Active Passive Portfolio Management Techniques

Post on: 29 Апрель, 2015 No Comment

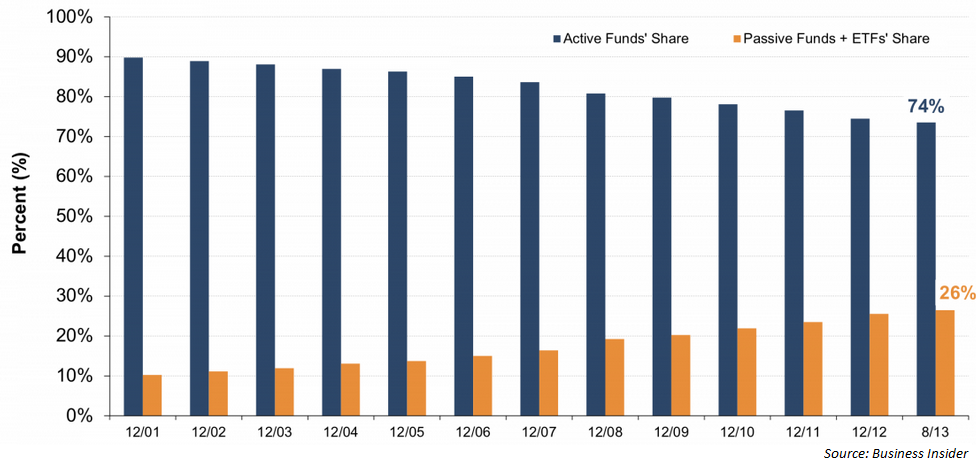

Combining active and passive investments is one of the best ways to build a winning portfolio. Building an active/passive portfolio allows you to combine the low cost of index funds and ETFs with the diversification and performance of active investments like international funds.

Other People Are Reading

International Mutual Funds

International investing is one of the best ways to diversify your portfolio and enhance your overall performance. Markets rarely move in lockstep, and often one country’s market is soaring while the stocks in another country are suffering through a bear market. By including actively managed international mutual funds in your portfolio, you can diversify your holdings while lowering your overall risk. Look for an international mutual fund with a solid track record of performance through good markets and bad, and one with a reasonable expense ratio of under 1 percent per year.

Exchange-traded Funds

References

More Like This

Active vs. Passive Investment Strategy

How to Passive or Active Management

You May Also Like

Stock mutual fund investors have the choice of investing in either passive or active funds. What is the difference and why does.

Active management of a mutual fund means that fund managers buy and sell securities attempting to outperform the overall market return. In.

Portfolio theory is an approach to investments developed by Harry Markowitz, a noted Nobel Prize winner in the field of economics. Portfolio.

When it comes to investing in the stock market funds, you have two distinct choices. You can use actively managed mutual funds.

Income gained from your portfolio of investments is typically classified as portfolio income. It can be a major source of income for.

Passive and active prevention strategies are types of injury prevention techniques. They differ in the amount of human action required to make.

Although psychiatrists no longer define passive-aggressive behavior as a mental illness, the symptoms of the behavior can present obstacles to personal and.

Real estate investment losses are categorized by the IRS as active or passive losses for filing purposes. Losses are deductible and offset.

Portfolio management is the act of managing and monitoring assets and investments. The goal of these investment decisions is to make the.

According to the book Human Resources Selection by Robert D. Gatewood, recruitment provides a desirable number of candidates for an organization's open.