Alternative assets near $7 trillion

Post on: 10 Апрель, 2015 No Comment

Share This Story

While more pension funds are rethinking their alternative investment allocations, higher valuations helped drive up growth in assets held by alt managers last year, according to Preqins 2015 Global Alternatives Report.

The total value of alternative assets in 2014 hit $6.91 trillion, up from $6.22 trillion the previous year, Preqin said.

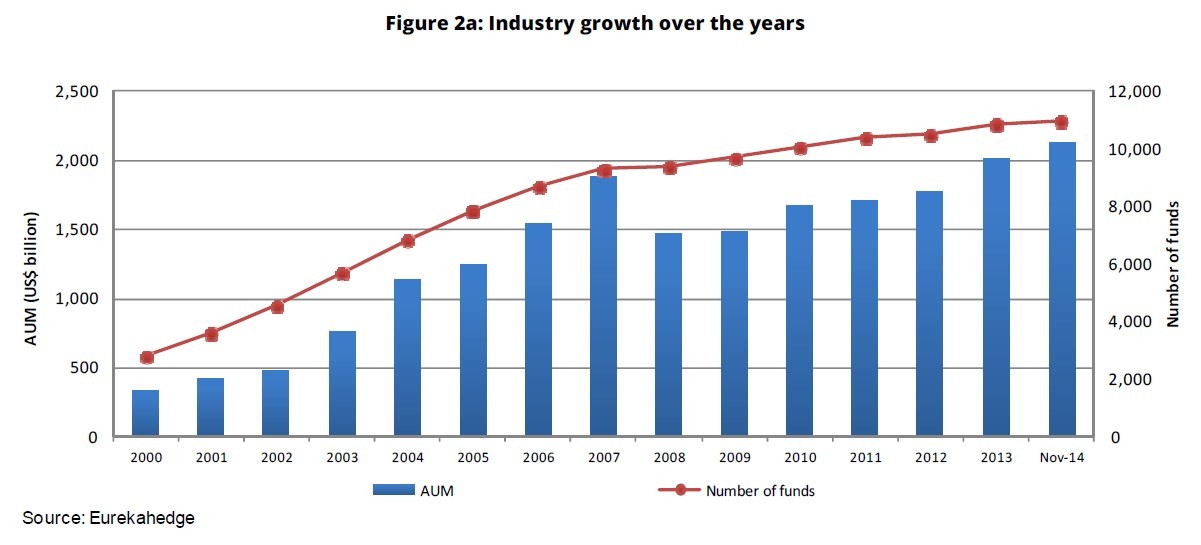

Hedge funds posted underwhelming returns, yet swelled to $3.02 trillion vs. $2.66 trillion at the end of 2013, thanks to investors willing to take on the risk in hopes of making a killing. Hedge funds saw the most growth compared to other alt assets last year, Preqin said.

All that despite the 3.78 percent return seen by hedge funds in 2014, the lowest in that asset class since 2011. By comparison, the Dow Jones Industrial Average returned 7.5 percent in 2014.

CalPERS, the countrys largest pension fund, valued at over $295 billion at the end of 2014, notably pulled all hedge fund assets from its portfolio, about $4 billion worth of investments.

A statement from CalPERS at the time said the decision was made as part of an ongoing effort to reduce complexity and costs in its investment program.

The recent news of CalPERS cutting hedge funds and reducing the number of private equity partnerships does not reflect wider sentiment in the industry, said Mark OHare, CEO of Preqin. From our conversations with investors, the majority of investors remain confident in the ability of alternative assets to help achieve portfolio objectives.

In a statement, OHare said a much larger portion of investors plan to increase their alternative exposure.

A controversial idea to allocate 15 percent of San Francisco Employees Retirement Systems funds to hedge funds was ultimately dismissed. Its investment board is expected to vote on a 5 percent allocation in the coming weeks.

The Orange County Employees Retirement System has $1 billion of its $7 billion fund invested in hedge funds, according to Bloomberg News.

In other finding from Preqins report:

- Total private equity assets jumped to $3.8 trillion as of June 2014, up from $3.5 trillion the previous June. More than half to the fund managers surveyed by Preqin reported increased competition for deals in this area compared to the previous year.