Americans Must Adjust to a World Dominated by China Fed s Bullard Real Time Economics

Post on: 21 Апрель, 2015 No Comment

India

James Bullard, president of the St. Louis Federal Reserve Bank, at the Credit Suisse Asian Investment Conference in Hong Kong on March 26, 2014. Bloomberg News

Normally when Federal Reserve Bank of St. Louis President James Bullard travels abroad, he finds himself talking about U.S. economic growth and the unemployment rate, and what that might mean for Fed monetary policy.

He did his share of that on a recent visit to Hong Kong. where he gave several talks at the Credit Suisse Asian investment conference. But he also found himself at one point imagining a world far removed from his daily experience.

In an interview with The Wall Street Journal on the sidelines of the conference, Mr. Bullard spoke of a future in which China and India are the economic leaders, and the U.S. must band together with Europe and Japan to try to counterbalance them.

“Certainly attitudes in the U.S. are going to have to change, because the U.S. will not permanently be the global leader the way things are going,” he said.

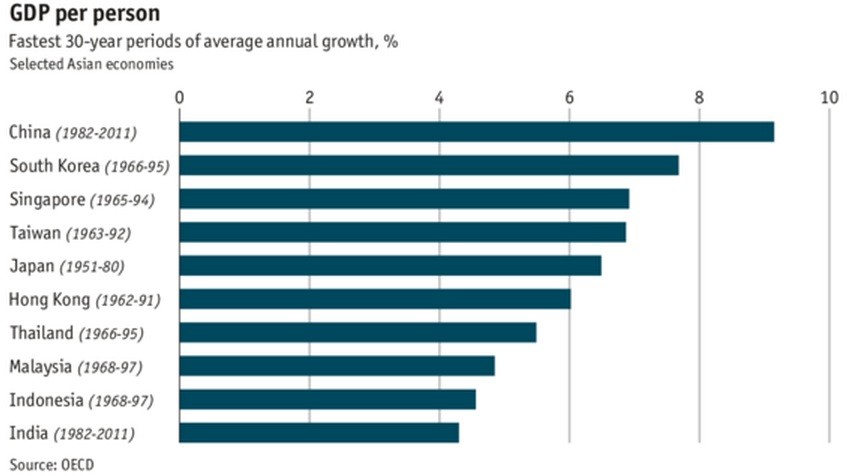

China is already the largest economy in the world after the United States, and is growing much faster than the U.S. Not too far in the future – estimates range from as soon as 2016 to as “distant” as 2028 it will surpass the American economy in size.

Most likely, China will eventually match the U.S. in per capita income terms as well. With a population about four times as large as America’s, that would imply a massive shift in the global balance of power.

In that case, “the U.S. would be playing a role to China similar to the role the U.K. plays to the U.S. today,” Mr. Bullard said. “People think it’s 50-75 years away but it’s probably only 25 or 20 years away, something like that.”

China’s economy currently is a little more than half the size of America’s, IMF data show, clocking in at $8.9 trillion in 2013 versus $16.7 trillion for the U.S.

Then there’s India, another economy of a billion-plus people that’s also growing quickly. Eventually, Mr. Bullard said, he can foresee a tri-polar world in which China and India are the major economic powers, counterbalanced by a bloc of the United States, Europe and Japan, whose populations together will total about one billion people.

“We’ve said the U.S. is a superpower, an economic superpower. But these are giants, they’re bigger than a superpower,” he said. “What would that world be like, both economically and politically? I think that’s really hard to understand. How much would the Western bloc be willing to cooperate politically to be a counterbalance to China and India?”

Mr. Bullard offered few specifics of what such a world would look like, but did acknowledge that it might require some adjustment on the part of ordinary Americans like those he serves in the heartland.

“The U.S. is just used to being so much bigger than all of its typical rivals, both in terms of population and in terms of GDP, that it can heavily influence policy on many dimensions not only economic policy, regulatory policy, even stretching into politics and certainly military aspects. This really dictates the world we live in,” he said.

“A lot of people who’ve grown up with that, it’s been that way their whole life they’re just not used to thinking about a world where you’re going to have to make more alliances, you’re not going to be the big kid on the block,” he said. “And the big kid on the block might not even be a democracy.”

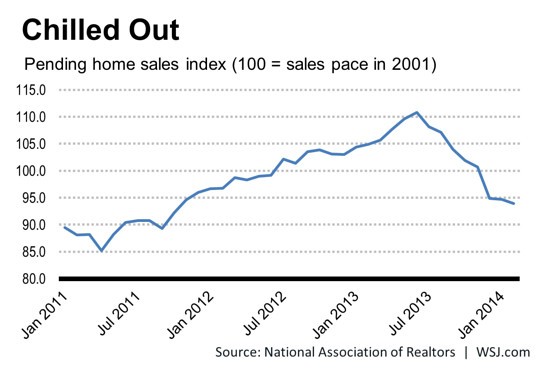

Heavy stuff. On the (relatively) lighter side, Mr. Bullard said hearing the perspective of people on the other side of the world helps inform his work as a Fed official. This time, he said, he’s been hearing plenty of concern in Asia about potential asset bubbles – particularly in Hong Kong real estate – growing risks to China’s growth, and the potential for disruptions in global markets as the Fed tapers its bond purchases.

His own take? Tapering reflects an improved outlook for the U.S. economy, and hasn’t created the wild ructions in international markets that some feared.

“I think policy is actually in a pretty good place right now,” he said. “But I’ve learned in this business you can’t ever count on anything staying the same for more than a couple months at a time.”

Follow @WSJecon for economic news and analysis

Follow @WSJCentralBanks for central banking news and analysis

Get WSJ economic analysis delivered to your inbox: