A HighYielding 6% Portfolio

Post on: 2 Апрель, 2015 No Comment

Summary

- A portfolio of equal parts EFA, HCP, KKR, KBWD and XMPT results in a total portfolio yield of over 6%.

- These holdings give exposure to domestic and international equities, stocks and bonds and a number of different sectors and asset types.

- In addition, reasonable long-term growth and portfolio diversification is achieved.

For income investors who need to extract regular distributions from their portfolios, it’s important that the portfolio not only provide adequate yield, but that it also maintain its overall value in both the short term and the long term. Reducing volatility thus becomes more important and aggressive growth less important. The proposed portfolio addresses both of these goals (low overall portfolio volatility and high yield) while also allowing for moderate growth.

Portfolio Breakdown

Holding a 20% allocation in each of these 5 will give a 80/20 mix of stocks and bonds as well as 20%-25% exposure to international equities. EFA, HCP, KKR and KBWD are invested in stocks, while XMPT is invested in municipal bonds. HCP, KBWD and XMPT are invested domestically while EFA tracks the MSCI EAFA index composed of large and mid-capitalization developed market equities, excluding the U.S. and Canada (i.e. international large and mid caps). US-based KKR consists of diversified holdings including international equities, accounting for the remaining 5% international portfolio allocation.

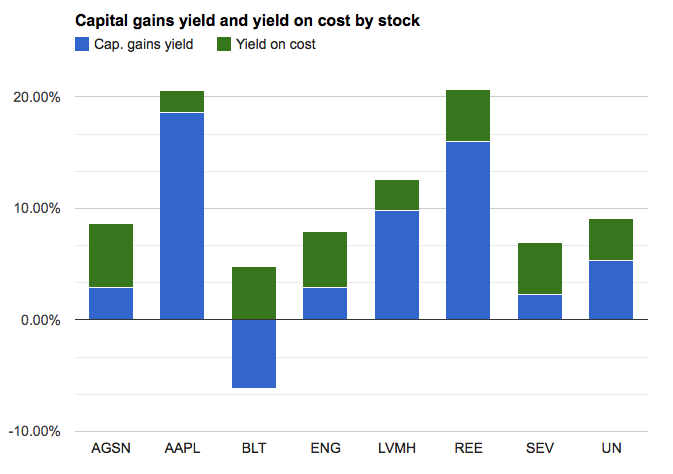

The yields of these 5 range from 3.5% to 8.2%, with an average yield of just over 6%. In addition, these 5 investments make up 5 different sectors: international stocks, health care, diversified private equity, financial & real estate equities, and municipal bonds (exempt from federal income tax). The highest expense ratio of the group is 0.4%, easily covered by the high yields.

EFA data by YCharts

Price Performance & Dividend History

Referring to the chart above showing normalized 5-year performance, it’s clear that these 5 holdings provide good diversification. They are not moving up or down all together. (When assets move up or down in price all as one, it indicates a lack of true diversification, even if multiple sectors or asset classes are present). The portfolio will thus maintain a relatively steady overall value, even as individual assets may rise and fall.

EFA has a total 3-year return of 11.3%. HCP has raised dividends every year since at least 2003 and possibly longer. Similarly, KKR has dramatically grown its dividend each year for at least the past 5 years. KBWD has a total 3-year return of 15.6% while XMPT has a total 3 year return of 5%.

Portfolio Composition

Health Care is considered to be a relatively safe play due to the expected growth in the 65-year-old plus demographic in the US. Meanwhile, sentiments are beginning to turn regarding the safety of financial stocks and real estate, not to mention private equity. Many would argue that the majority of portfolios benefit from some bond exposure and municipal bonds offer higher returns than government bonds with, in this case, federal tax exemptions.

That leaves us with international large cap stocks and the iShares MSCI EAFE ETF. The mediocre to poor recent record of international stock markets leaves people questioning whether international stock exposure is even worth the risk right now. On the one hand, there appears to be more volatility overseas and the lack of a centralized powerful player who can take swift and decisive action to give the economy and markets the medicine they need (i.e. similar to what the Fed has done in the US). On the other hand, US stocks have had quite a run the past 5+ years while the Europeans are finally considering quantitative easing and other monetary measures. So it might be about the right time to increase exposure to international stocks.

With a yield of 3.5%, EFA is certainly no dividend king. But it does provide low-cost, lower-risk exposure to international equities, which might turn out to be a good thing should international stocks outperform domestics. Another option in place of EFA is the Spider International Energy ETF (NYSEARCA:IPW ), which has a yield of 4.1% and an expense ratio of 0.5%. Like most energy equities, IPW has taken a beating ever since the start of the second half of 2014, as oil prices have fallen. However, when it bottoms out, it will a great buying opportunity. In addition, IPW gives both energy and international exposure in a single holding. Those not wanting any international exposure could turn to the Spider Utilities ETF (NYSEARCA:XLU ) yielding 4.0% or the Global X SuperDividend ETF (NYSEARCA:SDIV ) yielding 5.2%.

A mix of 5 holdings has been provided that together result in a total portfolio yield of over 6%, assuming 20% allocation to each. These holdings give exposure to domestic and international equities, stocks and bonds and a number of sectors and asset types. The proposed assets do not move up or down all together, meaning they provide a diversified overall portfolio and will give a stable overall portfolio value. With yearly rebalancing back to 20% allocations, performance can be enhanced by automatic buying low and selling high.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.