A look at inverse ETFs Canadian Business

Post on: 1 Май, 2015 No Comment

How bad are inverse exchange-traded funds (ETFs) at returning the inverse movements of the indexes they track?Frank Elston and Doug Choi tell us in a paper published in the Proceedings of the Academy of Accounting and Financial Studies (Volume 14, Number 1: 2009). It turns out out they can be so bad in replicating implied returns that Elston and Choiconclude investors would be better offin many instances shorting the long or double-long ETFs instead.

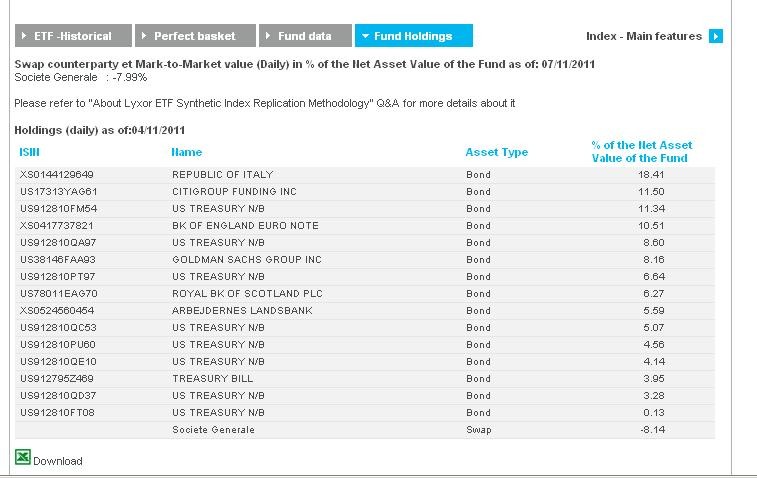

Inverse ETFs use swaps and futures; swaps predominate in inverse ETFs because of their flexibility (dont require standard deposits or times to expiration). But swaps are purchased over the counter from banks such as Goldman Sachs and Morgan Stanley and thus come with counterparty risk. Many swaps are not subject to mark-to-market accounting and margin maintenance requirements.

Probably the most serious drawback of inverse ETFs is the significant tracking error due to the constant-leverage trap (arising from the inverse ETFs objective of returning the opposite of the index on a daily basis). The table at the end of this post shows a representative cross section of tracking errors calculated by Elston and Choi for 2008.

In the table, DOG. an inverse ETF tracking the Dow Jones Industrial Average (DJIA), underperformed its implied return by over 3%. DXD. a double-inverse ETF for the DJIA, underperformed by 22%. However, the biggest misses were in the sector-based inverse ETFs as highlighted by the ETFs for real estate ( SRS ) and China ( FXP ). With their volatility, they recorded declines even though their implied return was over 85%.

Yet another disadvantage: inverse ETFs are unable to minimize the distribution of capital gains to the same extent other ETFs do, so investors with taxable accounts can experience a lower after-tax return. Inverse ETFs dont passively trackbaskets of stocks; they have to buy and sell derivatives daily. And in the U.S. the tax rate on short-term gains is higher than on long-term gains. In 2008, a group of leveraged inverse funds made capital-gain distributions ranging from 12% to 86% of their assets.

One advantage of inverse ETFs is avoidance of the practical problems associated with short selling. They are: i) the broker may not find the shares, ii) the broker has the right to terminate the short position anytime, iii) the accounting for short sales, especially for tax purposes, may become distinctly more difficult or time consuming.

Inverse ETFs enable short selling in registered retirement savings accounts. Many see this as another advantage. Others might not agree. Inverse ETFs are financial innovations that overcome regulatory prohibitions against short selling within retirement funds. Such regulations presumably exist to protect investors from taking excessive risks with savings that will be needed in old age.

In the conclusion to the paper, Elston and Choi suggest shorting the long versions of ETFs rather than going long on their inverse counterparts. This strategy could have even greater results when used in lieu of double-inverse ETFs for volatile sectors. There should be an extra boost from the tracking error. Of course, this strategy would have to be confined totaxable investment accounts (and one wonders if this would qualifythe recommendation of Elston and Choi).

Preet Banerjeehas a related post on shorting ETFs.