red flag is raised

Food and beverage costs can make significant impact on an operation and profitability; therefore they are the first things you have to examine and are important to know where these costs fall in relation to total sales on a regular basis. You must be able to monitor your food and beverage cost by comparing it to industry averages and historical performance. Consistent analysis can prove very helpful in identifying problems and trends. It is important to determine why food costs increase as well as decrease. Ideally you should be able to determine a consistent overall food cost which, when combined with properly pricing your food menu items, positively impacts your profitability

After you have determined total food costs and sales, you can determine if your food cost is in line with industry averages. Successful restaurants typically generate food costs in the 26 to 36 percent range of food sales. However, different types of restaurants typically run higher (steak houses) or lower (pizzerias) percentages. Comparing your cost percentage to restaurants with similar menus and service levels provides a more accurate perspective

Restaurants normally generate beverage costs in the 22 to 28 percent range of beverage sales. However, different types of operations may run higher or lower percentages; fine dining establishments may run up to 40 percent. Sales of bottles of wine, which occur primarily in fine dining restaurants, are usually less profitable than other alcoholic beverages and could be marked up as little as two times cost. This would result in a 50 percent beverage cost. Alternatively, restaurants that serve primarily draft beer may run as low as a 15 percent beverage cost. Comparing your cost percentage to restaurants with similar menus and service levels and industry averages is important.

In addition to comparing to industry average, you can use also your own historical food and beverage cost percentage to evaluate the current period food cost. Especially you can identify trends when comparing the food and beverage cost to their previous performance.

Analyzing Non Prime Costs. Keep in mind there are other costs of operating a restaurant that a customer does not notice but need to be analyzed.

Comparing your restaurant operating costs to the industry standard percentages or to its own historical costs will reveal any problems. When the cost to sales ratio falls near or beyond the upper bound of the industry range, it raises warning sign and calls for further evaluation on the troubling cost.

Once the problem areas are identified, the operator can implement strategies to increase earning potential. Improvement in this operating cost by one percentage point drop would result in one percentage point increase in the profitability.