A Moderating View on REIT ETFs

Post on: 25 Июль, 2015 No Comment

Sector ETFs News:

Real estate investment trusts and related exchange traded funds are starting the new year on a strong footing, but some remain skeptical about the spaces continued momentum.

The Vanguard REIT ETF (NYSEArca: VNQ ) has increased 5.9% year-to-date and rose 34.8% over the past year. VNQ shows a 12-monthy yield of 3.6%.

REITs have a long track record of providing investors with competitive performance, strong dividend income and portfolio diversification, National Associaton of Real Estate Investment Trusts CEO Steven Wechsler said in a CNBC article.

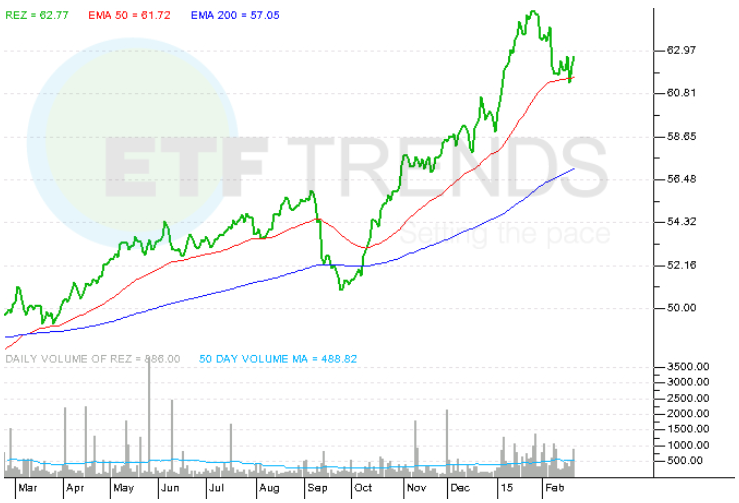

Residential REITs were the best performers in the financials space, with the iShares Residential Real Estate Capped ETF (NYSEArca: REZ ) up 39.8% over the past year. REZ is 7.1 higher year-to-date. [Meet This Year’s Best Financial Services ETF ]

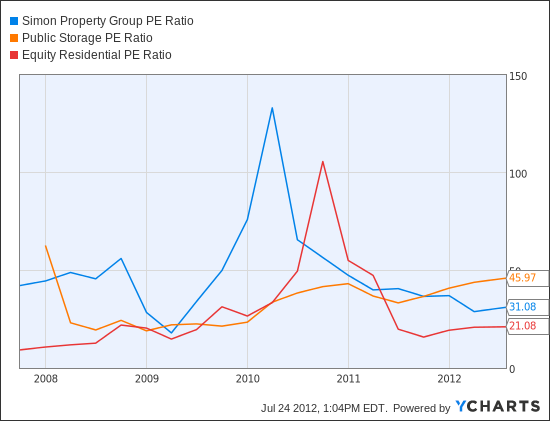

However, after the impressive year, valuations are now a potential drawback, especially if interest rates rise, which would make REITs less attractive as a yield-generating alternative. For instance, VNQ shows a price-to-earnings ratio of 40 and a price-to-book of 2.4, whereas the SPDR S&P 500 ETF (NYSEArca: SPY ) has a 17.3 P/E and a 2.5 P/B.

We could see a repeat in May of 2013 when bond market fell apart, said David Toti, a REIT analyst with Cantor Fitzgerald, said in the article, noting that REITs are now hitting their historical peaks from 2007. We are watching interest rates. There is more risk than there is upside.

Moreover, some argue that the residential REITs space could begin to slow as much more supply comes to major markets. However, office REITs could see further gains due to improving economic fundamentals. [Residential REITs ETF Could Slow As Renters Turn Into Buyers ]

VNQ is a diversified REITs ETF and includes a 16.3% tilt toward residential REITs and 13.3% in office REITs.

Vanguard REIT ETF

For more information on the real estate investment trusts, visit our REITs category .

Max Chen contributed to this article .

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.