Accounting for Special Purpose Entities Revised FASB Interpretation 46(R)

Post on: 23 Июнь, 2015 No Comment

Special purpose entities (SPE), also referred to as offbalance-sheet arrangements, were used as far back as the 1970s, when many companies engaged in securitization. Originally, these transactions served a legitimate business purpose: to isolate financial risk and provide less-expensive financing. In theory, because SPEs do not engage in business transactions other than the ones for which they are created, and their activities are backed by their sponsors, they are able to raise funds at lower interest rates than those available to their sponsors.

These offbalance-sheet arrangements may be called qualifying special purpose entities (QSPE) if they meet the requirements set forth in SFAS 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishment of Liabilities. Or they may be referred to as variable interest entities (VIE), in accordance with the definition and requirements established in FASB Interpretation 46 (revised December 2003), Consolidation of Variable Interest EntitiesAn Interpretation of Accounting Research Bulletin (ARB) No. 51,

Basically, an offbalance-sheet entity is created by a party (the transferor or the sponsor) by transferring assets to another party (the SPE) to carry out a specific purpose, activity, or series of transactions. Such entities have no purpose other than the transactions for which they are created. The legal form for these entities may be a limited partnership, a limited liability company, a trust, or a corporation. Regardless of their legal form, offbalance-sheet entities share the following characteristics:

- They are often thinly capitalized.

- They typically have no independent management or employees.

- Their administrative functions are often performed by a trustee who receives and distributes cash in accordance with the terms of contracts and who serves as an intermediary between the SPE and the parties that created it.

- If the SPE holds assets, one of these parties usually services them under a servicing agreement.

Generally, SPEs are formed to accomplish the following objectives:

- Financing certain assets or services and keeping the associated debt off the balance sheet of the sponsors.

- Transforming certain financial assets, such as trade receivables, loans, or mortgages, into liquid securities.

- Engaging in tax-free exchanges.

Sponsors may benefit from these offbalance-sheet entities in two ways. First, these entities enable the sponsor to remove debt from its balance sheet so it meets certain ratios or loan covenants. Second, such arrangements protect the sponsor from possible financial failure by its SPEs. That is, if the project for which an SPE was created fails and the SPE cannot service its debt, the sponsor is at risk only for what it has put into the SPE. The sponsor pays a price for these offbalance-sheet arrangements, however: The sponsor will also have to remove from its balance sheet the assets related to the debt that has been moved to the SPE. For example, if a sponsor uses an SPE to finance a capital project, neither the liability nor the assets of that project will be included in the sponsors balance sheet.

Types of SPEs

To accomplish their objectives, SPEs may take different forms. For example, an airline that needs a fleet of airplanes or a gas company that needs a pipeline can employ SPEs to finance such projects. The offbalance-sheet entity will own these assets for the specific use of the sponsors, and use them as collateral to raise cash to finance them. As long as these arrangements meet existing accounting guidelines, the sponsoring companies need not consolidate these assets and the associated debt. These offbalance-sheet arrangements can take the form of synthetic leases, take-or-pay or throughput contracts, or securitizations. Other forms of business transactions that have been accomplished via offbalance-sheet entities include investments accounted for under the equity method, joint venture research and development arrangements, and investments in low-income-housing projects. This article, however, focuses on only a few of these arrangements.

Synthetic leases. In a popular SPE known as a synthetic lease, the sponsor establishes an SPEa shell companyfor the purpose of buying and financing an asset for a specific use by the sponsor. SPEs can be set up for sale-leasebacks or build-to-order or buy-lease transactions. The SPE takes the title to the property, collects the rent from the lessee/sponsor, and pays off the loan. These arrangements became popular after the 1980s real estate crunch, when it became less attractive for companies to directly buy and finance the assets they needed.

Synthetic leases can serve two important purposes: First, for financial accounting purposes, they enable lessees/sponsors to treat leases as operating leases, whereby payments are recorded as rent expense and the underlying assets and the associated liabilities are kept off the lessees balance sheet. This treatment of the lease enables the company to show a stronger balance sheet than if the lease was treated as a capital lease.

Second, for federal income tax purposes, these contracts are structured so that the lessee/sponsor may treat the transaction as if it is, in substance, the owner of the leased property. As such, the lessee/sponsor then treats the payments as debt service, enabling it to deduct interest expense and depreciate the asset. A company can be a tenant for financial accounting purposes and an owner for tax purposes.

Take-or-pay contract. A buyer agrees to pay certain periodic amounts for certain products or services. The buyer must make the specified periodic payments, even though it does not take delivery of the products or services. For example, two gas companies might form an SPE to build a refinery and agree to pay specific annual amounts for refined oil. These payments are made regardless of the actual delivery of the product.

Throughput contracts. One party agrees to pay certain periodic amounts to another party for the transportation or processing of a product. For example, two gas companies might form an SPE to build a network of pipelines and agree to pay specific annual amounts for transporting oil through these pipelines. These payments are made regardless of the actual use of these pipelines.

Securitization. Another widespread use of SPEs is in securitization transactions, where a pool of financial assets, such as mortgage loans, automobile loans, trade receivables, credit card receivables, and other revolving charge accounts, is transformed into securities. (Nonfinancial assets, such as patents, copyrights, royalties, and even taxi medallions, can be securitized as well.) In a typical securitization, an originator (the transferor) establishes an SPE, or, as it is also called, a special purpose vehicle (SPV). The SPV usually exists in the form of a trust for the purpose of converting a bundle of financial assets into cash on behalf of the sponsor. The sponsor sells the pool of assets to the SPV, which will hold them and issue debt securities for cash, which the SPV uses to pay the sponsor for the transfer of the financial assets. The sponsor then services the debt from the cash flows generated from the securitized assets. Thus, the originator of the SPV securitizes the assetsturns them from loans into debt instruments.

For securitization to work, the company disposing of financial assets must structure the transaction so that it retains no effective control over the assets removed from its balance sheet. If it does not release effective control over the transferred assets, then the transaction is treated as a secured borrowing.

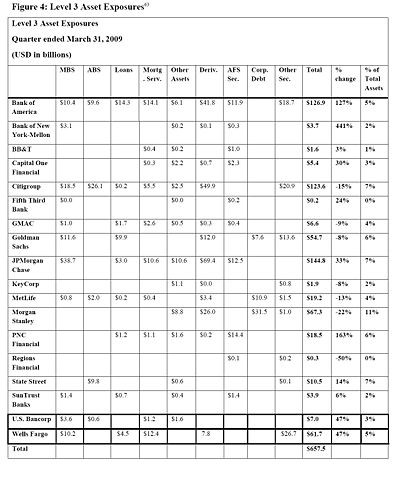

The challenge for investors is the difficulty in spotting these transactions. Unfortunately, the magnitude of the dollar amounts involved in these transactions notwithstanding, any available disclosures about them are buried in footnotes. There is no easy way of estimating the amount of assets or liabilities that are subject to these arrangements. Exhibit 1 demonstrates the results of a random review of 66 public companies, primarily in the energy, financial, and industrial sectors. SPE transactions for this sample accounted for close to $230 billion as of 2001. Of these transactions, 92% were securitizations of receivables, with leases accounting for the remaining 8%. It should be noted that these offbalance-sheet arrangements were disclosed in the footnotes; the real problem is with SPEs hidden from financial statement users. The amount of money involved in these transactions can only be guessed, and one can only expect that the amount involved is significant.

Accounting for SPEs

Until recently, accounting standards have not responded to the development of such sophisticated transactions and arrangements. The accounting standards dealing with offbalance-sheet entities have produced inconsistent results, because the standards are incomplete and fragmented. An original pronouncement that indirectly established the foundation for SPE accounting is Accounting Research Bulletin (ARB) 51, Consolidated Financial Statements. issued in 1959. The principles built into ARB 51 were that the usual condition for a controlling financial interest is ownership of a majority voting interest.

The creators of these sophisticated SPEs, however, have been able to design entities where sponsors maintain control without owning majority voting power. The intended transactions for these entities were packaged into legal forms that have no voting interest. The interest of the sponsor, or the sponsors control, is secured through legal restrictions on the ways the SPE uses its assets, particularly in regard to what parties the entity may permit access. Consequently, companies have been able to avoid consolidating these entities where in substance they had control, but such control did not meet the definition of ARB No. 51.

The 3% rule. The nonconsolidation feature of SPEs became possible due to an accounting rule established by the now-defunct EITF Issue 90-15, according to which the sponsor of a SPE did not have to consolidate the assets and liabilities of the SPE as long as the equity interest of a third-party owner was at least 3% of the SPEs total capitalization; at the same time, the majority of equity voting rights cannot reside with the beneficiary.

Exhibit 2 lists accounting standards that directly or indirectly deal with offbalance-sheet entities. These standards may be referred to as pre-Enron standards that did not go far enough to provide an accurate picture of the relationships between the sponsoring companies and their SPEs. FASB was not totally inactive in this area: Recognizing the loopholes in the accounting for securitizations, FASB attempted to reform the existing GAAP for those transactions through SFAS 125, Accounting for Transfer and Servicing of Financial Assets and Extinguishment of Liabilities. in 1996.

Soon after issuing SFAS 125, FASB became aware of flaws that necessitated its revision. SFAS 140, Accounting for Transfer and Servicing of Financial Assets and Extinguishments of Liabilities. is the end result. This statement establishes the conditions where the transfer of financial assets should be accounted for as a sale by the transferor, and the conditions under which a liability should be deemed to have been extinguished. It further defines qualifying SPEs, which should not be consolidated in the financial statements of the transferor or its affiliates.

SFAS 140 significantly improved disclosure. With the concern about the quality of assets on the balance sheet, the disclosure requirements of SFAS 140 are more useful for investors and analysts trying to decipher the riskiness of the assets retained in securitizations. Securitizations can significantly affect a companys bottom line and be quite subjective in their calculation. The disclosures are useful to investors assessing earnings quality.

Post-Enron GAAP

As the Enron crisis brought attention to the use of SPEs, FASB responded by issuing a proposed interpretation of existing accounting principles aimed at putting many offbalance-sheet entities back onto the balance sheet of the companies that created them. In June 2002, FASB issued an exposure draft to revise the accounting for SPEs. This exposure draft was an Interpretation of ARB 51. The final Interpretation 46, Consolidation of Variable Interest Entities, an Interpretation of ARB 51. was issued in January 2003. Upon learning that certain provisions were not being interpreted as the board intended, FASB issued Interpretation 46(R), which also incorporates guidance from FSP FIN 46-3, FSP FIN 46-4, FSP FIN 46-6, and FSP FIN 46-7.

The current accounting standards require an enterprise to include in its consolidated financial statements subsidiaries in which it has a controlling financial interest. The existing common definition of control is met when a parent company has more than 50% of the voting stock in a subsidiary. Over the years, however, companies have found ways to obtain economic control of other entities without owning 50% of the voting stock, thereby avoiding consolidation of these entities.

Unfortunately, until recently, the accounting-for-consolidations policy did little to answer the question many have been asking: Who else has engaged in Enron-style SPE transactions? New developments are expected to capture egregious SPEs, and provide users of financial statement with clearer information.

FASB Interpretation 46(R)

The objectives of Interpretation 46(R) are to explain how to identify variable interest entities (VIE) and how to determine when a business enterprise should include the assets, liabilities, noncontrolling interests, and results of activities of a VIE in its consolidated financial statements. Some entities commonly referred to as SPEs are not subject to this interpretation, and other entities that are not SPEs are subject to this interpretation; thus the need for the designation VIE. Interpretation 46(R) defines a VIE as an entity that meets one of the following criteria:

- The total equity investment at risk is not sufficient to permit the entity to finance its activities without additional subordinated financial support provided by any parties, including equity holders.

- The equity investors lack one or more of the following essential characteristics of a controlling financial interest:

- The direct or indirect ability through voting rights or similar rights to make decisions about the entitys activities that have a significant effect on the success of the entity.

- The obligation to absorb the expected losses of the entity.

- The right to receive the expected residual returns of the entity.

According to this interpretation, such VIEs should be consolidated in the financial statements of their primary beneficiaries. Basically, this interpretation is designed to expand the definition of control for consolidation of financial statements to include consolidation based on variable interest, as well as consolidation based on voting power.

The first condition noted above requires good judgment on the part of companies and their auditors. The sufficiency of the equity investment must be evaluated at each reporting period. To help determine sufficiency, the interpretation increases the 3% threshold to 10%: an equity investment shall be presumed insufficient to allow the entity to finance its activities without relying on financial support from variable interest holders unless the investment is equal to at least 10 percent of the entitys total assets (emphasis added).

While this may seem like a simple bright-line criterion, determining the sufficiency of equity investment in a VIE is subject to considerable judgment. Specifically, the interpretation also allows an equity investment of less than 10% to be considered sufficient to permit the VIE to finance its activities if at least one of the following three conditions is met:

- The entity has demonstrated that it can finance its activities without additional subordinated financial support.

- The entity has at least as much equity invested as other entities that hold only similar assets of similar quality in similar amounts and operate with no additional subordinated financial support.

- The amount of equity invested in the entity exceeds the estimate of the entitys expected losses, based on reasonable quantitative evidence.

Conversely, the 10% threshold does not automatically mean that the equity level is sufficient to permit the entity to finance its activities without additional subordinated financial support. In other words, the interpretation leaves room for flexibility in determining what the equity investment in an entity should be in order to avoid consolidation of such an entity by its variable interest holder.

Consolidation Based on Variable Interests

An entity must first be evaluated for consolidation based on straightforward voting-interests criteria. If such criteria are not met, a VIE may still be subject to consolidation by its primary beneficiary based on variable interests. The interpretation defines variable interests in a VIE as contractual, ownership, or other pecuniary interests in an entity that change with changes in the entitys net asset value. Basically, variable interests are the means through which financial support is provided to a VIE and through which the providers gain or lose from the activities and events that change the values of the VIEs assets and liabilities. Exhibit 3 lists various transactions that may results in variable interests.

This interpretation considers a primary beneficiary to be an enterprise that meets at least one of the following conditions:

- Its variable interest in the VIE absorbs a majority of the entitys expected losses.

- Its variable interest in the VIE absorbs a majority of the entitys expected returns.

- It has the ability to make economic decisions about the VIEs activities.

An enterprises ability to make economic decisions that significantly affect the results of the activities of a VIE is not, however, by itself a variable interest. It is, however, a strong indication that the decision maker should carefully consider whether it holds sufficient variable interests to be the primary beneficiary.

Determining whether an enterprise is the primary beneficiary of an entity should take place at the time the enterprise becomes involved with the offbalance-sheet entity. At each reporting date, however, an enterprise with an interest in a VIE should reconsider whether it is the primary beneficiary, if the entitys governing documents or the contractual arrangements among the parties change. Subsequent to the initial involvement in a VIE, a primary beneficiary should also reconsider its initial decision to consolidate the entity if it sells or otherwise disposes of any of its variable interests. Similarly, an enterprise that was not originally a primary beneficiary in a VIE should reconsider if it acquires an additional interest in the entity.

Expected Losses and Expected Residual Returns

Determining whether an interest holder in a VIE is a primary beneficiary depends on the entitys expected losses and expected residual returns. These calculations are forward-looking and subject to estimation. In addition, an entitys expected losses are key factors in determining whether such an entity is a VIE. A VIEs expected losses and expected residual returns include the following items:

- The expected negative variability in the fair value of the entitys net assets, exclusive of variable interests.

- The expected positive variability in the fair value of the entitys net assets, exclusive of variable interests.

Furthermore, FASB Staff Position 46(R)-2 makes clear that even an entity that has no history of net losses and expects to continue to be profitable in the foreseeable future can be a VIE that should be consolidated in its primary beneficiarys financial statements. This position clarifies the definition of expected losses as based on the variability in the fair value of the entitys net assets exclusive of variable interests, not on the anticipated amount or variability of the net income or loss.

According to Interpretation 46(R), expected losses and expected residual returns refer to amounts derived from expected cash flows as described in FASB Concept Statement 7, Using Cash Flow Information and Present Value in Accounting Measurements. The following example illustrates how to compute expected losses and expected residual returns. This illustration assumes that an offbalance-sheet entitys estimated annual cash flows and changes in the entitys assets continue for two years; also that the present value of the probability-weighted expected outcomes for each of the next two years is the same as their fair value. In most cases, however, this assumption may not hold, and thus the present values should be adjusted for appropriate market factors. The fair value amount of the estimated outcomes becomes the benchmark for determining the entitys expected losses and expected residual returns. Exhibit 4 shows the range and probability of estimated annual outcomes expected to occur and their present values (based on a 5% discount rate).

Exhibit 5 shows how expected losses are computed once the fair value of the expected outcomes is determined. In this illustration, because the estimated outcomes are different from Year 1 to Year 2, the expected losses for each year should be calculated separately. For each year, estimated outcomes that are less than the total expected outcome for that year contribute to expected losses, which in this illustration is $989,000 in Year 1 and $987,000 in Year 2, for a total expected loss of $1,976,000. The total expected losses are used as a base for determining whether an entity is a VIE, and the primary beneficiary of such an entity. Exhibit 6 shows how to compute expected residual returns for the same pool of assets. Similarly, for each year, estimated outcomes that are more than the total expected outcome for that year contribute to expected residual returns, which in this illustration is $990,000 in Year 1 and $986,000 in Year 2, for a total expected residual return of $1,976,000.

If a VIE has different parties with different rights and obligations, each party determines its own expected losses and expected residual returns and compares that amount with the total to determine whether it is the primary beneficiary. As shown above, the party whose variable interests in a VIE absorb the majority of the expected losses or expected residual returns is considered the primary beneficiary and must consolidate the entity. If one party receives a majority of the entitys expected losses and another party receives a majority of the entitys expected residual return, however, the party absorbing a majority of the expected losses is required to consolidate the VIE. FASB considered exposure to losses to be the more important of the two conditions in determining the primary beneficiary.

Scope of Interpretation 46(R)

This interpretation applies to transactions that are currently invisible due to ambiguous ownership, where the voting equity ownership does not give the owners a controlling financial interest. The following entities, however, are specifically excluded from the scope of this interpretation:

- A qualifying SPE (QSPE) used in a transfer of financial assets, as dictated in SFAS 140.

- An employee benefit plan subject to the provisions of SFAS 87, Employers Accounting for Pensions ; SFAS 106, Employers Accounting for Postretirement Benefits Other Than Pensions ; or SFAS 112, Employers Accounting for Postemployment Benefits, by the Employer .

- An enterprise subject to SEC Regulation S-X Rule 6-03(c)(1) is not required to consolidate any entity that is not also subject to that same rule.

- According to FASB Staff Position FIN 46-1, all not-for-profit organizations as defined in SFAS 117, Financial Statements of Not-for Profit Organizations. are exempt from the provisions of this interpretation. A not-for-profit organization, however, may be a related party for the purpose of determining the primary beneficiary of a VIE. In addition, a not-for-profit entity used by a business enterprise in a manner similar to a VIE in an effort to circumvent the provisions of Interpretation 46 is subject to the interpretation.

- Separate accounts of life insurance entities as described in the AICPA Audit and Accounting Guide, Life and Health Insurance Entities.

- An enterprise with an interest in a VIE or potential VIE created before December 31, 2003, is not required to apply this interpretation to that entity if the enterprise cannot obtain the necessary information to consolidate the VIE.

- An entity that is deemed to be a business as described in this interpretation does not have to be evaluated by a reporting enterprise to determine if such an entity is a VIE.

- Governmental organizations and financing entities established by governmental organizations are not required to apply this interpretation, unless they are used by a reporting enterprise to circumvent the provisions of this interpretation.

Exhibit 7 provides an overview of the scope of this proposed interpretation, the requirements of which will nullify the provisions of EITF Issues 84-40 and 90-15 and Topic D-14. Furthermore, it will modify or partially nullify EITF Issues No. 95-6, No. 96-21, No. 97-1, and No. 97-2, as well as finalize the requirements of EITF Issue No. 84-30.

Implementation

The original Interpretation 46 arrived with a very short implementation grace period. The requirements applied immediately to VIEs created after January 31, 2003, and to VIEs in which an enterprise obtains an interest after that date. The revised Interpretation 46(R) is required in financial statements of public entities for periods ending after December 15, 2003. Special provisions apply to enterprises that fully or partially applied Interpretation 46 prior to issuance of the revised Interpretation.

The SPEs that this interpretation covers are currently invisible, by design. There is no simple or reliable way for analysts or investors to judge which companies are most likely to be affected. Clues might be found in the managements discussion and analysis, but not enough to enable financial statement users to reliably estimate how the interpretation will affect companies financial statements. This new interpretation might cause very few changes in corporate balance sheets, because companies that would have to consolidate their SPEs under the requirements of this interpretation might already be taking steps to shut down or sell their interests prior to the effective date. This scenario would avoid the embarrassment for the sponsors of presenting what they never professed to own. The other alternative is that Interpretation 46(R) might cause significant adverse adjustments to companies balance sheets and create technical defaults in loan covenants.

Jalal Soroosh, PhD, CMA, KPMG Faculty Fellow, is a professor of accounting at Loyola College, Baltimore, Md.

Jack T. Ciesielski, CPA, CFA, CMA. is president of R.G. Associates, Inc. Baltimore, Md.