6 Strategies for Dealing with an Underwater Mortgage US News

Post on: 21 Июнь, 2015 No Comment

Stay and pay? Refinance? The pros and cons of several options.

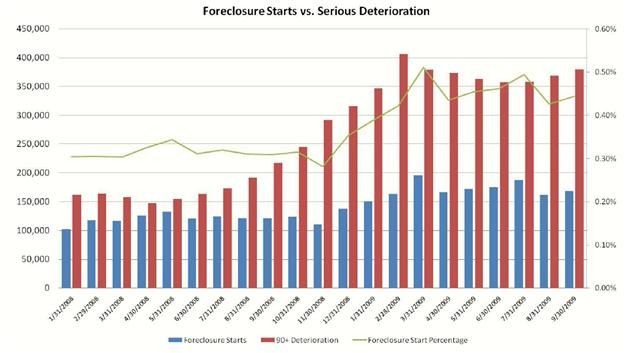

A report released last month by CoreLogic showed that 10.9 million residential properties with a mortgage were underwater (meaning the owners owe more on their mortgage than the property is worth) as of second quarter of this year. For the millions of homeowners with these kinds of mortgages, there are no easy answers. Should they keep paying and hope the market improves? Try for a loan modification? Cut their losses and walk away?

Gerri Detweiler, personal finance expert for Credit.com. explains the pros and cons of several options for those with underwater homes.

1. Stay and pay. People feel attached to their homes, so Detweiler says their first impulse is often to stay put and keep sending in mortgage checks, even if it doesn’t make financial sense in the long run. Is it realistic for you for awhile? she asks. Not just the next few months, but can you afford to stay and pay for the next several years? You may still be underwater at that point. Maintenance fees are another consideration. For instance, if you know you’ll need a new roof or the heating system is on its way out, those repairs can add up. Of course, if the value of your home has declined, you may be able to get it reassessed and pay lower property taxes.

2. Refinance. A traditional refinance may not be an option for homeowners with negative equity. But those with loans owned by Fannie Mae or Freddie Mac who have not been more than 30 days late on a mortgage payment in the past 12 months may qualify for a refinance under the Home Affordable Refinance Program (HARP), which was extended until June 30, 2012. If your loan hasn’t been sold to Freddie or Fannie, Detweiler says you may be able to work directly with your lender on a refinance. Your credit score should not be impacted if you refinance, although you could still lose your home if your situation changes and you can’t afford the mortgage payments.

3. Loan modification. In a loan modification, the lender agrees to lower the interest rate and payment, either temporarily or permanently. If your mortgage payment is more than 31 percent of your monthly pre-tax income and you have suffered a financial hardship, you may qualify for a loan modification under the Home Affordable Modification Program (HAMP). Some lenders have their own loan modification programs as well. Trouble is, the process can be extremely time-intensive. And very few loan modifications actually reduce the principle, so you’re still in negative equity—you’ve just lowered your monthly payments. Until you’re at positive equity, you’re stuck with that house, says Detweiler, pointing out that if there is a reduction in principle, you might have to pay taxes on that amount. Depending on how the modification is reported by the lender, it could also impact your credit score. She suggests consulting a HUD-approved credit agency to discuss your options.

4. Short sale. If your lender agrees to a short sale, you’re allowed to sell your house for less than you owe on the mortgage. One couple I interviewed got like $120,000 wiped out by their lenders, says Detweiler. Depending on where you live and your financial circumstances, there are some amazingly good deals. But you could be one of the unlucky ones who has a lender who doesn’t want to play ball. Before you close on a short sale, be sure to consult a tax professional, who can explain if you owe any taxes on the forgiven debt, and a real estate lawyer with experience in short sales to make sure the agreement relieves you of the deficiency.

5. Foreclosure or walking away. Walking away from your mortgage is essentially the same as foreclosure, says Detweiler. It’s one of the most serious items on your credit report, in the same category with bankruptcy and repossessions. But the impact on your credit score shouldn’t be the only consideration, adds Detweiler. Focus on ‘how am I gonna come out of this financially?’ If you do decide to walk away, your biggest challenge could be getting the bank to take back the house. The bank doesn’t actually foreclose on that so you’re still legally responsible, says Detweiler. The city may bill for trash pickup, you could be on the hook for insurance issues that arise. She suggests staying on the property as long as possible to make sure it’s properly maintained leading up to the foreclosure.