A Discounted Infrastructure Fund With A % Yield FMD Capital Management

Post on: 25 Апрель, 2015 No Comment

Written by Michael Fabian, April 09th, 2014

It’s not an area of the market that most investors toil over while rounding out a portfolio of closed-end funds (CEF’s), but infrastructure CEFs can add a unique opportunity for income and capital appreciation in the current market environment. Infrastructure is a broad complex, and undoubtedly there are many different ways to gain exposure.

Hard-assets such as airports, port facilities, toll roads, MLPs, utilities, and real estate can provide a low-risk income stream for savvy investors that know how to access these high yield sectors. Furthermore, with the expectation the global economic engine will continue to charge forward for the remainder of 2014, exposing your portfolio to a leveraged infrastructure CEF trading at a discount could add a level of alpha over traditional dividend paying equities.

My favorite fund for this purpose is the Cohen and Steers Infrastructure Fund (UTF), a $3 billion portfolio made up of 168 global holdings. I selected UTF for clients in our Dynamic CEF Income portfolio due to its size, balance, international reach, and large discount.

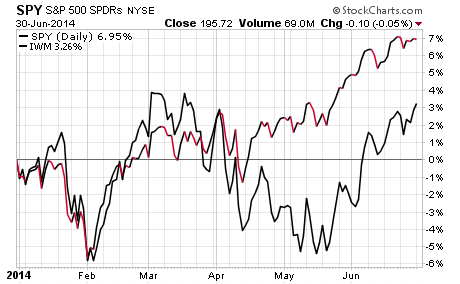

Diving deeper into the numbers, UTF is currently trading at a discount of -13.1% to its NAV, with the 52-week average discount hovering at -11.6%. Its portfolio is leveraged by roughly 30%, and is weighted 83% to equities and 17% to preferred stock and corporate fixed-income. Its current distribution rate is 6.75%, of which only a marginal amount is considered return of capital. In addition, we have been impressed with its performance and volatility vs. an indexed based ETF such as the iShares Global Infrastructure fund (IGF) even in light of the fact that UTF isn’t an all-equity strategy.

Although infrastructure stocks underperformed the broad market in 2013, economically cyclical subsectors of the UTF portfolio including airports, rail, and toll roads which make up roughly 25% of total holdings could begin to make up ground in 2014. Dissecting the country diversification, a little over half of UTF is allocated amongst assets based in the U.S. at 51%, while Europe accounts for 29%, Canada at 5%, and lastly Japan at 6%. I particularly like the large allocation to Europe, as their economic recovery is still in an adolescent stage when compared to the United States. Europe also has the opportunity to exhibit more relative strength as they will likely have more accommodative government policies in place by the end of 2014.

We originally opened our 10% position in UTF in client portfolios back in August of 2013 with the thesis that stabilizing interest rates could clear the air for many of the highly indebted utilities within the portfolio. As of today, we are still considering the fund a good investment for new clients that join the strategy due to the cyclical areas of the UTF portfolio.

Infrastructure funds have begun to outpace the broad equity markets in the first quarter 2014. and we believe that could continue if interest rates continue their descent or remain stable. In addition, we have seen a dramatic shift in risk behavior as investors have sought out defensive sectors that UTF benefits from.

The overarching investment theme of income and capital appreciation should continue unless we see drastic changes to the health of the economy or swiftly rising interest rates. Following along that same theme, we would reduce our holdings in UTF if equity volatility spilled over into a more widespread selloff that pushed the price below the $20.50 level.

When it comes to investment strategy, maintaining perspective and discipline will go a long way to ensuring positive changes are executed in a timely fashion. To detail the type of discipline in our CEF income portfolio. I recently wrote a special report expanding on our investment themes in addition to our selection process.