6 Healthcare REITs Benefiting From Aging Baby Boomers

Post on: 6 Июнь, 2015 No Comment

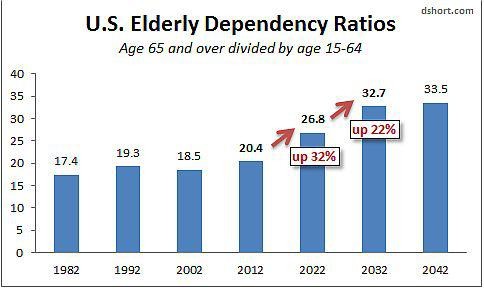

With many of the baby boomers (those born between 1946 and 1964) starting to retire, it would be wise to pick an investment or two that would benefit from this demographic. Beginning this past January, about 10,000 baby boomers will turn 65 each day that means there are about 3.65 million potential retirees every year for the next 17 years.

One way to invest for this demographic is to take a look at healthcare REITs. The healthcare REITs pay dividends and will experience steady growth as they benefit from the large population of aging baby boomers. Click to enlarge:

HCP is a REIT that invests in senior living facilities, life science, medical office, hospital, and skilled nursing facilities in 46 states. It has $18.6 billion in assets under management as of June 30, 2011. HCP reported 3Q earnings earlier this week. It met expectations as net income came in at 41 cents per share, which was exactly what analysts expected. Revenue grew 40% to $444.7 million, up from $317 million. It was the largest healthcare REIT even before acquiring HCR ManorCare last year and has the largest cash flow out of these 6 REITs

Health Care REIT (NYSE:HCN ) invests in the following healthcare sectors: senior housing, assisted living facilities, independent living/continuing care retirement communities, medical offices, hospitals, and skilled nursing facilities. It has a $13 billion portfolio. It has the highest 5 year expected earnings out of these 6 REITs. HCNs four newest senior living investments have an 86% occupancy rate, so it has significant growth potential in a high-barrier-to-entry market. Investors can expect a total annual yield of 16.88% (dividends plus expected earnings) if it meets its expectations.

Senior Housing Properties Trust (NYSE:SNH ) is a trust that invests in nursing homes, medical offices, hospitals, senior apartments, independent living properties, assisted living properties, and clinic and biotech laboratories. As of September 30, 2011, it owned 357 properties in 37 states and Washington DC. It recently reported a 37% increase in net income for the nine months ending September 30, 2011 of $112.8 million compared to $82.6 million in the nine months ending September 30, 2010. Investors should expect a total annual yield of 15.13% when combining its dividends and expected earnings growth.

LTC Properties (NYSE:LTC ) invests in long-term care properties such as skilled nursing facilities, assisted living facilities, and independent living properties. Its portfolio consists of 170 properties. It enjoys the highest profit margin of these 6 REITs. LTC just announced the purchase of a new skilled nursing facility with 156 licensed beds. Look for LTC to provide a total annual yield of 12.15%.

Healthcare Realty Trust (NYSE:HR ) has investments of approximately $2.9 billion in 219 real estate properties in 29 states as of September 30, 2011. It invests in inpatient rehab facilities, skilled nursing facilities, medical offices, assisted living facilities, and independent living facilities. HR just reported third quarter earnings which were in line with analysts expectations of 31 cents per share. Revenue rose 18% to $76.1 million from the same quarter in 2010. Investors can expect a total annual yield of 11.3% from HR.

Ventas (NYSE:VTR ) invests in hospitals, skilled nursing facilities, senior housing facilities, medical office buildings, and other healthcare related facilities. It has an enterprise value of about $23 billion and has more than 1,300 properties in 46 states, Washington DC, and 2 Canadian provinces. It reports its latest earnings on Friday November 4, 2011. Analysts are expecting net income of 82 cents per share, which would be a 15.5% rise over the same quarter last year. Ventas earnings have exceeded estimates for the past three quarters. Investors should expect a total annual yield of 12.03%.

Conclusion

With 3.65 million baby boomers entering retirement every year, the outlook for healthcare facilities will continue to grow and generate steady earnings over the long haul. The dividends are healthy and should remain intact. These REITs have stable property fundamentals and good liquidity. They should be able to grow and diversify their portfolios.

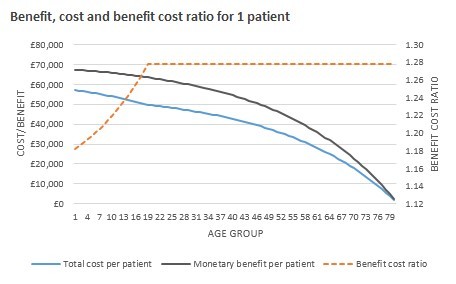

One of the most in-demand properties in healthcare real estate are medical office buildings. The demand for medical office buildings is expected to rise over the next ten years as the aging population seeks treatment for all types of conditions.

One area of concern for healthcare REITs has been declining Medicare and Medicaid reimbursement rates, which would affect tenant revenues and their ability to pay rents. However, these REITs have been shifting their portfolios away from assets that rely on Medicare and Medicaid reimbursements. The REITs are focusing more on assets that receive revenues primarily from private insurance or individual savings.

Overall, the outlook for healthcare REITs is positively strong due to the aging population that will continue to accelerate.