American Express Headwinds and Tailwinds (AXP)

Post on: 11 Апрель, 2015 No Comment

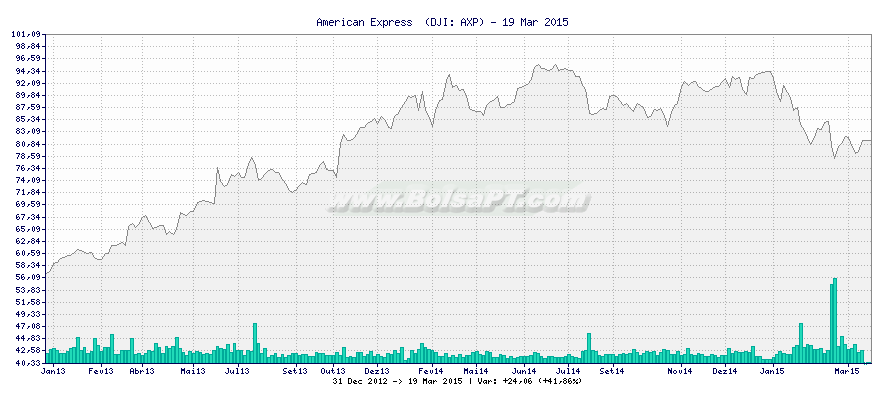

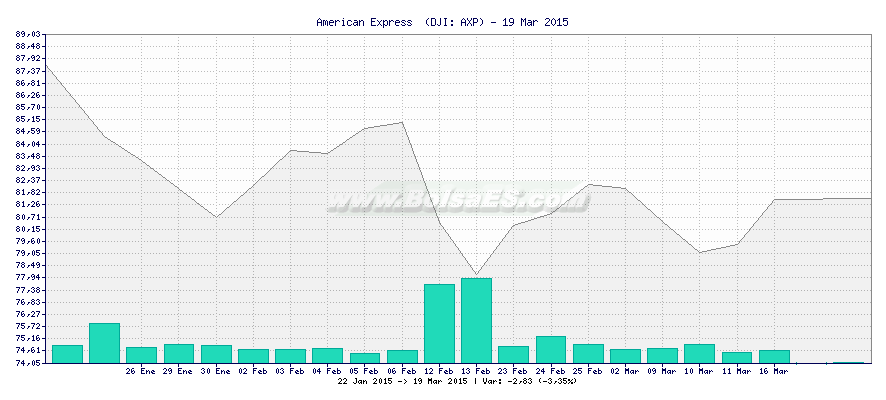

American Express Co. (AXP ) has a lot going for it at the moment. This includes revenue, earnings-per-share, and dividend growth. Add generous stock buybacks and it’s definitely a company worth looking at from an investing perspective. That said, there are also two big headwinds.

First, a Little History

American Express primarily generates revenue by charging fees to merchants (discount revenue) and by charging annual card membership fees (net card fees). In the third quarter, discount revenue jumped 9% year over year, and discount revenue increased 5%. Total expenses also declined 5%, which was primarily due to business travel operations in the prior year.

Over the long haul, American Express is aiming for revenue growth net of interest expenses of at least 8%, earnings-per-share growth of 12%-15%, and return on equity of 25% or more. If American Express achieves these goals, then it will seek to return on average over time approximately 50% of the capital via dividends and stock buybacks. The former is important because it means you’re getting paid regardless of whether or not the stock goes up or down. The latter is important because it reduces the share count, which increases earnings-per-share. This, in turn, excites investors and increases demand for the equity. (For related reading, see: Comparing Credit Card Companies .)

Currently, American Express yields 1.1%. This isn’t very impressive compared to other companies a firms in the financial sector, but American Express has generated $8.93 billion in operational cash flow over the past twelve months, it has $21.84 billion in cash and short-term equivalents, and it has shown five-year dividend growth of 6.36%. Additionally, American Express did not cut its dividend during The Great Recession. All positive factors, but what about those two aforementioned headwinds?

Loading the player.

Competition and High-End Exposure

The first headwind is simple: increased competition. The payments industry is always evolving, and the barrier to entry is low. Success will depend on which companies gain and/or retain market share of the digital market. Though competition has significantly increased, American Express has two big positives here, which are its brand name and its available capital, the latter of which can be invested in innovative concepts that can be applied to the payments industry.

A bigger (yet temporary) concern is that American Express has a lot of exposure to the high-end consumer. That’s excellent news for right now, and it has been for several years, but if the stock market, bond market, and/or real estate market were to falter, then American Express would feel that pain in a big way. Many of those high-end consumers rely on investments to grow their net worth, and for increased spending dollars. In other words, if those investments went south, high-end consumers would be much less likely to use their American Express cards. However, this wouldn’t have an immediate effect on American Express thanks to the revenue structure mentioned above. Therefore, savvy investors who are paying attention might find a small time window for a safe exit. (For more, see: Millionaire Credit Cards: What’s In Their Wallets? )

American Express maintaining its dividend throughout The Great Recession is nice, but it doesn’t mean much when the stock gets hammered: AXP closed at $64.98 on March 1, 2007 and $12.06 on Dec. 1, 2008. If we were ever to find ourselves in this type of environment again — not outside the realm of possibility given highly accommodative monetary policies — then American Express wouldn’t be a good place to hide. Fortunately, it’s always possible to buy more when a good company’s stock has been hammered, and there is little doubt that American Express will be around for many years to come. (For more, see: Invest in Dividend Aristocrats with this ETF .)

The Bottom Line

If the broader market falters at some point in the near future, then American Express is not likely to weather the storm well. On the other hand, this could present an opportunity if played correctly. American Express is a long-term winner. It’s also a company that has historically been kind to its shareholders via buybacks and dividends. Please do your own research prior to making any investment decisions. (For related reading, see: The Big Credit Card Companies Have Room to Grow .)

Dan Moskowitz doesn’t own any shares of American Express.