A SelfDirected IRA for Real Estate Investing

Post on: 16 Май, 2015 No Comment

My office gets several inquiries each day about setting up a self-directed IRA for real estate investing. This article discusses what a self-directed IRA is and how its different from a regular IRA.

An IRA Is an Individual Retirement Account

Each individual can set up his or her own account and can have more than one IRA account.

Use a self-directed IRA to grow your nest egg!

IRA accounts fall into several categories, including:

1. Traditional – The most common type of IRA account. The individual can contribute money each year and receive a tax deduction for the money contributed. The income earned in the account is tax-deferred and subject to income tax when withdrawals are made after age 59.5.

2. ROTH The individual can contribute money each year and does NOT receive a tax deduction for the money contributed. All income earned is tax free, and withdrawals at retirement are tax-free.

3. SEP – A Simplified Employee Pension is tied to a company and adopted by business owners for their employees. Contribution limits are MUCH larger than Traditional or ROTH IRAs. but since SEP accounts are treated as IRAs, funds can be invested the same way as any other IRA.

4. SIMPLE – Similar to a 401k, its an employer-sponsored plan in which the company can match employee contributions.

5. Education IRA – Also known as a COVERDELL ESA. it allows contributions to a plan that is eventually used for education.

ALL of these can be a self-directed IRA for real estate investing.

So, What Is a Self-Directed IRA?

Technically, all IRAs are self directed, in that you can direct which investments your IRA account is placed into. Traditionally, IRAs are invested in securities, CDs, money market, etc. A self-directed IRA is one in which you can direct your IRA funds into all assets permitted by law.

Is It Legal to Invest My IRA in Real Estate?

The IRS only excludes IRA investments in two assetscollectibles and insurance. That leaves pretty much everything else, including real estate. in play.

So, Can I Invest in Real Estate Using My Fidelity IRA?

In a word, no. Most of the larger financial institutions limit what you can direct your IRA investments into, namely securities, CDs, money market, etc. If you want to have a truly self-directed IRA, youll need to roll your funds into a different IRA custodian who will allow non-traditional assets as a permitted investment. Such custodians are more “boutique” operations that are set up to handle real estate, precious metals, private placements, etc. within an IRA.

What Is the Cost of Using a Self-Directed IRA Custodian?

Self-directed IRA custodians charge more than the large financial institutions. In fact, a LOT more. Depending on what and how many assets you move to a self-directed custodian, the cost can be as much as $300-$600 per year! But, if youre earning double-digit returns in real estate with your IRA, youll quickly forget about the hefty fees and be grateful for the self-directed custodian.

Can I Manage the Real Estate IRA Assets?

Managing rental property or real estate construction projects for your IRA account is definitely in the grey area of the law. You may get away with ministerial tasks, but you cannot take a management or construction fee on behalf of the assets, and you certainly cannot perform services or work on the assets personally.

Can I Borrow Money from My IRA to Buy Real Estate?

No, you cannot borrow from the IRA. The IRA account itself purchases the real estate in its own name. for example, XYZ IRA CUSTODIAN, INC. FOR BENEFIT OF ACCOUNT #12534.

Can I Spend the Income Earned from the Real Estate?

Not before the age of your legal retirement age, and at that point the income taken out would be considered a “distribution,” which could be taxable.

How Difficult Is It to Run a Self-Directed IRA?

Well, put it this way There’s no instant, click-trading anymore. You have to fill out and fax a form to your custodian for each transaction, and it may takes days for them to execute the transaction. And a real estate rental can have several “transactions” a month (receive rent, pay mortgage, pay repairs), and each transaction has a fee associated with it. This can get expensive, not to mention cumbersome and time-consuming.

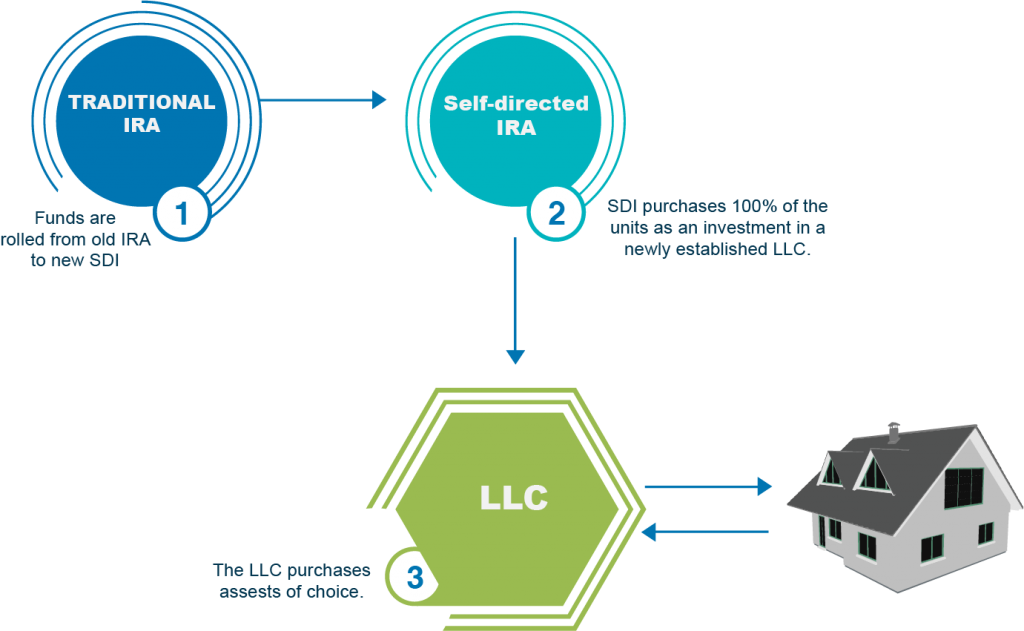

What is a “Checkbook” IRA?

A checkbook IRA is a self-directed IRA set up so you have checkbook control of your IRA funds rather than directing the custodian what to do with the funds in and out of the IRA account. You can learn more about it by watching this video .

To set up a self-directed IRA for your retirement funds, call us at 303-398-7032 .

About the Author.

William Bronchick, J.D. is a nationally-known attorney, author, and speaker. He has been practicing law and investing in real estate since 1990 and has been involved in over 2,000 real estate transactions.