Actively v Managed Funds

Post on: 24 Июль, 2015 No Comment

Definition:

An actively-managed investment fund is a fund in which a manager or a management team makes decisions about how to invest the fund’s money.

A passively-managed fund, by contrast, simply follows a market index. It does not have a management team making investment decisions.

You’ll often hear the term actively-managed fund in relation to a mutual fund, although there are also actively-managed ETFs (exchange-traded funds).

The personal finance community likes to debate about whether actively-managed or passively-managed funds are superior. Supporters of actively-managed funds point to the following positive attributes:

- Active funds make it possible to beat the market index.

- Several funds, like Fidelity’s Magellan Fund under the guidance of Peter Lynch, posted huge returns. The Magellan Fund averaged a 29 percent return from 1977 to 1990.

On the other hand, actively-managed funds have several downsides:

- Statically speaking, most actively-managed funds tend to underperform, or do worse than, the market index.

- The Magellan Fund (the example cited above) is notable because it’s the exception, not the norm, and few people could have guessed that it would do so well when it began. We only know how well it did with the benefit of hindsight.

- Every time an active fund sells a holding, the fund incurs taxes and fees. which diminish the fund’s performance

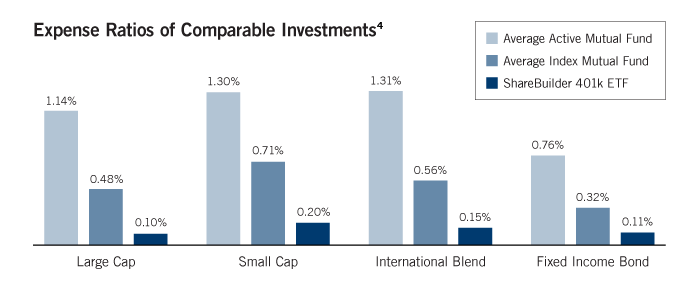

- You’ll pay a flat fee regardless of whether your fund does well or does poorly. If the index offers a 7 percent return, and your active fund gives you an 8 percent return, but charges a 1.5 percent fee, then you’ve lost half a percent.

Can You Give Me An Example?

Bob puts his money in a fund that tracks the 5&P 500 Index. Bob’s fund is a passively-managed index fund. He pays a 0.06 percent management fee.

Sheila puts her money in an actively-managed mutual fund. She pays a 0.95 percent management fee.

Bob’s fund is guaranteed to mimic the performance of the S&P 500. When Bob turns on the news, and the anchor announces that the S&P rose 4 percent today, Bob knows that his money did the same thing. When Bob turns on the news and the anchor says that the S&P fell 5 percent today, Bob knows his money did the same thing.

Bob also knows that his management fee is small, and won’t make a big dent in his returns.

(Bob knows there will be some very slight variations between his fund and the S&P 500, because it’s next-to-impossible to track something perfectly. But Bob can rest assured that those tiny variations shouldn’t be significant. As far as Bob is concerned, his portfolio is imitating the S&P.)

Sheila’s actively-managed fund buys and sells all kinds of stocks — banking stocks, real estate stocks, energy stocks, auto manufacturing stocks. Her fund managers study industries and companies, and buy-and-sell based on their predictions of those companies’ performance.

Sheila knows that she’s paying almost 1 percent to those fund managers, which is significantly more than Bob is paying.

She also knows that her fund won’t track the S&P 500. When a news anchor announces that the S&P 500 rose 2 percent today, Sheila can’t draw any conclusions about what her money did. Her fund might have risen or fallen.

Sheila likes this fund because she holds onto the dream of beating the index. Bob is stuck to the index; his fund’s performance is tied. Sheila, however, has a chance of outperforming, or doing better than, the index.

Disclaimer: The information on this site is provided for discussion purposes only, and should not be misconstrued as tax advice, investment advice and/or legal advice. While I have made every effort to include accurate and complete information, I cannot make any guarentees, and laws and codes change frequently. Always consult with a tax professional and legal professional before making any financial decision.

Also Known As: Some people just refer to mutual funds, defaulting to the assumption that it’s actively-managed.