Analyst Fund of Hedge Funds Group at Morgan Stanley in USPennsylvaniaWest Conshohocken

Post on: 28 Июнь, 2015 No Comment

Morgan Stanley — US-Pennsylvania-West Conshohocken

About this job

Job description

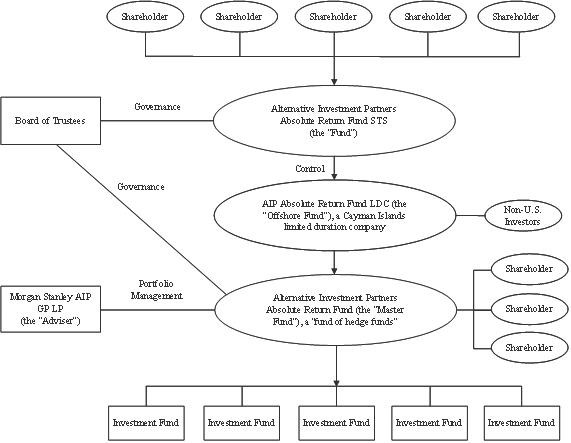

Morgan Stanley Alternative Investment Partners, L.P. (“MS AIP”) is Morgan Stanley Investment Management’s alternative investments fund of funds group. MS AIP consists of three units – the Fund of Hedge Funds Group, the Fund of Private Equity Funds Group and the Fund of Real Estate Funds Group. The Fund of Hedge Funds Group constructs and manages portfolios of hedge funds and portable alpha solutions on behalf of institutional and high net-worth clients through its various pooled vehicles (limited partnerships) and segregated accounts. MS AIP currently has over $35 billion in assets under management and advisory. MS AIP is staffed with over 130 employees. It is based in West Conshohocken, Pennsylvania (a suburb of Philadelphia), with additional offices in New York, London and Tokyo.

The Fund of Hedge Funds Group invests in hedge funds pursuing the following investment strategies: long/short equity, systematic equity and futures, credit and capital structure arbitrage, distressed debt investing, merger arbitrage, event-driven special situations investing, convertible arbitrage, fixed income arbitrage, mortgage arbitrage, and macro investing, among others.

The candidate will be responsible for sourcing and monitoring hedge fund managers within the systematic strategies segment. They will directly to the Portfolio Manager responsible for this strategy. This position is located in West Conshohocken, Pennsylvania. The successful candidate will play a key role in all phases of the investment process.

RESPONSIBILITIES

Identification and Evaluation of Investment Opportunities:

• Support the investment process by identifying compelling hedge fund managers across the globe. Duties include participating in on-site due diligence meetings to evaluate a hedge fund’s investment edge, its process and risk management capabilities, conducting research on hedge fund strategies and performing both innovative and routine quantitative analysis.

Investment Execution:

• Work with strategy team in preparing investment analyses, and in drafting recommendations to the Investment Committee.

• Support the negotiation of investment terms and capacity with hedge fund managers.

Investment Monitoring:

• Identify and anticipate qualitative, quantitative and market factors that will impact expected returns/profitability.

• Support the strategy team by participating in the quarterly and annual review process of underlying investments.

• Support the strategy team in conducting hedge fund strategy reviews and market updates on a regular basis and presenting to the investment team.

• Maintain proper investment records in the investment database.

Qualifications

Requirements

• Undergraduate or graduate concentration in a quantitative or technical field is highly desired.

• Strong analytical skills and experience with statistical analysis, financial modeling and optimization is desired.

• Ability to travel on a regular basis. Some non-US travel expected. Position will require approximately 25% travel.

• Demonstrated ability to work effectively in a team-oriented environment.

• Attention to detail and a thorough documentation standard.

• Ability to communicate well, both orally and in writing.

• Self-motivated with good interpersonal skills.