7 Financial Rules for the PostRecession Economy

Post on: 8 Июль, 2015 No Comment

20pixels /%

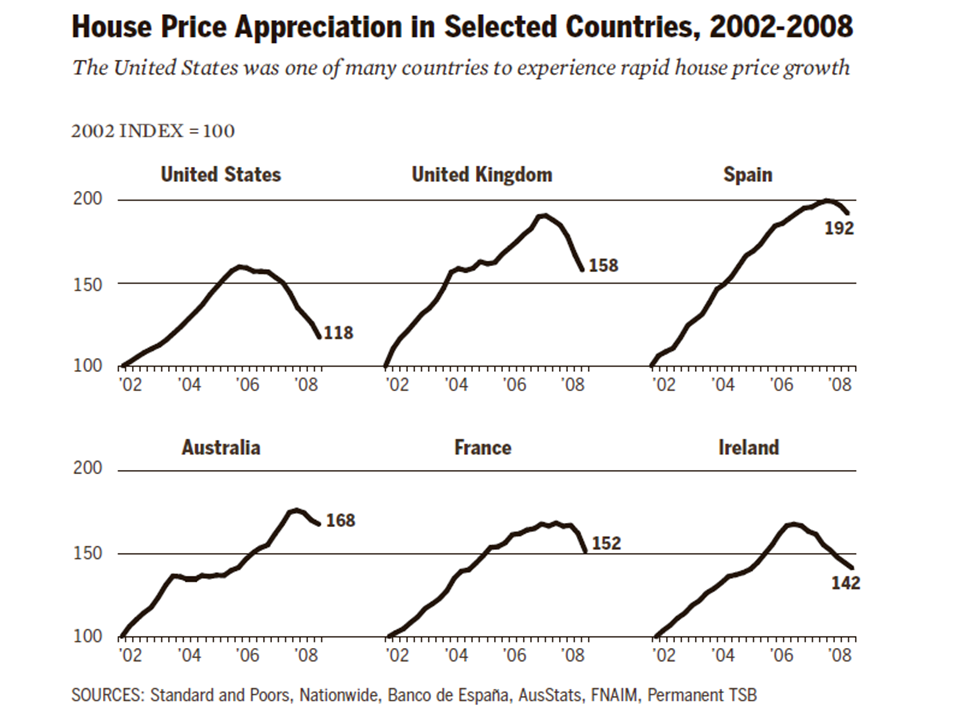

Yes, you read it right. The recession is over. Sales have been up 6 months in a row, the wheels are starting to turn again and we may have already passed the peak of home foreclosures. However, the effects of this recession are not over. The traditional advice your mom gave you might now be valid in this shaky financial environment. Here are some new rules to follow as we rebuild.

Renting Might be Right for You

Depending on your age and the cost of rents in your area, renting a home might be better than owning. If you dont expect to live another 30 years, buying doesnt make much sense. Like most financial truths, its a harsh reality to face. A real estate investment is unlikely to grow any faster than inflation, creating a loss for you or your heirs. Look at rents; compare them to the payments you would make for the remainder of your life against mortgages payments for 30 years. Dont forget to figure for taxes and insurance, plus repairs and other costs of home ownership. Renting might make more sense.

Retirement Savings

There are many flavors of retirement account and you are not limited to a single account. If your work offers a 401K, open a Roth on your own if you are unsure which will be most beneficial. It should all come out in the wash, leaving you with additional savings if you contribute the same amounts in to each account every year.

Dividends over Value

The era of value investing in the stock market is over. Some buyers still tend to look at business value to decide on a purchase, but dividend yield from stocks is a much bigger piece of the puzzle. A good dividend does not automatically make a good stock, but these payments may make you feel better about hanging onto that bucking bronco of an unstable market. Even when the stock values plummet, you still have the consolation prize.

Emergencies Come in Packs

Remember the saying that deaths and births come in threes? It seems to me that the same things happen with emergencies. One even make you dip into the emergency fund and your stress over that event leads to a costly mistake and then yet another. No one can tell you just how big your emergency fund should be, but would one-months salary be enough? Personally, I feel more comfortable with six months. The money sits in a high interest savings account, ready for me if I need it.

Dont Retire Early

Once a sign of prosperity, early retirement is beginning to look downright foolish. Many baby boomers have started their own businesses and you might want to think about that as well. If you can keep yourself afloat until age 66, youll be entitled to full benefits.

Say Goodbye to High Returns

The days of 8, 10 or even 11% earnings on investments are over. Some will be lucky to get 2% back. The new normal sits between 6% and 8%. It still beats inflation, but not by much.

The Future is Uncertain Plan for It

Paying off debt is still an important goal, but your retirement savings need to come first. Dont get could with nothing to sustain you in your elder years. With a shaky economy and talk of overhauling Social Security, you just dont know if it will be there for you. Take care of yourself instead of counting on Uncle Sam.

How have the rules changed for you since the recession? Share your experience with us in the comments section!

Jessica Bosari is an Internet copywriter and blogger for various publications and her own blog. You can read more of Jessica’s work here. If you have any comments or questions about SavingTools or about saving money, leave your comments in the form below or email jessica@savingtools.com. Thanks!